Cracking Coconuts

Vita Coco (COCO) Deep Dive

Vita Coco’s 2022 shareholder letter: “It is no longer good enough for a beverage to taste good. It also has to offer something beyond refreshment.”

Vita Coco’s story began in 2003, when co-founders Michael Kirban and Ira Liran stumbled upon a market opportunity: while coconut water was a widely available consumer packaged goods (CPG) offering in countries like Brazil, it was a nascent market in the United States: “we estimate the coconut water category in the U.S. was under $10 million when we launched in 2004”.

Over time, as demand in the U.S. started to materialize, Kirban and Liran moved to solidify their supply chain. This led them to the Philippines, where they approached the largest producers of food grade coconut products. When they inquired about purchasing coconut water, the suppliers “literally laughed at [them]”; from the perspective of these companies, the water they desired was nothing more than a by-product of their production process for other coconut products.

Kirban and Liran made them an offer: in exchange for an investment to help procure certain production equipment, they wanted a long-term, exclusive supply agreement for their coconut water. (This is a model that they would go on to replicate with other coconut product manufacturers in Indonesia, Sri Lanka, Malaysia, and Thailand.) Given the inherent constraint associated with producing coconut water – it must be packaged in a short window after being cut from the tree – this was an important development for Vita Coco.

Fast forward to 2009: with Vita Coco’s revenues growing at a rapid clip, the industry behemoths took notice. Coca-Cola acquired a minority stake in Zico, which became a majority ownership position in 2012. In addition, PepsiCo invested in O.N.E. (they took majority ownership in December 2010), along with the acquisition of Amacoco, Brazil’s largest coconut water company.

In short order, Vita Coco found itself in direct competition with the dominant players in global (non-alcoholic) beverages. What happened subsequently is noteworthy (including reported talks in 2017 for PepsiCo to acquire Vita Coco for a price that approached $1 billion): in 2021, Coca-Cola sold Zico back to its founder. Later that year, PepsiCo sold a number of its North American juice brands to a private equity firm, including its coconut water portfolio (preceded by a $41 million impairment charge in 2020 “related to a coconut water brand” in the company’s North American beverages segment).

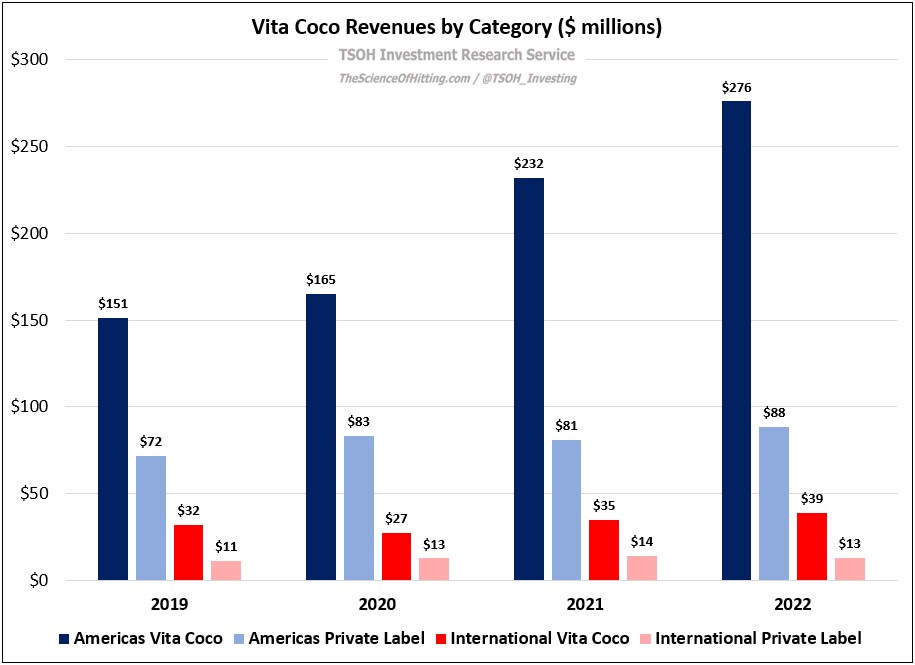

Summarizing the developments of the past two decades, Vita Coco has weathered both heightened competitive concerns and industry fluctuations (“retail-store sales of coconut water fell to $528 million in 2019, down 22% from 2015”). As Kirban noted at the time of the IPO, “we pushed [Coca-Cola and PepsiCo] out of the market through our supply chain skills… they were bad at cracking coconuts.” The essentially nonexistent U.S. coconut water category from the mid-2000’s now has retail sales approaching $700 million annually (it’s still just ~0.5% of the U.S. beverage market). Vita Coco is the category leader, with ~50% U.S. market share. In addition, as I’ll discuss in more detail below, Vita Coco management shifted its strategic focus in 2016 to also serve private label demand for certain strategic customers, most notably Costco (private label accounted for 24% of COCO’s FY22 revenues).

Americas

Vita Coco’s business is heavily dependent on its Americas region, and specifically the United States. In addition to accounting for nearly 90% of the company’s revenues, the Americas region had gross margins in 2021 and 2022 that were ~1,000 basis points higher than its International business.

At roughly 30% of its 2022 sales, Costco is Vita Coco’s most important customer (and while we don’t have regional customer-specific revenue data, ~70% of Costco’s warehouses are in the United States.) As for any CPG company, this can be a mixed blessing: while Costco offers the prospect of significant sales volumes, they press suppliers to deliver great deal for members – and as prior scuffles with companies like Coca-Cola have shown, they are not shy about taking action when they deem it appropriate to do so.

On that point, this comment from COCO’s 2022 annual report stood out to me (in reference to the Americas region): “Private Label net sales increased 9.3% to $88.2 million in 2022. The increase was mostly driven by benefits from net pricing actions and mix shifts, which were partly offset by a CE [case equivalent] volume decrease. The loss of some geographic regions for a key private label customer mid-year was only partially offset by gains with new customers.” That became a larger issue when management made the following disclosure on the company’s Q2 FY23 call: “In recent negotiations with our largest private label customer, the proposed terms to maintain the business were contrary to our margin targets and long-term goals. We have, therefore, jointly made the decision to transition the supply relationship at this time. We greatly value our long-term partnership with this customer, who remains a key retailer for our branded products.”

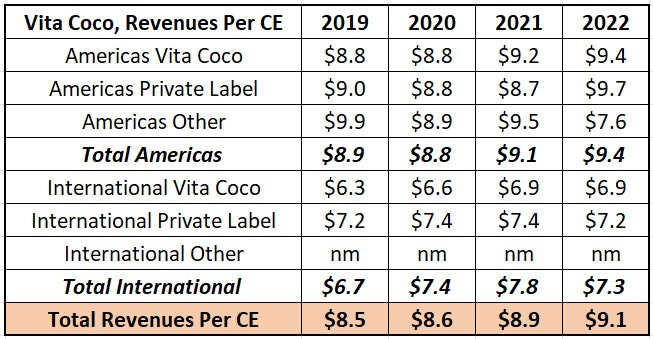

This is a major development – and while management didn’t specifically say so, the 10-Q disclosures indicate it was Costco (tie together the comments from “Subsequent Events” and “Note 7”). Beyond the financial implications - which were not specifically quantified, but my guess based on what was said during the Q2 call is a number around ~$50 million per year - it speaks to one of my long-term concerns about this business: I’m not convinced coconut water is a category where a brand like Vita Coco will stay meaningfully differentiated from private label offerings like Kirkland (feels closer to a category like milk than soft drinks). It’s interesting to think about that in light of the company’s reported financials. The following chart breaks down COCO’s revenues by geography and product type on a per case equivalent (CE) basis, or 12 of its 330ml (11.1 ounce) Tetra Paks. What you can see is that there has not been a material difference between Vita Coco’s price realization (revenues per CE) on branded and private label over the past four years.