Hibbett: Small Town Sneakers

On Monday, John Hempton of Bronte Capital posted a research report on his Substack about a company called Hibbett (Bronte owns ~5% of Hibbett).

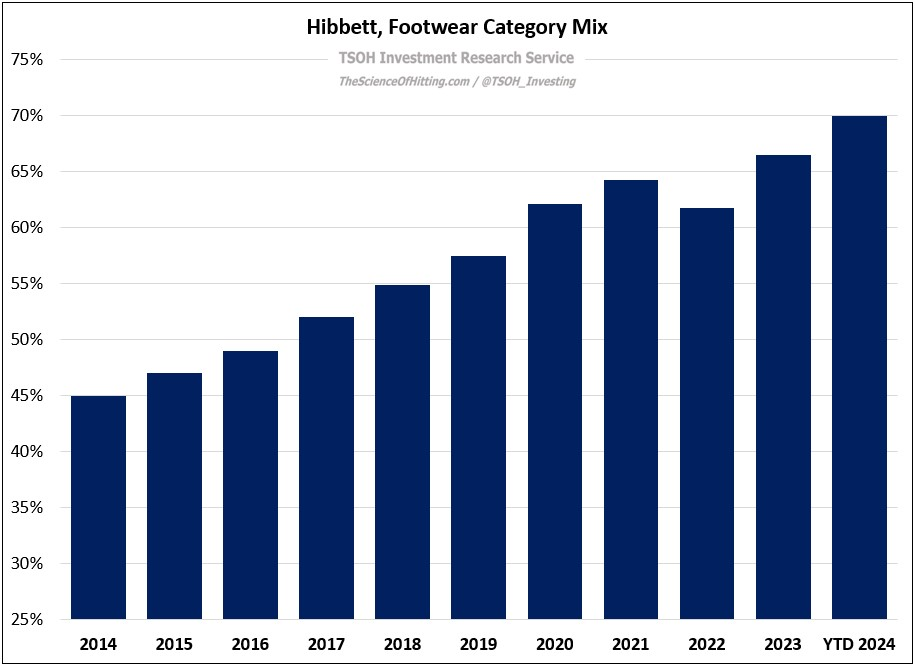

Previously, I was only familiar with Hibbett by name; I assumed it was a small box competitor (in terms of the product mix) to retailers like Dick’s Sporting Goods and Academy, but with lesser selection and higher prices. John’s post made me quickly realize that I was quite misinformed about Hibbett’s, and it became clearer why as I started digging deeper on the company. As an example, consider the following: ~70% of Hibbett’s revenues are attributable to the footwear category, versus just 20% - 25% for Dick’s Sporting Goods.

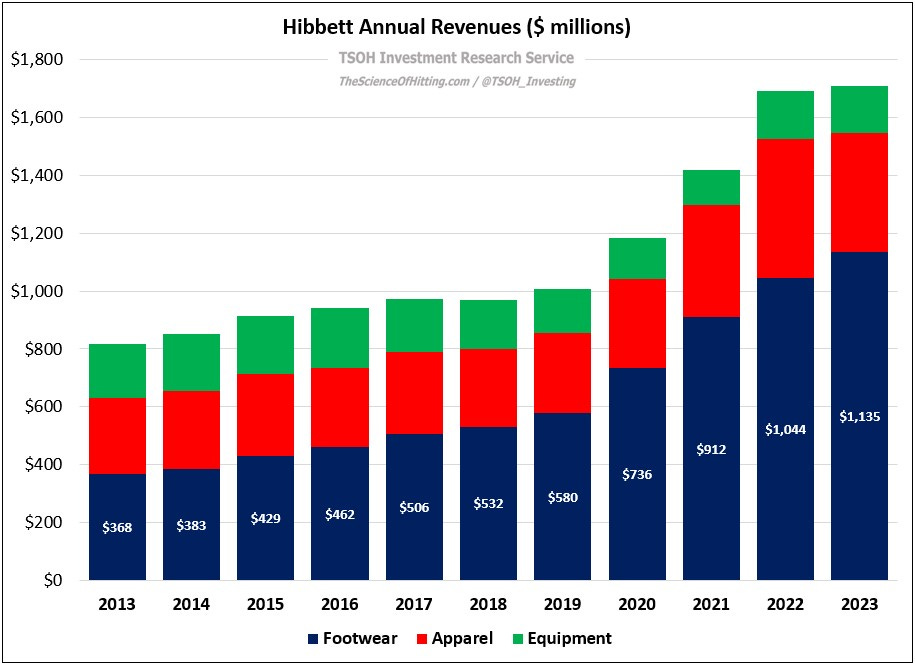

As you can see below, Hibbett’s annual footwear revenues have tripled over the past decade, from $368 million in FY13 to more than $1.1 billion in FY23.

As CEO Mike Longo wrote in the company’s FY23 shareholder letter, this reflects Hibbett’s transformation from a sporting goods retailer to a fashion retailer. (“They were a sporting good shop in small towns selling baseball bats and mitts in competition with Amazon. This was a losing proposition.”)

With that transformation has come further exposure to Nike, which accounted for ~70% of Hibbett’s FY23 revenues (a decade ago, that was ~50%). That happened despite continued efforts by Nike to push its own Direct / DTC mix. By comparison, Foot Locker’s Nike concentration has been declining in recent years. As you think about the diverging trends for Hibbett and Foot Locker, I’d also note that Nike management called out Hibbett as one of its “key partners” on their Q2 FY24 call. That is for a customer that generates ~$1.2 billion in annual retail sales for Nike, i.e. <2% of its global revenues.

What is the explanation for these developments?