Celsius: A Global Opportunity?

Note: Join me on Tuesday, June 24th, for an exclusive AlphaSense expert discussion with Jon Bratta, the former VP of Emerging Brands at Monster Energy. Our conversation will focus on the ascent of energy drink brands like Celsius and Alani Nu, who are shaking up a category long dominated by Red Bull and Monster. Register today to access this AlphaSense expert webinar.

From “Fully Optimized?” (Dec 2024): “I think the valuation is likely to prove reasonable, at a minimum, at ~$28 per share, but I’m still not sure that I can truly own Celsius. That reflects lingering concerns about its long-term competitive position as the rest of the industry has shifted their focus to Celsius’ turf (not just Alani Nu, but also Red Bull and Monster in sugar free). This was a close decision - but my answer on CELH, for now, is still no.”

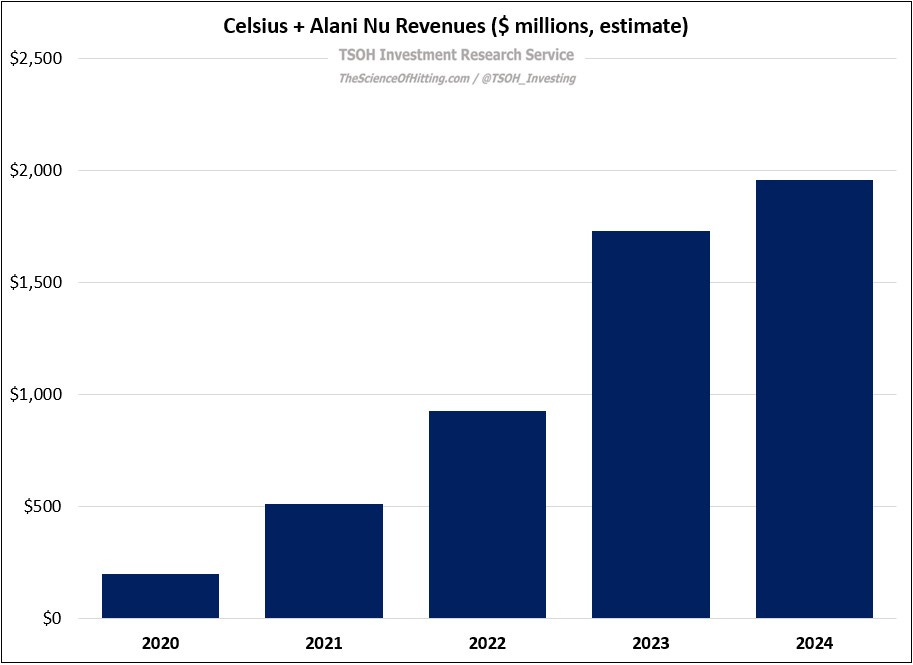

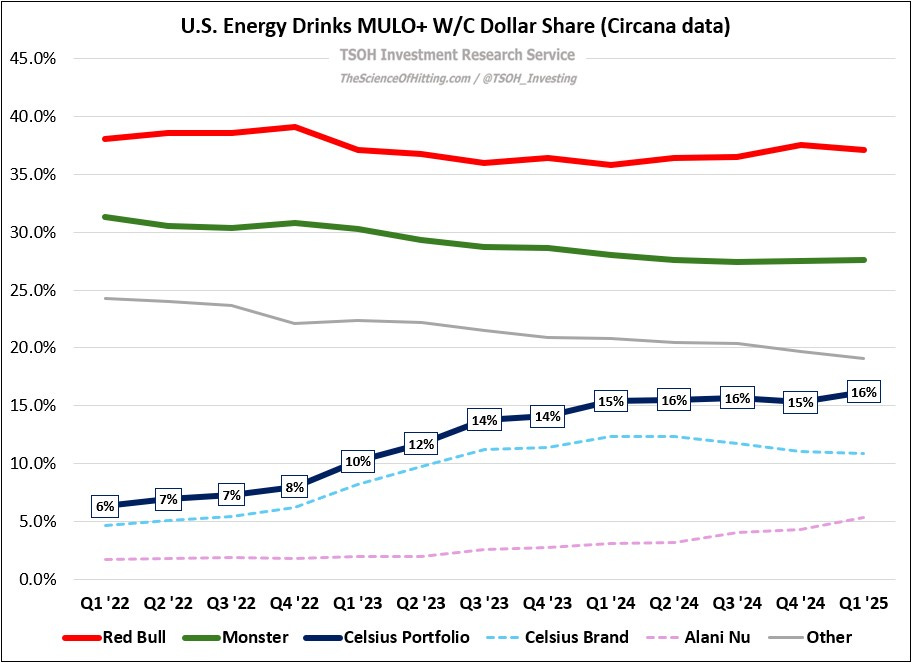

There has been some significant industry developments over the past six months, most notably Celsius’ acquisition of Alani Nu for ~$1.65 billion. As a result of this deal, the Celsius portfolio accounts for ~16% of the U.S. energy category, with FY24 pro forma revenues of nearly $2 billion. (The ~16% dollar share attributable to Celsius and Alani Nu is up from ~6% three years ago. Monster and Red Bull have both ceded some share over the same period.)