Celsius: The Pepsi Question

From “Celsius: Fully Optimized?” (December 2024): “This is an intensely competitive category, with brands like Alani Nu - which competes more directly with Celsius - taking significant market share in recent quarters.”

Celsius’ answer? If you can’t beat ‘em, join ‘em.

On February 20th, the company announced a deal to acquire Alani Nu for ~$1.8 billion; net of ~$150 million in tax assets, the purchase price is equal to ~3x Alani Nu’s 2024 revenues of $595 million. (Unsurprisingly, management would quibble with my characterization on their competitive dynamics; as CEO John Fieldly put it, “The Alani Nu brand has a very unique consumer base, which is incremental to our portfolio and complementary to Celsius.”)

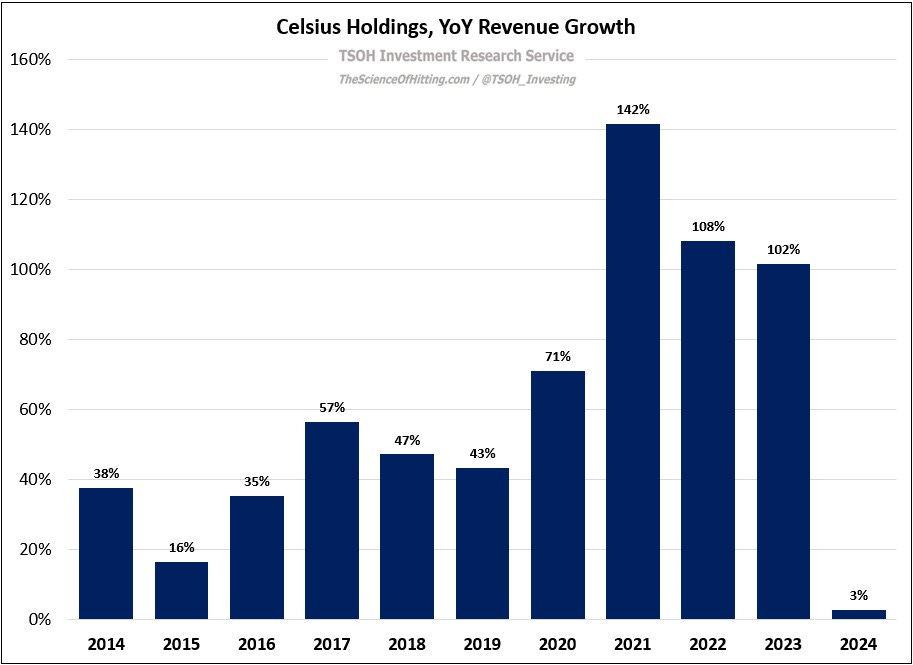

On the valuation, the deal is in the same ballpark to what Keurig Dr. Pepper (KDP) paid for the first 60% of GHOST – a brand of comparable size to Alani Nu, but which reported +16% retail sales growth in 2024, compared to +64% retail sales growth for Alani Nu (slide 20). In addition to adding the category’s 2024 success story to their portfolio, this deal comes at a time when the Celsius brand has seen its retail sales growth slow – albeit from a breakneck pace that saw reported revenues climb >10x from 2020 to 2024. I think those two variables point to another relevant consideration for management: this deal could have meaningful implications for the long-term development of Celsius’ relationship with PepsiCo, which owns ~8% of the company (CELH).