An Open Letter To Comcast CEO Brian Roberts

Mr. Roberts,

My name is Alex Morris. I’m an equities analyst, the owner of TSOH Investment Research, and a former Comcast shareholder (a meaningful percentage of my family’s savings were invested in the company’s shares from March 2018 until November 2023). My original investment in the company reflected a few core beliefs: the strong competitive position of Comcast’s various businesses, most importantly in the Cable (connectivity) franchise; its financial strength; and the benefits that often accompany family control – in this case, effective long-term leadership by the Roberts family.

I want to preface this letter by noting that I generally have a favorable view of the company, and I could imagine owning the stock again (as a long-term investor, not someone who goes in hoping to flip the shares for a short-term gain). At the same time, I think it’s clear that Comcast’s position has been negatively impacted by some key strategic missteps over the past 5-10 years.

Comcast withstood these mistakes because of a strong starting hand in the mid-2010’s, a position you deserve much credit for (adroit decision-making in prior periods). Unfortunately, that has been less evident in key decisions made over the past decade, which has weakened the company’s hand. This must change. As Charlie Munger once put it, “If you jump out of the window on the 42nd floor, you’re still doing fine on the way down as you pass the 20th floor - but that doesn’t mean that you don’t have a serious problem.”

I see a similar root cause in the most glaring missed opportunities and strategic mistakes of the past 5-10 years: Comcast management dithered on difficult decisions that were critical to the long-term trajectory of their key business franchises. As a result, each of those core franchises is now in a relatively weaker position than 5-10 years ago. Comcast needs to be much more aggressive in the pursuit of key strategic initiatives in its core U.S. Cable business, most notably converged connectivity, while changing course in businesses where its competitive position has greatly weakened. Without meaningful change, we may look back in 5-10 years and conclude that Comcast’s position in the mid-2020’s was akin to passing the 20th floor.

“A Really Special Company”

On Comcast’s Q4 FY12 call in February 2013, you said the following in response to an analyst question about your vision for the company over the coming decade: “We believed that scale in Cable was going to make a difference, and it is really starting to pay dividends… For content [NBCUniversal], we have always thought for many years that it’s a great business on a standalone basis. It’s created a lot of wealth over a long period of time, and we think we’ll find ways to do so in the future. Having both in one company makes us a really special company. Now we need to execute and continue to find ways to have the two work together and apart.”

Given Comcast’s leadership position across broadband, pay-TV, and at NBCUniversal, there isn’t a single company that was better positioned over the past decade than Comcast to see how the U.S. connectivity and media industries were evolving. As such, you held an unparalleled view into the future of these businesses. In combination with the company’s strong financial strength, which is a testament to the way that you’ve run Comcast for the past 20+ years, you could’ve made the case in the mid-2010’s that Comcast was very well positioned to compete and win in each of those areas: broadband, pay-TV distribution, and the content / NBCU Media business.

The company’s recent results, on an absolute and relative basis, suggest otherwise: Comcast’s competitive position has worsened in each of those areas over the past five years. As a result, the stock price, which first crossed $30 per share in 2015, is trading at ~$35 per share a decade later.

Below, I discuss three noteworthy examples that reflect the impact of faulty strategic decision-making. It is critical to note that the company doesn’t lack the financial resources to pursue more aggressive action. What I hope will become evident is that this is exactly the change that is needed.

Comcast Cable (Internet & Connectivity)

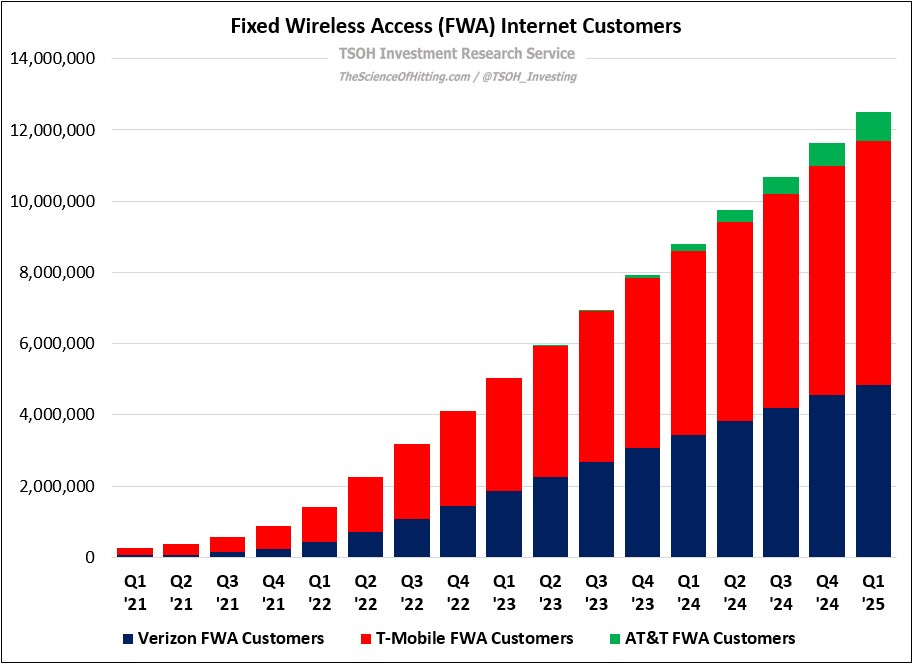

Broadband has been Comcast’s crown jewel for the past 10+ years. The problem, as I see it, is that management has halfheartedly responded to emerging competitive threats, most notably on their offensive posture - aggressively pursuing converged connectivity. A notable competitive threat has emerged from fixed wireless access (FWA), which you said the following about at the Morgan Stanley TMT Conference in March 2022: “Time will tell, but it's an inferior product. Today, we don't feel much impact from that. It's lower speeds. We've seen that with DSL in the past, and we've been able to do well against that. We don't take it for granted, but we’ve seen lower priced / lower speed offerings before. In the long run, I don't know how viable [FWA] is… We know how to compete, and I think we will compete just fine.”

In the three years since those comments, the three major U.S. wireless companies have added another ~11 million net FWA customers. Over the same period (since Q1 FY22), Comcast has lost ~677,000 net broadband customers. It would’ve seemed unfathomable a few years ago, but Comcast’s broadband customer base declined by ~1.7% YoY in Q1 FY25. After many years with net broadband customer additions of >1 million annually, we’re now moving in the other direction. (Also, note that FWA - as you described it, “an inferior product” – has much higher NPS scores than Comcast Cable.)

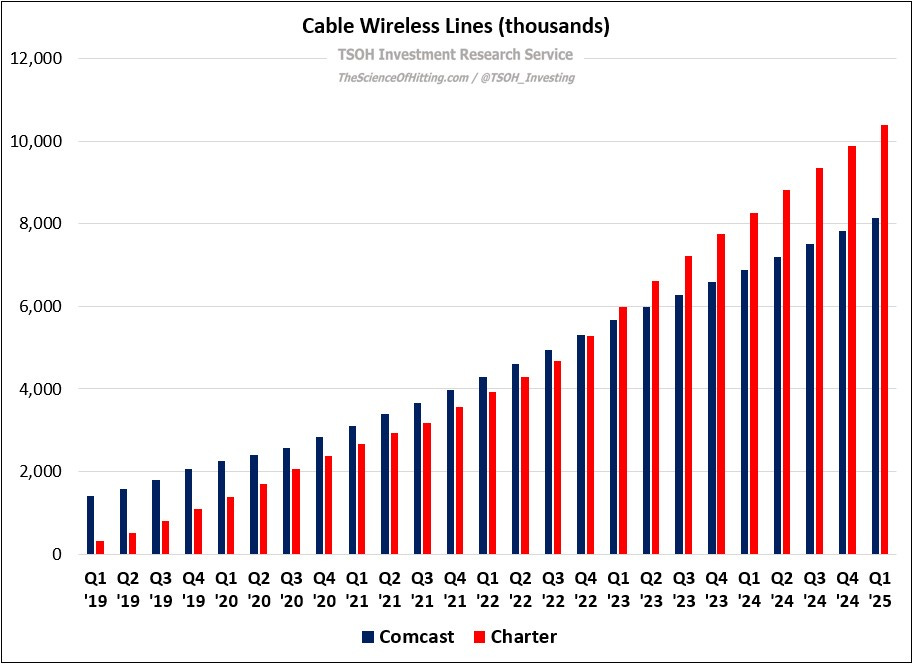

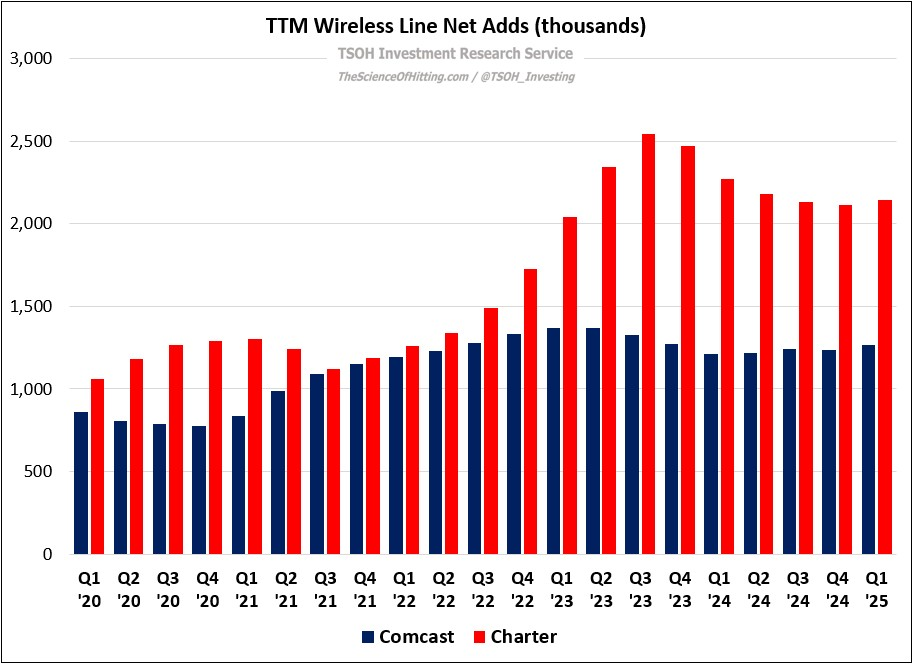

Management’s answer, and one I agree with, is to lean on their advantaged position in converged connectivity. The issue is that Comcast has taken a cavalier approach to this strategy. As you can see below, Charter – who presumably should be more concerned with any near term P&L pressures given significantly higher financial leverage – has much more aggressively pursued wireless net adds than Comcast. Charter’s wireless net adds have outpaced Comcast’s in each of the past 14 quarters, a collective gap that totals >2.7 million wireless lines. There isn’t a good reason why, but Charter has been running laps around Comcast in wireless over the past 2-3 years.

On Comcast’s Q1 FY25 call, Mike Cavanagh said the following: “In this intensely competitive environment, we are not winning in the marketplace in a way that is commensurate with the strength of the network and connectivity products. [We’ve] worked hard to understand the reasons for this disconnect and have identified two primary causes: one is price transparency and predictability, and the other is the level of ease of doing business with us.”

It’s disconcerting to realize that Comcast is coming to this realization now.

TTM broadband customers have declined in each of the past eight quarters, and the YoY rate of decline has progressively worsened. For a company that lived through a somewhat similar (early) experience in the pay-TV business, I find this lack of urgency truly puzzling – particularly since executives like Cavanagh have long argued convergence is an opportunity where Comcast “is structurally positioned to win”. If management truly believes that, then much more aggressive tactics in wireless are required; the lackadaisical approach that has been taken over the past 2-3 years must come to an end.

Comcast Cable (Pay-TV & Video Distribution)

In U.S. pay-TV distribution, a word that fairly describes the company’s strategy for much of the past decade is “indifference”. Starting from a position as the largest MVPD in the country, the company has lost >10 million U.S. pay-TV customers over the past seven years (from ~22.3 million to ~12.1 million). While broader industry pressures have been a large headwind, this compares to the more than eight million customers that have been added to YouTube’s vMVPD business over the same period. From the outside looking in, it doesn’t seem like Comcast management has been overly bothered by this; the plan, if you’d like to call it that, is to let the business wither away.

While that seems like an odd position to take given the likely churn benefit of retaining bundled (double / triple play) households, along with the weight the company could’ve leveraged in supplier negotiations given its scale, it is even more perplexing given that the company has a dog in this fight with NBCU. In what is a recurring theme throughout this letter, the summary is Comcast sat back and watched as an emerging competitor ate its lunch – and then did little, or at best acted far too late, in response. In this example, it’s closer to the former: the company continues to bleed hundreds of thousands of U.S. pay-TV customers each quarter, with no sign of significant mitigation efforts.

The same applies to the TV OS / software business, where Xfinity had a strong position with a best-in-class user interface that was a point of pride for Comcast; now, it is an irrelevant competitor to Amazon, Google, and Roku (I’m sure most Americans would be baffled if you asked them about “Xumo”).

NBCUniversal (Media & Peacock)

At NBCUniversal, a deal that you undoubtedly deserve much credit for on its timing and price tag, the theme parks remain a clear bright spot (and I’m sure Epic Universe will prove to be another worthwhile addition to the portfolio).

What’s less encouraging is the position in the media business, specifically at its legacy linear channels business and Peacock. To me, this is the example that is most at odds with the “special company” argument made in 2013. Despite having a front row seat to changes underway in broadband, pay-TV, and at NBCU (all of which pointed to the direction the world was moving in with DTC video streaming), along with the business diversification and financial strength to support meaningful investments throughout the 2010’s, Comcast didn’t launch its streaming service, Peacock, until mid-2020.

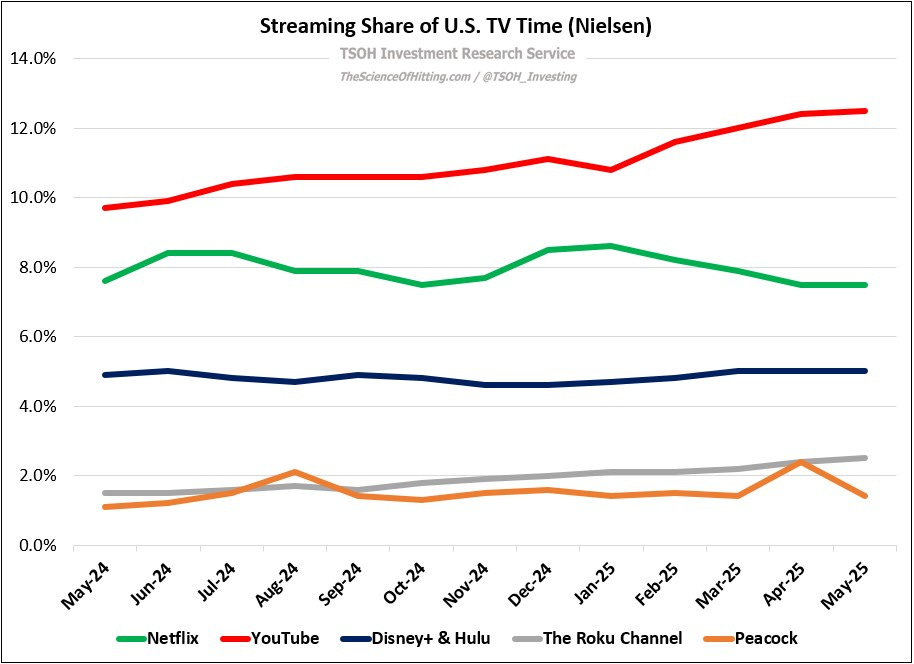

When you spoke about streaming two years earlier, in February 2018, you said the following: “We have a different model than Netflix; at the moment, their FCF is negative but they're adding customers.” Fast forward to today, and Peacock has replicated the first part of that playbook (generating sizable losses) - but despite these efforts, paid subscriber growth has slowed and Peacock accounts for a minuscule share of U.S. TV time. NBCU was late to the party – and despite cumulative EBITDA losses that are just shy of $10 billion, the path to long-term success remains unclear. (It’s interesting to consider how the past 2-3 years may have played out if this willingness to accept losses of ~$2 billion per year had been applied to Cable / wireless.)

In addition, NBCU is in the process of spinning off the majority of its legacy cable networks portfolio – a collection of channels that face a difficult future and which will be hugely disadvantaged as key sports rights come up for renewal (for example, EPL games that currently air on USA Network).

In summary, NBCU’s media businesses remain under significant pressure. That isn’t new, but the temperature has continued to rise over the past five years. My hope at one time was that Comcast would realize that a tough decision was required: exit the media business or pursue a transaction that would give the company a fighting chance at achieving global scale. Instead, management has largely stuck to a “wait and see” approach. What I once thought was measured patience, waiting for the right opportunity to make a big move, I now see as a lack of conviction and a road that will lead to further struggles for NBCU’s media businesses. The company’s own actions - for example, continuing to license its best animation programming to Netflix - indicate that it isn’t playing to truly compete in global DTC video streaming.

Each of the examples cited above reflect a consistent problem: in the face of disruption, Comcast has been slow and timid. What’s most disheartening about this is the company’s financial strength and family control should’ve positioned it to do just the opposite – to act aggressively and with long-term focus in a way that is harder for most public companies to replicate. Instead, my sense is that Comcast has done the opposite – for example, by prioritizing Cable ARPU growth and segment margins over the aggressive actions that would’ve accelerated the pace of wireless net adds. This cannot continue.

The company must effectively respond to change in its core businesses, and I think those efforts would benefit from narrower focus; one path to get there is by exiting businesses where industry leadership has become out of reach.

Conclusion

In your closing remarks during the Q1 FY25 call, you said the following: “The team has a sense of urgency, energy, and focus to getting customer pain points resolved [in broadband]. While this may take a little time to fully take hold, our history of operational execution would tell you that while sometimes we may not move first, once we get in motion, we do it extremely well.”

I agree with that conclusion – if Comcast can marshal its resources, and truly show a sense of urgency and focus, then it will successfully navigate today’s challenges. To me, that argument is strongest in Cable and converged connectivity, where management has argued they have a winning long-term strategy that cannot be sustainably matched by wireless competitors. In the quarters and years ahead, Comcast should be taking the necessary actions to ensure that it is at least matching the pace of wireless net adds reported by Charter. There is no reason why this gap exists other than a lack of urgency and focus - and given your superior financial position, it is Comcast that should be more willing to accept any associated short-term financial impact.

In other businesses, most notably Media, the company faces tough decisions after years of dithering: are you willing to make the significant investments required to compete in global video streaming? In my view, that ship has sailed – Comcast waited far too long to throw its hat in the ring and does not have good reason to believe it will be among the top 2-3 competitors in this business in the U.S., let alone around the world. The situation demands that Comcast is realistic about its position, and Versant won’t be the solution.

As you said, urgency and focus.

Exiting the NBCU Media business, and potentially all of NBCU, would bring an added benefit: it would clearly signal management’s confidence in the long-term strength of its connectivity businesses. Resources, financial and otherwise, would be 100% focused on serving bundled households, including tens of millions of families that want a modern pay-TV offering.

In closing, I’m encouraged by the change of tone from management on the Q1 FY25 call. The next step is meaningful actions in the Cable business and at NBCU that truly signal a heightened sense of urgency and focus. Given the challenges Comcast faces across its businesses, now is the time to prove that Comcast is the “special company” that you spoke about back in 2013.

Thank you for your time.

- Alex Morris (TSOH Investment Research)

Note - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.