Airbnb: "A New Chapter"

“In a crisis, you often have clarity. Somebody who has a near-death experience suddenly sees more clearly, and we were staring into the abyss. We realized we had to get back to our roots. We had been pursuing many initiatives - transportation, travel content, a hotel offering, a luxury service - which we had to scale back. We turned what had been the equivalent of a ten-division company into a single-division functional organization…”

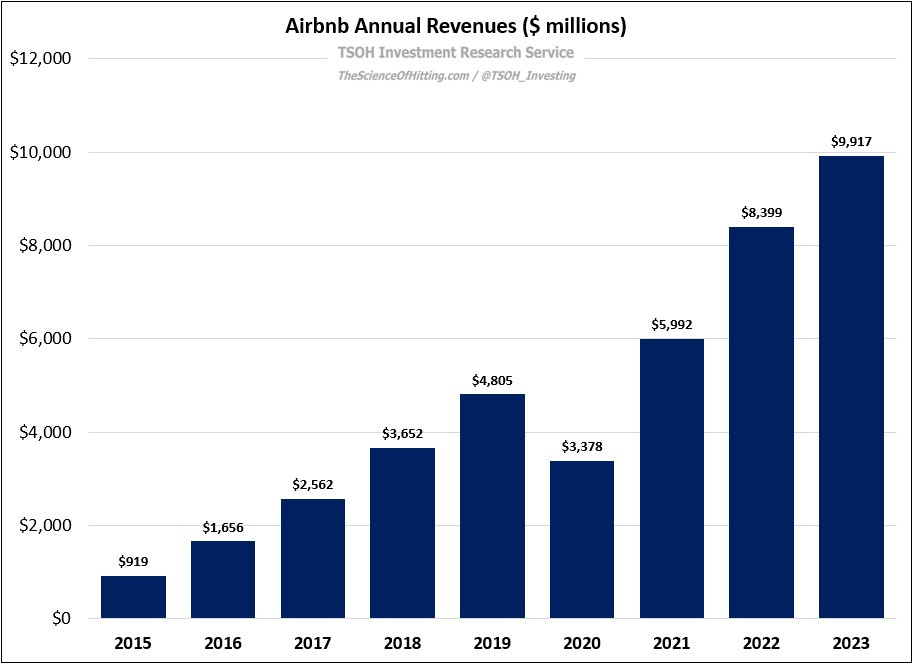

In terms of their financial results, the Airbnb story has never been more compelling. After a near-death experience during the early days of the pandemic, the company quickly refocused on its core business. Subsequent industry tailwinds (travel resurgence, the rise of remote work, etc.) and an intense focus on operating efficiency has led to impressive new heights: FY23 revenues were ~$9.9 billion, up >100% from pre-pandemic levels.

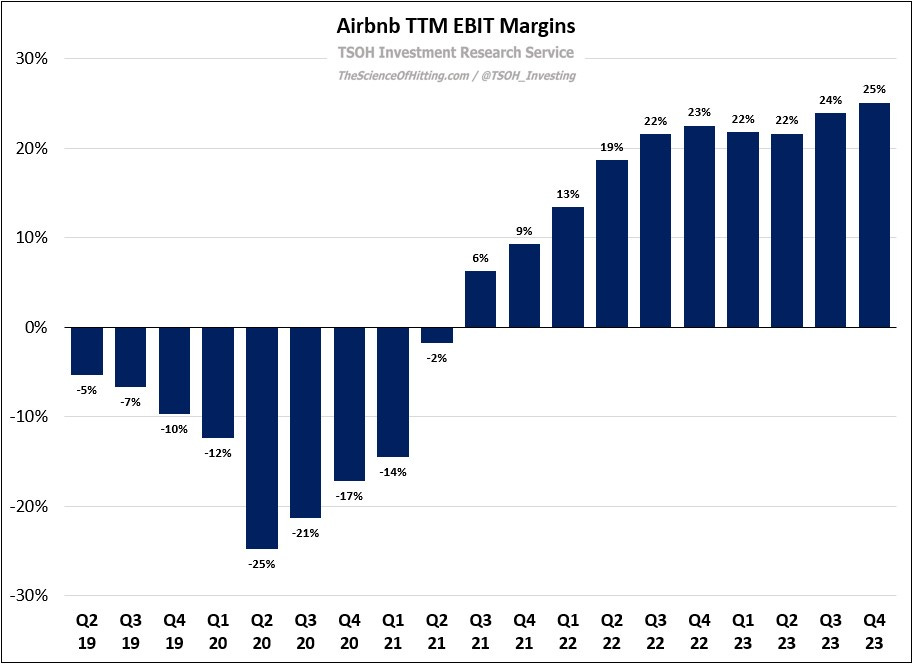

As opposed to consistently losing money during the pre-pandemic years, Airbnb reported FY23 adjusted operating income of ~$2.5 billion (~25% margins, an improvement of ~3,500 basis points compared to FY19). The company also generated ~$3.8 billion of free cash flow in FY23, which funded ~$2.3 billion of share repurchases. The long-term opportunity in Airbnb’s core business is to keep solidifying their leadership position in large, established markets like the U.S., Canada, France, etc., while methodically expanding throughout Europe, Asia Pacific, and Latin America. (“The areas where we’re underpenetrated… the vast majority of countries around the world.”)

At the same time, while alternative accommodations remains the cornerstone of the business, it’s also clear management has a more expansive vision. As Chesky noted on the Q4 FY23 call, “2024 marks the beginning of a new chapter for Airbnb… We are at an inflection point. We spent the last three years perfecting our core service, and we’re ready to embark on our next chapter… I think Airbnb can go far beyond travel over the coming years.”

From a business perspective, I’ve long admired Airbnb; the final hurdle that I’ve yet to clear has been the valuation (the primary focus of today’s post).

But the conversation on the Q4 call presents another question that needs to be addressed: what are the implications for the business as management’s focus grows beyond alternative accommodations – and even beyond travel?

Widening The Moat

As I’ve discussed over the past two and a half years, I think it’s critical to understand Airbnb’s ongoing evolution, including efforts to more effectively balance supply and demand, the recent focus on affordability and ADR’s, as well as the significance of features like “I’m Flexible” and “Similar Listings” in nudging hosts and guests towards Airbnb’s goal of platform efficiency.

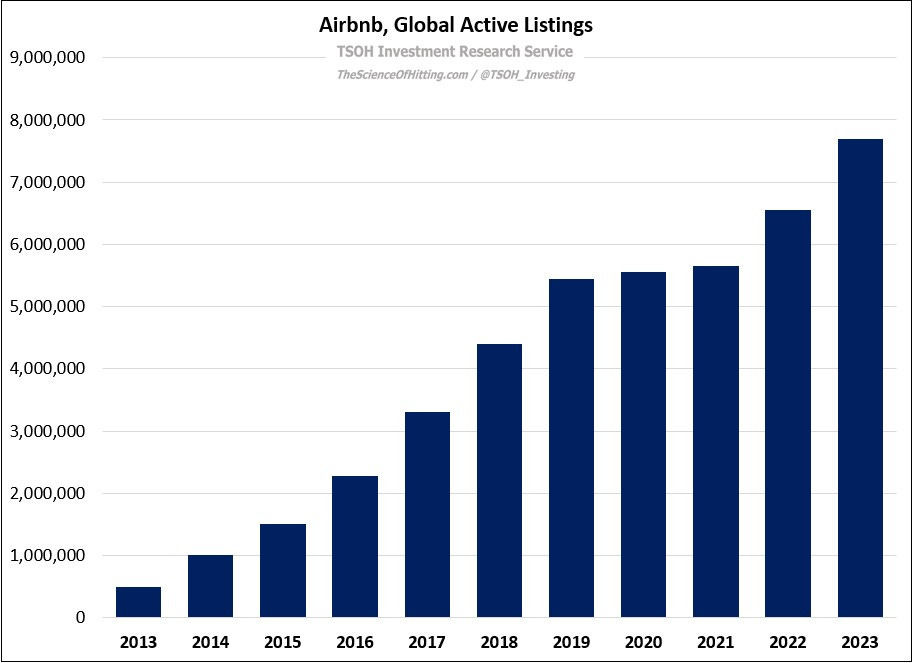

The short update is that Airbnb continues to fire on all cylinders. The company keeps introducing new features to improve the guest and host experience, and they are working, with notable examples on cleaning fees, weekly / monthly discounts, etc.; in doing so, I’d argue they’ve widened their moat in alternative accommodations, particularly in established markets.

I particularly liked management’s answer on the Q4 call when asked about the threat from competitors like Booking Holdings and Expedia / Vrbo; it aligns with my long held views on Airbnb’s sustainable advantages: “I know competitors are trying to come into North America to take share, but that’s not what we're seeing… A lot of the competition is focused on professional host supply, which is undifferentiated and often cross-listed. The differentiated [individual host] supply we’ve been able to bring on has been a material net benefit for us… We are the brand in this category, a noun and a verb that is used all over the world. We are the only ones with a custom-built platform… The best game we can play is to continue to focus on executing ruthlessly. If we continue to do that, we're going to take share.”

“Beyond Travel”

VC investor Fred Wilson, 2011: “We made the classic mistake [on Airbnb] that all investors make. We focused too much on what they were doing at the time, and not enough on what they could do, would do, and did do.”