"What We Stand For"

An update on Five Below (FIVE)

From “Five Below: Nothing But Upside?”: “I have grown more cautious on Five Below. It’s critical for someone who plans on being a long-term owner to invest in companies within your circle of competence and which you truly have conviction in (tough times will appear eventually). For now, I think Five Below falls short on that requirement relative to the companies in my portfolio. The stock is likely to remain on the bench unless that changes.”

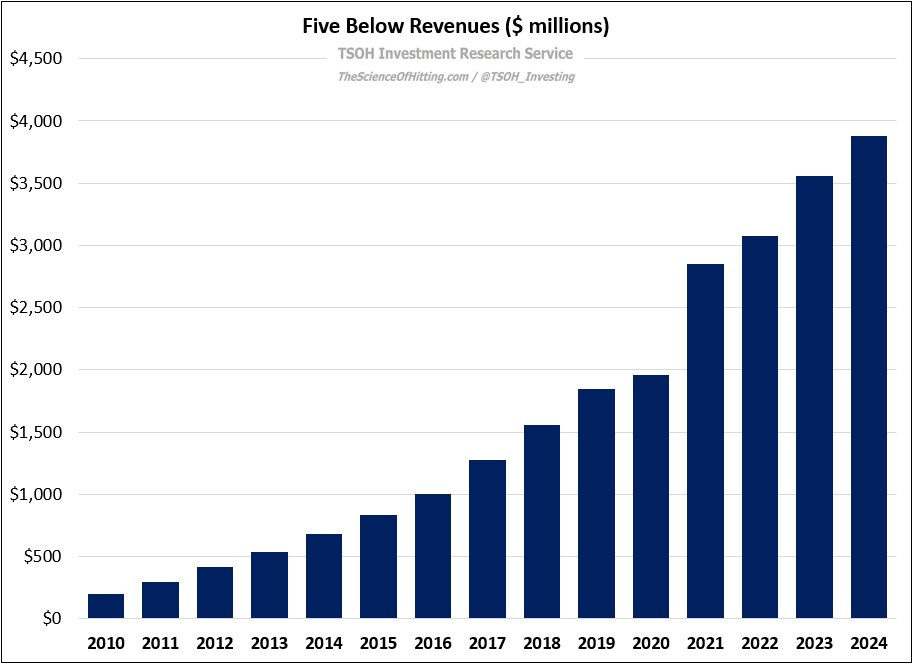

A lot has happened subsequently, with Mr. Market’s response suggesting he hasn’t been thrilled by those developments: at ~$63 per share, FIVE has declined ~60% since “Nothing But Upside?” was published in September 2023. The stock has retreated to levels first eclipsed in 2017, when annual sales were ~$1.3 billion; they’ve tripled subsequently, to ~$3.9 billion in FY24.

As of Wednesday’s close, FIVE has a market cap of ~$3.5 billion and an enterprise value of ~$3.0 billion. Relative to FY25e revenues of ~$4.2 billion, it trades at ~0.8x forward revenues. This is a valuation level (on price-to-sales) that FIVE shares haven’t traded anywhere near over the past decade.

Unsurprisingly, that reflects some significant near term challenges.