Tinder's Melting Ice Cube?

From “Match Group: Maturation” (August 2023): “I think these risks are worth taking, and I’m encouraged that management is experimenting. The other point, which is tied to what we’re seeing in the current results and 2H FY23 guidance, is that the financial goal is ultimately to maximize revenues, not Payers or RPP (given the product that they’re selling, there’s an inherent trade-off at the extremes between the growth of these two variables).”

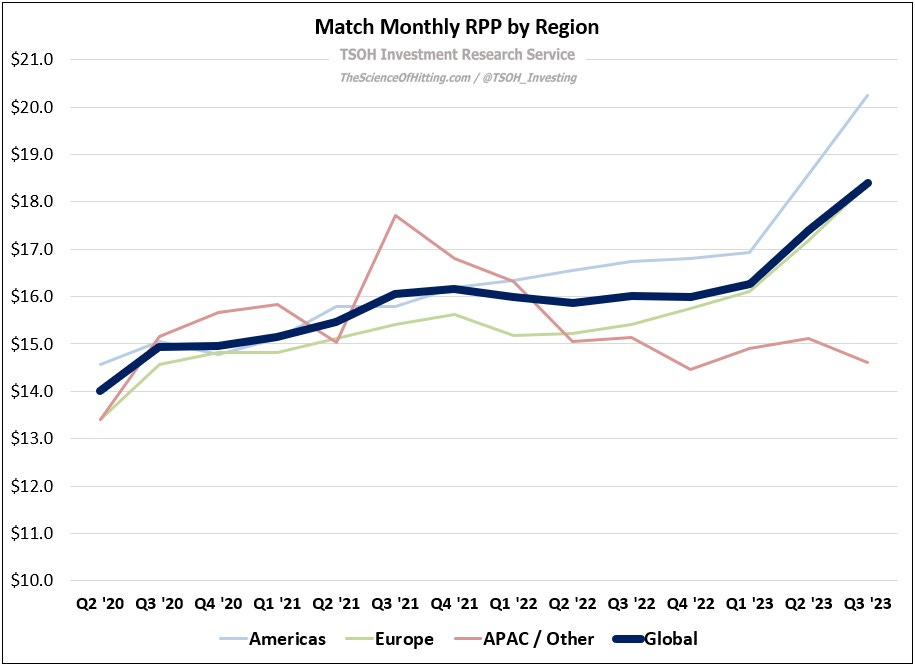

The trends discussed in “Maturation” continued in Q3 FY23 (as expected), with a mid-single digit decline in Payers offset by a mid-teens increase in revenue per Payer (RPP). The net result was 9% revenue growth in Q3 FY23; while that remains below the growth rate investors came to expect from Match, it’s an acceleration from the weak results over the past year.

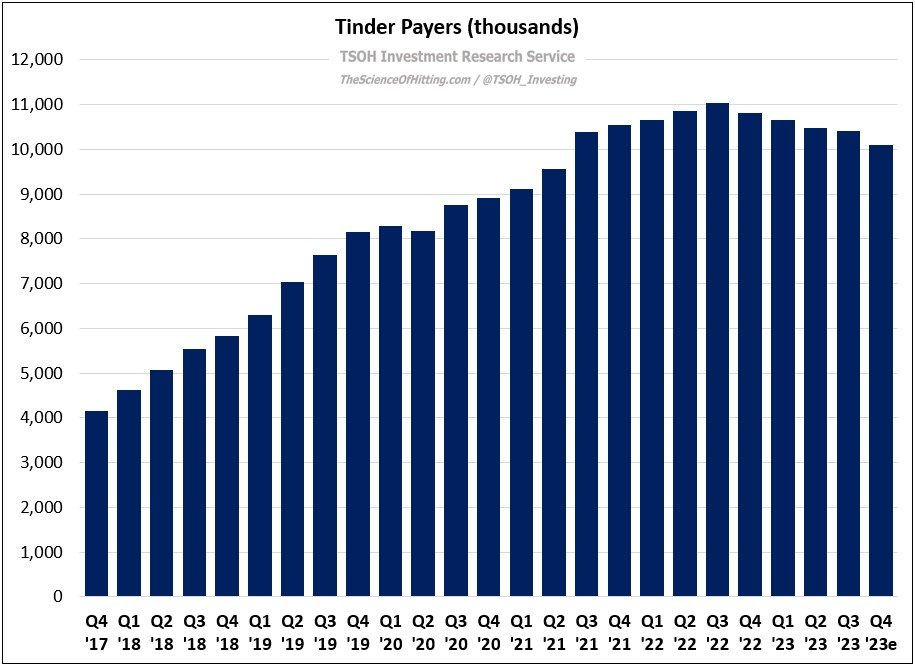

The reaction to the print was decidedly negative: the stock, which has been pummeled over the past two years, fell another ~15% following the Q3 results. What’s clear is that the investment community continues to harbor serious questions / doubts about management’s strategic vision. Above all, Mr. Market is very concerned about the trade-off between Payers and RPP, particularly at Tinder; do RPP lifts justify the Payer declines? Is the second variable even an active choice? In today’s write-up, I’ll share my updated thoughts on Match’s competitive position and long-term strategy, along with my thoughts on the road that lies ahead for the global leader in online dating.

Tinder

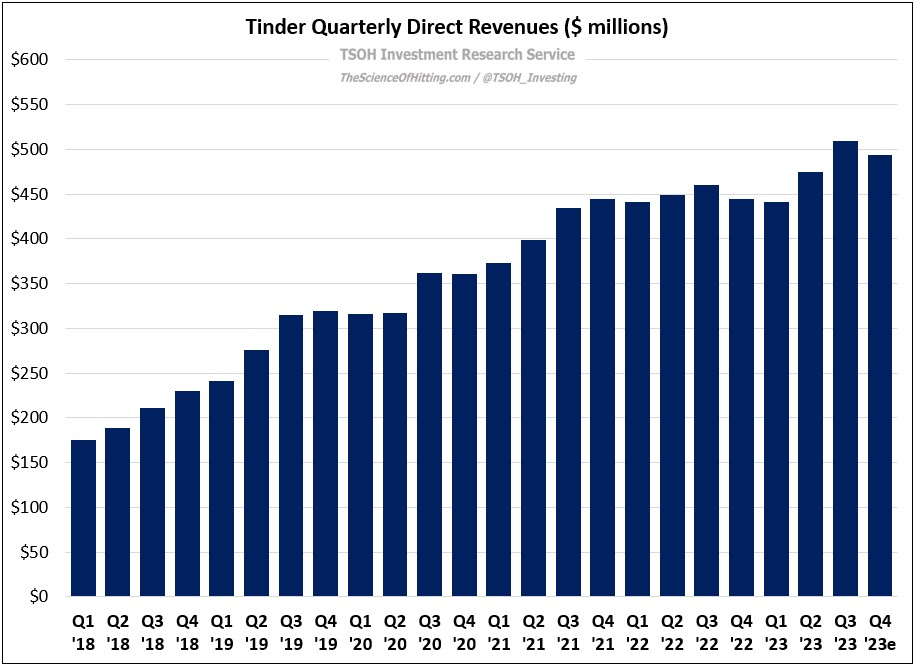

One metric that stood out from the Q3 results was Tinder revenues, which surpassed $500 million for the first time (+11% YoY). Tinder is on track for FY23 revenues of >$1.9 billion (trailing five-year revenue CAGR of +19%).

What the revenue metric fails to reveal is a fairly significant drop in Tinder Payers, which will likely end the year at roughly 10.1 million – a decline of nearly one million Payers from the Q3 FY22 highs. (That said, ~10.1 million Tinder Payers would still be up ~25% from pre-pandemic levels.)

The large gap between revenue growth and the Payer declines at Tinder is explained by pricing: Tinder’s global RPP was $16.3 in Q3 FY23, up ~17% YoY. In the United States, which has been the primary focal point for “price optimizations”, Tinder RPP in Q3 FY23 was up more than 40% YoY. That’s a good summation of the tussle as it relates to Tinder’s business: while it’s difficult to quibble with ~19% annualized revenue growth for FY18 – FY23e, the market fears that the recent Payer declines are indicative of sustained, and potentially irreversible, headwinds for the world’s leading dating app.