Five Below: "Nothing But Upside"?

Monday’s post focused on Dollar General, which is currently facing significant business headwinds. Today’s discussion will focus on another retailer with some lingering questions about its near term financial trajectory: Five Below.

While FIVE’s issues appear much less severe than what’s come up at DG, consider that its current FY23 EPS guidance (~$5.4 per share) is slightly below its original FY22 EPS guidance. Put another way, despite a ~30% increase in the store count over the past two years (FY21 – FY23e), FIVE’s operating income is expected to increase by <5% over the same period.

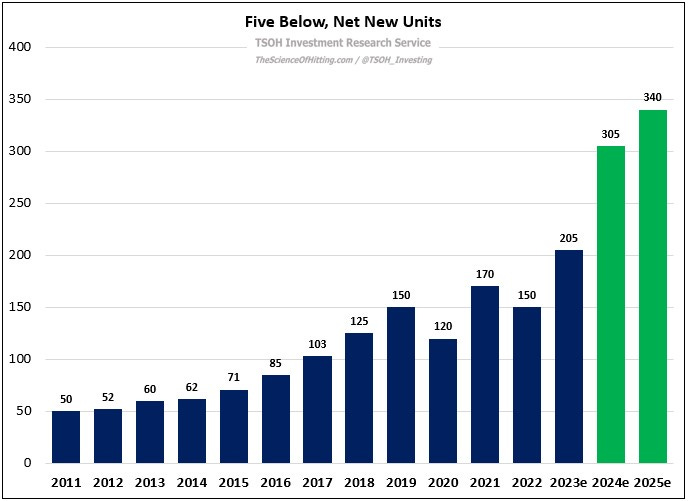

The recent results present some questions, particularly relative to the FY25 financial targets that management set in early 2022: (1) FY25 revenues of ~$5.7 billion, ~60% higher than the ~$3.5 billion expected in FY23e; (2) FY25 EPS of ~$10 per share (“more than double EPS” from $5.0 in 2021), ~85% higher than the ~$5.4 per share expected in FY23e; (3) FY25 EBIT margins of ~14%, ~300 basis points above 2023e; and (4) ~2,200 stores by yearend FY25, which implies an additional 650 (cumulative) net new units in 2024 and 2025 (as shown below, that will require a pace of annual unit growth that is ~2x higher than what FIVE reported over the past five years).

In summary, these financial goals seem quite optimistic (to put it mildly). That said, as I’ve discussed previously, FIVE’s management team has exceeded some difficult multi-year targets in the past. In addition, given the recent pressure on the company’s stock (it’s declined by more than 20% since the beginning of August), the valuation is also moving in the right direction.

In summary, I’d argue Mr. Market is expressing some doubts on the near term “Triple-Double” targets; is that a fair assessment based on today’s trajectory (an unrealistic goal), or is it a compelling opportunity for FIVE investors?