Cable: Back On Offense

From “Cable’s Convergence Calamity?” (August 2022):

“As we think about the long-term evolution of the connectivity industry, two alternative paths lie ahead of us: will everybody pursue a standalone strategy, which means the wireless companies and the cable companies will be stepping on each other’s toes (picking off their highest ARPU customers), or will they find a more rational route for serving America’s connectivity needs?

My personal view is that Comcast and Charter are well positioned in either scenario. Each company has established a wireless + wireline product bundle that can cost effectively meet the connectivity needs of their best (bundled) customers. Today, the number of households that have adopted Cable’s wireless + wireline bundle is still pretty low (I estimate that each company has around 2.0 – 2.5 million customer accounts with that bundle); my bet is that these totals will grow significantly in the years ahead. On that point, I wouldn’t be surprised if both pursue a more aggressive pricing strategy, even if it’s a short-term hit to their wireless profitability; they should be laser focused on increasing the number of bundled connectivity households / accounts.”

Charter and Comcast both reported their Q3 FY22 financial results at the end of October, and my read is that this quarter was a step in the right direction (particularly relative to the troubling results reported in the first half of the year). Both companies are seeing continued success with their wireless offerings while defending / slowly growing their core broadband customer base (which I’d argue remains heavily impacted in the short-term by the COVID pull-forward and other temporary market pressures, with a smaller impact attributable to competitive dynamics). In addition, they’re becoming more aggressive in their pursuit of the long-term opportunity that lies ahead for their connectivity strategies; as a result, I continue to believe that Charter and Comcast remain well positioned to improve their consumer value proposition and their financial results over the long run (falling stock prices and large repurchases are also a nice tailwind).

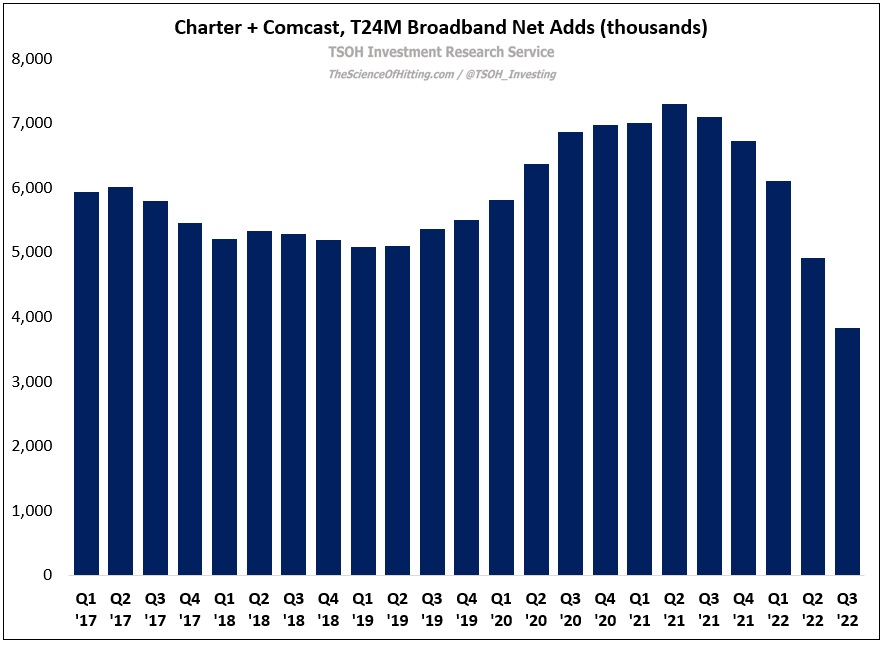

Starting with the broadband businesses, Comcast and Charter both reported a small increase in Q3 net adds (+14k and +75k, respectively). As shown below, they collectively added ~3.8 million net broadband customers over the past two years (T24M); that’s clearly a deceleration from the 5.0 – 5.5 million T24M net adds they reported throughout 2019 (pre-pandemic levels), but it comes on the back of significantly outsized gains in 2020 / 2021 (when T24M net adds averaged ~6.8 million). That’s a long way of saying that while recent net add trends have been weak, and are unlikely to improve in the near future, these results appear satisfactory when viewed in the proper context.

In addition to focusing on volumes (total customer relationships), it’s also important to keep an eye on rates / pricing (ARPU’s) and profitability.

On that point, this comment from Comcast’s call stood out to me: “Digging into Q3, our results at Cable Communications, again, underscored the impressive consistency in this business, with 5% EBITDA growth and 120 basis points of year-over-year margin expansion, bringing us to 45.1%, our highest margin on record.” In recent years, the margin profiles at Comcast and Charter have benefited from revenue mix shift (away from lower margin video / pay-TV and towards higher margin broadband services).

With mobile, my initial understanding was that we were effectively swapping out one low-margin business focused on reducing customer churn (pay-TV) for another (wireless). I’ve come to believe in recent quarters is that this conclusion may have been flawed: despite the fact that there are significant customer acquisition costs being incurred in wireless, consolidated Cable margins have remained strong. As we look to the years ahead, I think we have reason to believe Cable segment margins should continue to hold up nicely, even as wireless scales. (By the way, profit dollars is the metric to focus on; if they serve a larger percentage of customers’ overall connectivity needs, profit growth will follow. As outgoing Charter CEO Tom Rutledge said on the call, “There's a huge [connectivity] marketplace with a lot of spend in it, and we're not getting much of it; we'd like to get more, and we will.”)