Vita Coco: Testing The Moat

From “Cracking Coconuts” (October 2023): “In the early stages of my research, I was drawn to the idea that Vita Coco has developed certain sustainable supply chain advantages over the past 10-15 years as a result of being a first mover who has now established industry leading scale. That argument may still be valid - but the fracturing of Vita Coco’s distribution agreement with [Costco] is the type of development that leads me to question how strong that advantage truly is… If they can effectively navigate the loss of the [Costco private label] relationship while continuing to grow branded volumes, revenues, and EBIT at an attractive clip, that would suggest Vita Coco’s position in the category is stronger than I’ve given them credit for.”

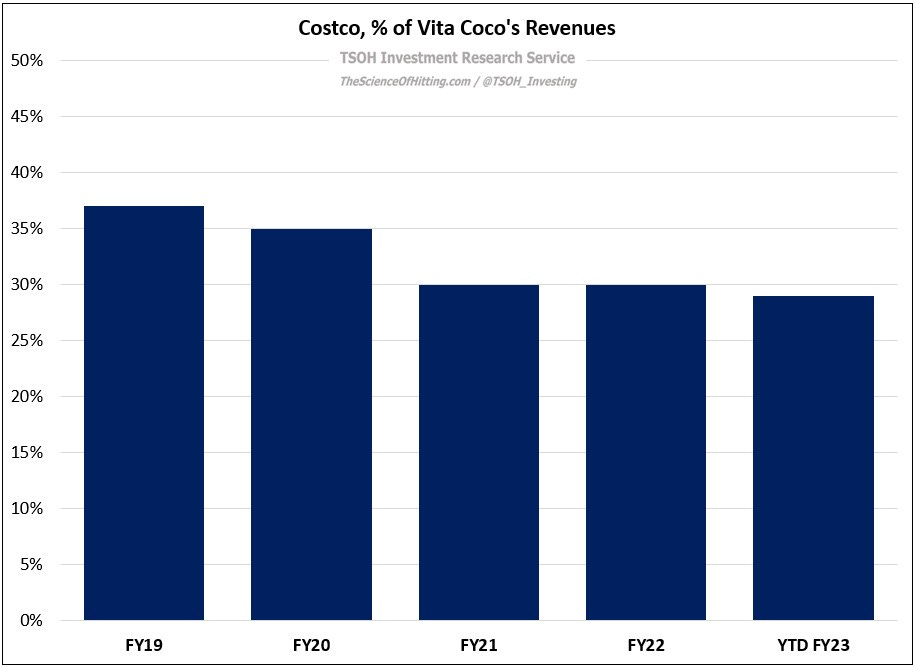

The loss of Costco’s private label business was a key focal point of the deep dive; beyond the negative financial hit to the FY24e results, I argued that it presented material concerns as it related to the long-term impact on Vita Coco’s competitive positioning / moat. For that reason, I was pleased to hear on the Q3 call that the agreement had (suddenly) been restored. Here’s Vita Coco management explaining what led the two parties to return to the table:

“Since our last update, [Costco] requested we continue our partnership; we now expect to continue supplying a significant portion of their private label coconut water needs, a decision that we believe is reflective of their valuing our supply chain for its outstanding reliability and quality… This decision shows we have a significant supply chain advantage… Our conclusion would be they concluded that whatever their plans were, were not going to work… What we can tell you is we’re comfortable with continuing to supply a portion of the business… We love private label when it’s within our margin structure and business model.” (Piper Sandler Conference on 09/12/23: “We’re dealing with a retailer with a fair amount of power… You’ve got to know when to walk away… We also think what we do is very hard to replicate… They think they can do it - and if anyone can do it, they can.”)

While I think this is a positive development, the devil is in the details (some of which are unclear at this time). Specifically, the 10-Q reveals the renewed deal is for a relatively short period - “through 2024” - with the call commentary and 10-Q suggesting that another company will be responsible for supplying at least some portion of Costco’s private label demand. Given those factors, it’s unclear if this will be a sustainable solution for both parties or closer to a temporary stopgap. Either way, and particularly if Vita Coco was able to negotiate a financial agreement that truly met their business needs, I think it is much better to have a renewed deal with Costco than the alternative.

FY23 Financials

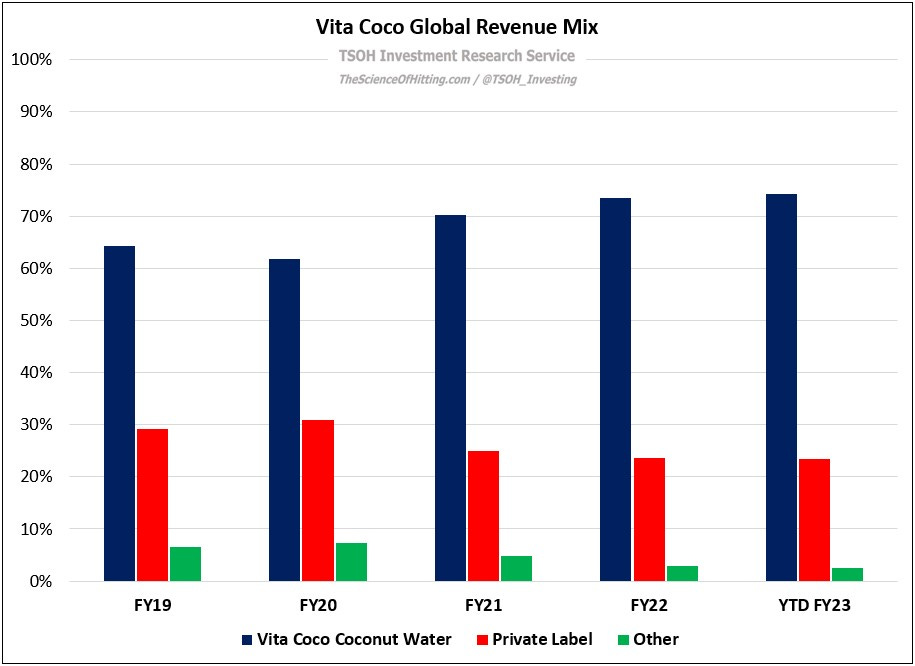

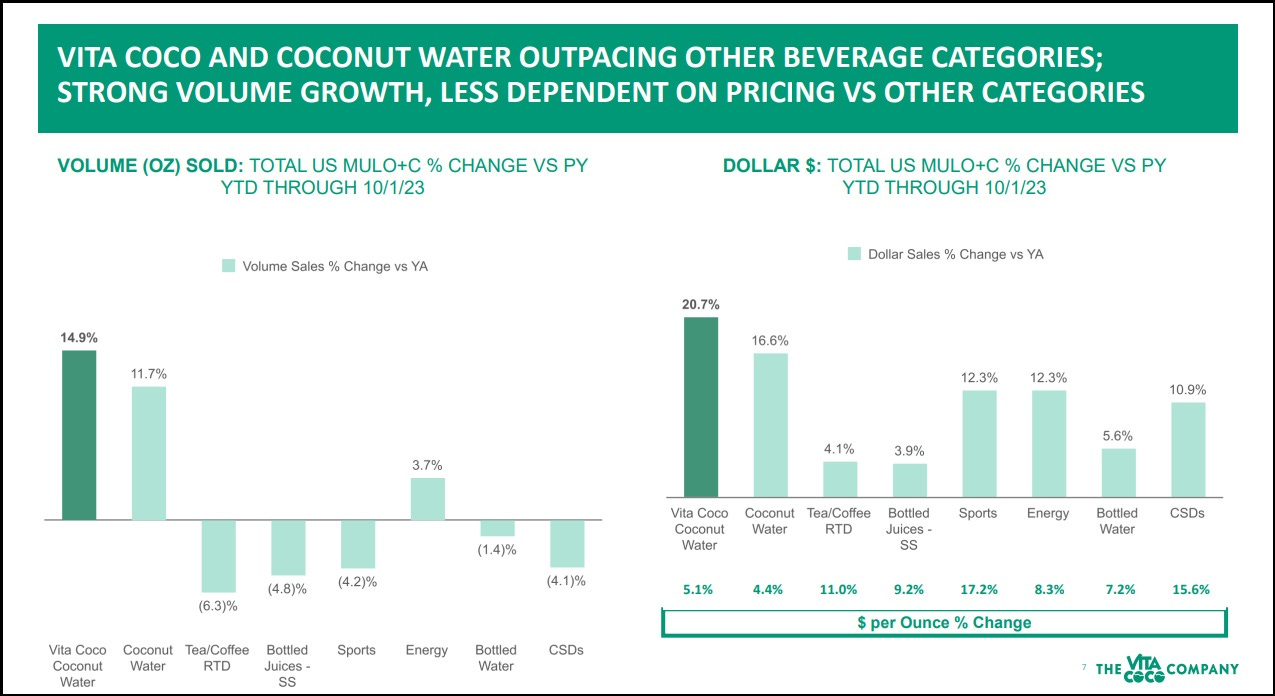

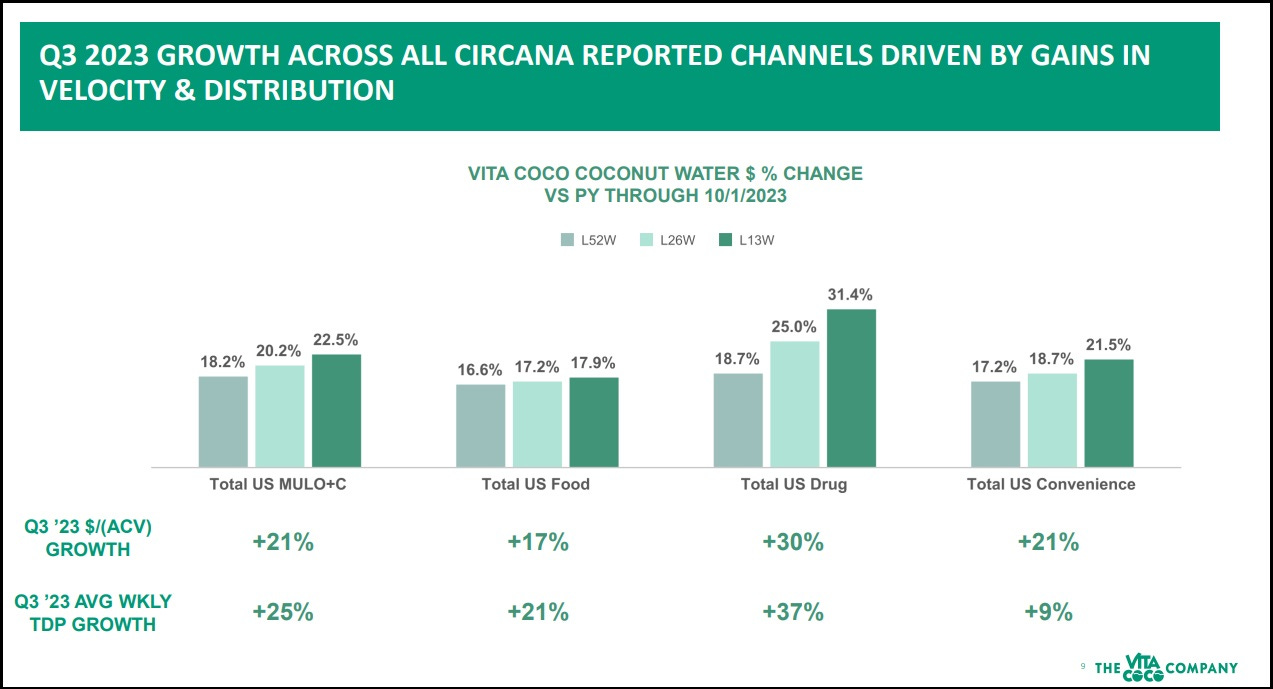

In Q3 FY23, Vita Coco’s revenues were up 11% YoY to $138 million, attributable to 18% growth for the private label business and 8% growth for branded Vita Coco (largely driven by higher CE volumes). As shown on slides nine and ten of the quarterly deck, the company is seeing success in U.S. channels like drug and C-stores on velocity and distribution. This can be a “chicken or the egg” problem for less established brands; the success that Vita Coco is witnessing is a testament to an impressive period for the broader U.S. coconut water category, alongside the company’s sustained dominant position within the category (~50% share, or roughly 2x larger than the combined share of Harmless Harvest and Goya, the #2 and #3 brands).