TJX: Off-Price and On-Trend

A recurring theme for TSOH Investment Research is retailers that appear well insulated from e-commerce risk (disruption). The key variables I consider in that analysis are what the company sells, who they sell it to, and some distinct feature of the model (such as a treasure hunt experience) that is difficult to replicate online. That has led me to value-focused retailers that primarily sell groceries and other consumer packaged goods (CPG’s) like Dollar General, Dollar Tree, Ollie’s, and Grocery Outlet. Today’s write-up will focus on The TJX Companies – a retailer with a much different product mix than those listed above (primarily apparel and home goods), but which has similarly shown an ability to effectively navigate an evolving industry.

T.J. Maxx stores feature a wide variety of brand name and designer merchandise. The assortment is rapidly changing (“never the same place twice”), with the product on the shelves dependent upon the opportunities found by the company’s ~1,300 global buyers, who transact with ~21,000 different vendors. (The store layout is by category, as opposed to by brand; this provides a level of flexibility to repurpose the selling floor as needed to highlight categories where they have the deepest inventory.) As an outlet for suppliers holding unwanted or unseasonal merchandise, T.J. Maxx is able to offer retail prices that are generally at least 20% lower than what customers would pay at full-price competitors like department stores. Notably, that value proposition is front and center, with price tags displaying the “compare at” price that the product would cost elsewhere. As management says, their value proposition is a combination of brand, fashion, price, and quality.

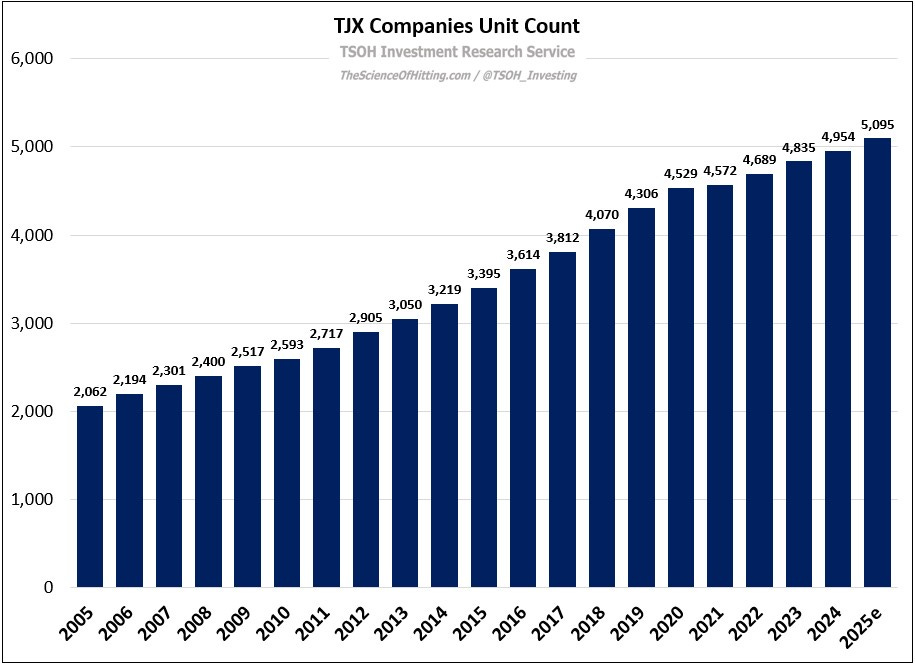

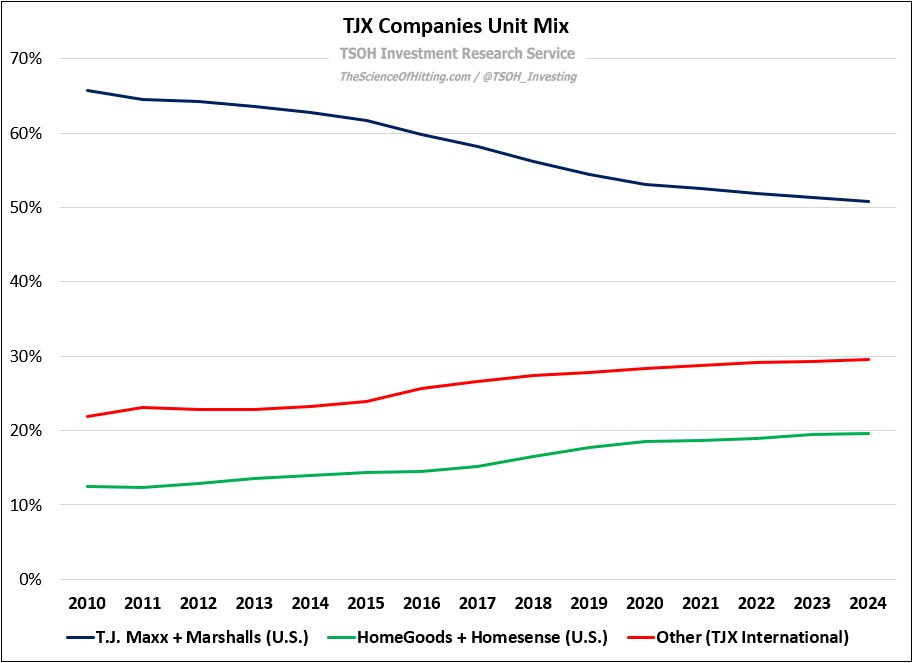

As you can see below, TJX has consistently expanded its footprint over time, with the various banners on pace to surpass 5,000 stores in FY25. The majority (~70%) are in the U.S., led by T.J Maxx and Marshalls stores, with those banners differentiated due to their product assortment. (The first T.J. Maxx stores opened in 1977 to compete with Marshalls; 18 years later, in 1995, TJX acquired Marshalls for ~$550 million.) TJX also has a large presence with its U.S. HomeGoods and Homesense banners (~20% of its unit count), off-price retailers of home fashions like furniture and cookware.