Walking The Peacock Plank

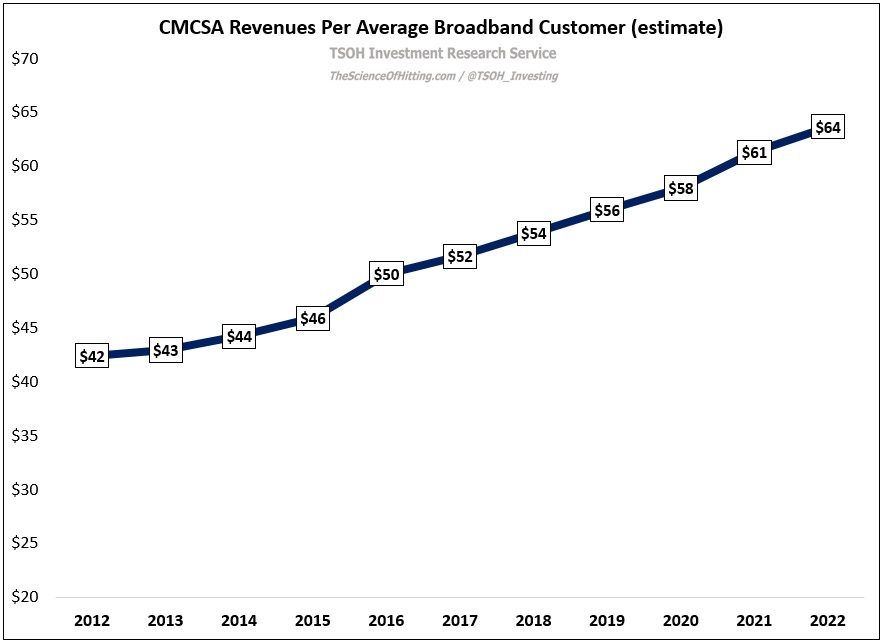

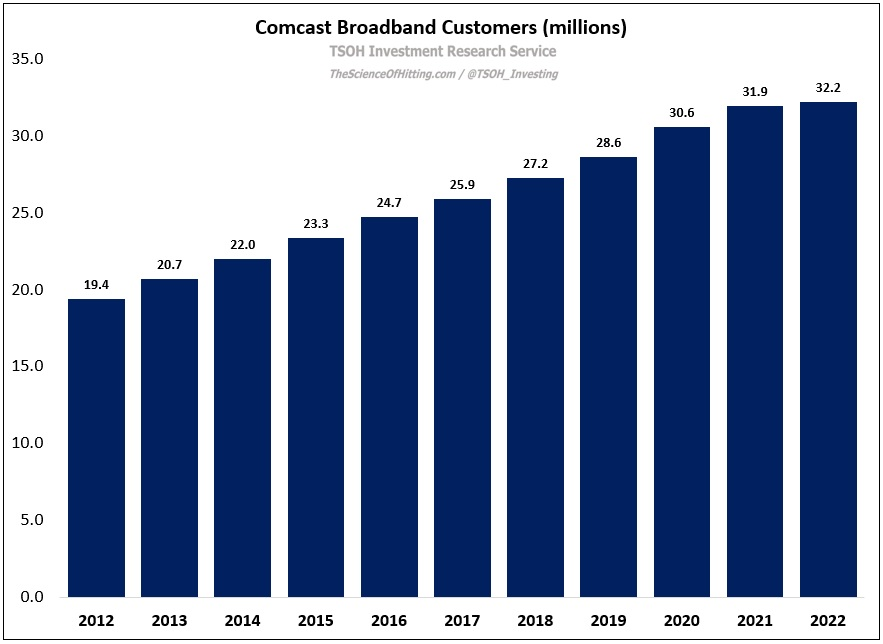

When the TSOH Investment Research Service launched in April 2021, I published a review of every company in my portfolio. One of those positions, which I still own today, was Comcast. The crux of my thesis was as follows (link to the full discussion): “The majority of Comcast’s value resides in the Cable Communications segment (~80% of EBITDA), largely due to sustainable competitive advantages in broadband. Persistent customer growth (15 consecutive years with more than one million net broadband customer adds, to 30.6 million high-speed internet customers), as well higher ARPU’s, declining capital intensity (largely due to lower CPE spend), and continued improvements in churn has led to a large and consistent increase in EBITDA over the past decade (up ~80% to $25.3 billion).”

As I went on to explain, the company had two other businesses on shakier ground (Sky and NBCUniversal, or NBCU). On NBCU, I argued that the company would need to get much larger to truly compete in global DTC streaming (“merge with a company like WarnerMedia”); the other options were to sell NBCU (somebody else could get larger) or pursue a licensing strategy a la Sony. As I wrote then, this brought up an important question for shareholders: “Is CEO Brian Roberts focused on maximizing the per share value of Comcast, or is he an empire builder (with a dash of Disney envy)? My hope is the former, but there’s reason to question that conclusion.”

Fast forward to today, and both sides of the house have experienced significant new developments. As I survey the landscape, I think there’s reason to question whether my prior assumptions on this investment still hold water; said differently, is the long-term thesis for Comcast intact?

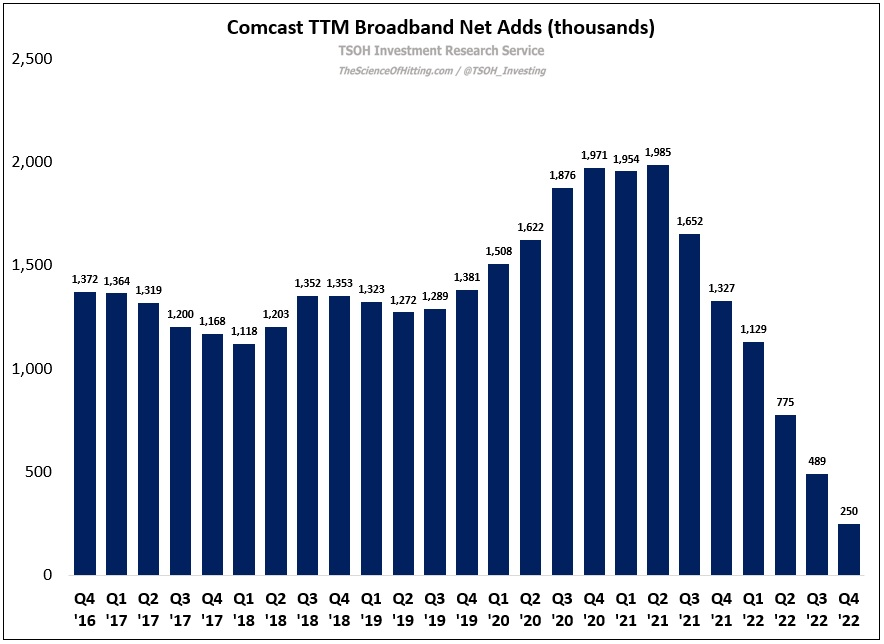

Starting with Cable, the days of one million plus broadband net adds have abruptly come to an end. While there are still open questions about the direct causes (COVID overhang, mover churn, competition, etc.), the recent trends are striking: Comcast added 250,000 net broadband customers in 2022, by far the lowest trailing twelve month (TTM) result in the past 5+ years.

While I once believed this outcome was largely attributable to temporary external factors, which implied an eventual return to the pre-COVID trends in broadband, that assumption is looking increasingly misguided (wrong).

The first reason why I say that is straightforward: I don’t think management believes it anymore. As CEO Brian Roberts noted on the Q4 call, “We are striking the right balance between rate and volume in residential broadband, and we plan to continue to do so in 2023.” That framing sounds logical, but it stands in stark contrast to their performance over the past decade, when Comcast consistently delivered rate growth and volume growth in broadband.

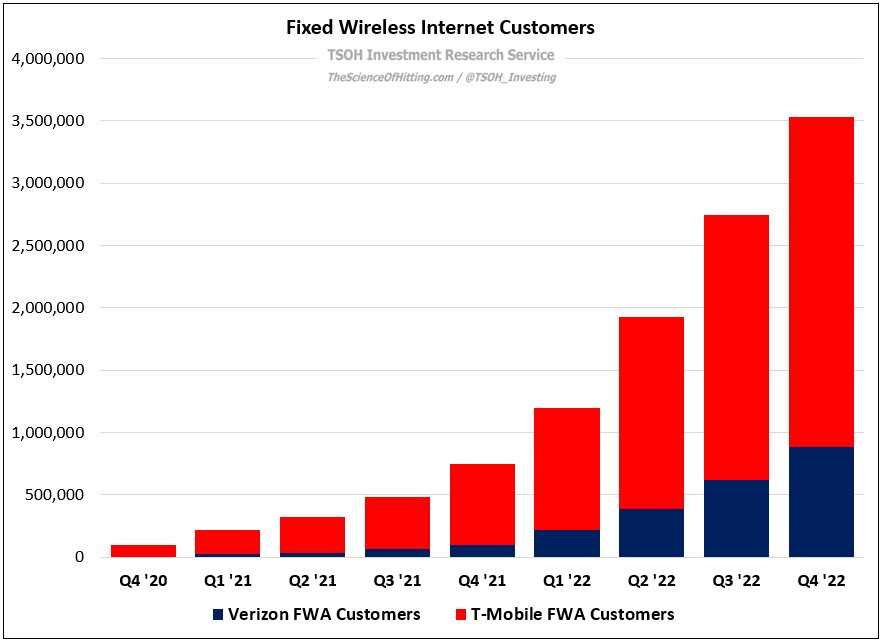

Second, while there is an ongoing debate about the unique characteristics of the average fixed wireless (FWA) customer, along with questions about the sustainability of broad deployment of the model (AT&T CEO John Stankey has been clear that he believes FWA has a “finite shelf life” in urban and suburban markets), the reality is that these offerings have seen significant growth as of late: in 2021 and 2022, Verizon and T-Mobile collectively added 3.4 million net FWA customers. (Charter Q4 FY22: “In terms of competitive impact, some of the lower gross additions probably relate to DSL conversion going to a new entrant, fixed wireless, instead of coming to us.”)

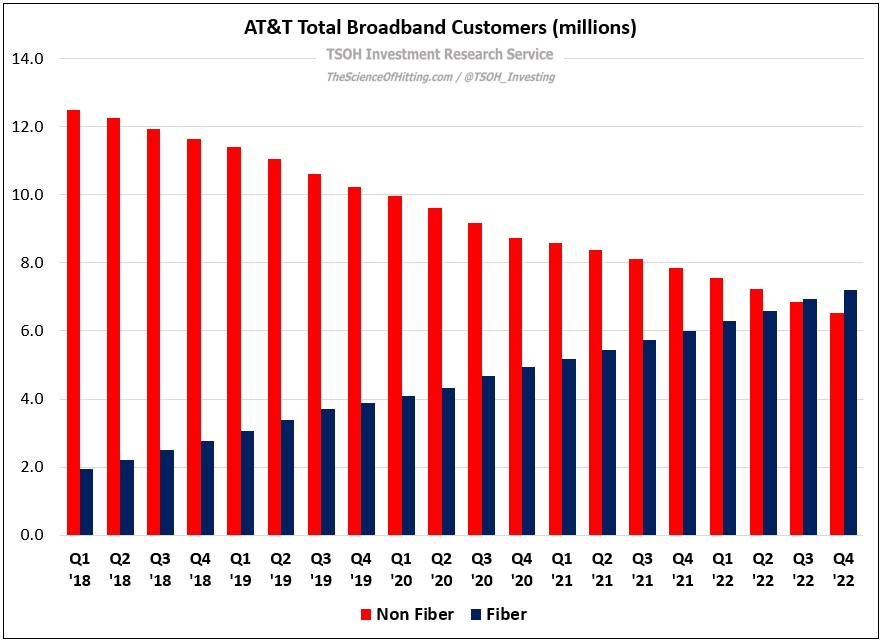

Third, the results from companies like AT&T suggest that Fiber is also taking its fair share of the pie: AT&T Fiber customers increased 20% YoY in Q4 FY22, to ~7.2 million, with ARPU’s up 9% YoY. While AT&T’s Fiber gains have been offset by losses in their non-Fiber households, with their overall broadband customer base remaining roughly unchanged over the past 5+ years at ~14 million customers, the current pace suggests Fiber will account for ~80% of their customer mix in 3-4 years. (By the way, AT&T Fiber ARPU’s are in the same ballpark as Comcast’s broadband ARPU’s; if fiber is generally considered to be an inherently “better” offering, that’s a problem.)

Long story short, while I still think Cable holds a strong hand given the technical and economic limitations for fixed wireless (Comcast residential broadband-only customers consume nearly 700 gigabytes of data per month), the questionable long-term assumptions required by overbuilders, etc., the reality is that Cable isn’t reaccelerating volume growth in broadband.

While the investment community seems to have shifted to the view that the current results are “good enough” (minimal sub growth), I personally think that’s a meaningful change that makes the investment decision harder - and if slow / no growth turns into broadband sub losses, this may be a value trap.

(Long time readers may notice I glossed over the wireless / convergence opportunity; Comcast’s wireless business reported solid Q4 results and it’s a key part of the thesis. As Roberts said on the call, “We are in the best position to win in convergence. We have a leg up on our competitors, with a capital-light strategy that does not involve customer or network trade-offs.”)

NBCUniversal (NBCU)

That brings us to Comcast’s non-cable businesses.