Match Group: Maturation

From “Feeling The Heat” (December 2022): “The current state of affairs at the Established Brands also presents an important question for the future of the industry: is there staying power in the online dating market? While scale offers significant benefits for users (a larger pool of singles), it also comes with its share of downsides… The success being seen at Bumble and at Hinge, in contrast to the stumbles at Tinder and the continued decline of the Established Brands, is a cautionary tale for investors in this industry.”

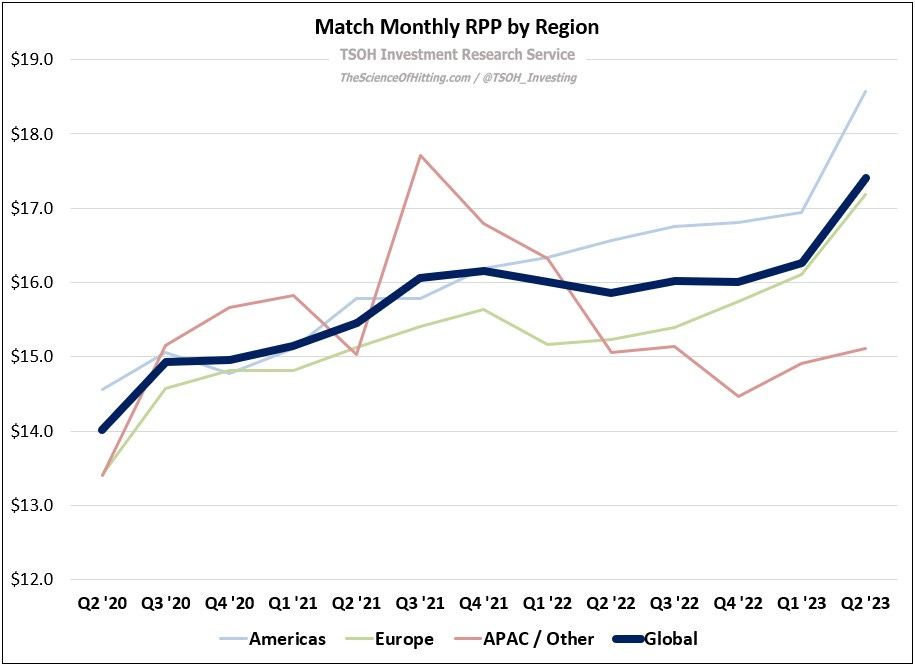

Today, the world leader in the online dating business finds itself in unfamiliar territory: the number of paying customers across Match’s collection of dating apps is declining. The company ended Q2 FY23 with 15.6 million Payers, down 5% YoY; notably, this outcome reflected a 4% YoY decline at the company’s leading app (Tinder Payers declined by ~400,000 to 10.5 million), along with a 6% YoY decline in its leading region (Americas Payers declined by ~500,000 to 7.7 million). That said, the pressure on Payer volumes was more than offset by a significant increase in revenues per payer, or RPP. As shown in the second chart below, global RPP exceeded $17 (per month) in Q2 FY23, which was up ~10% YoY – the largest (%) increase in Match’s RPP in more than two years (with management’s guidance, by my calculations, suggesting a mid-teens YoY increase in Q3).

What explains the diverging trends in the underlying drivers of Match’s business? And for investors, are these changes likely to precede improved financial performance - as well as a higher stock price - for Match Group? (The stock, at ~$44 per share, is down ~75% from the late 2021 highs.)