"This Is The Right Time"

Fever-Tree U.S. + Molson Coors

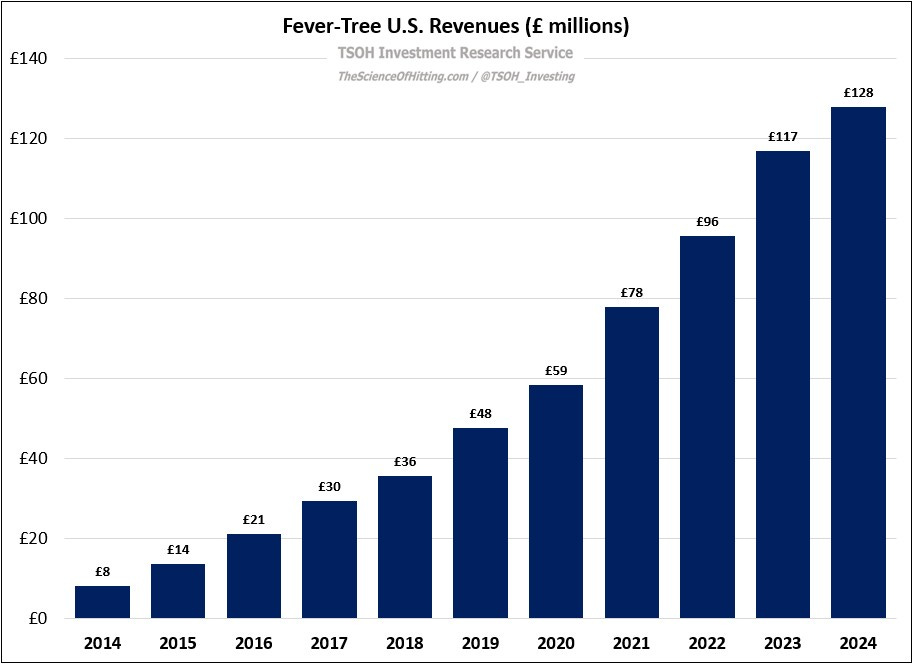

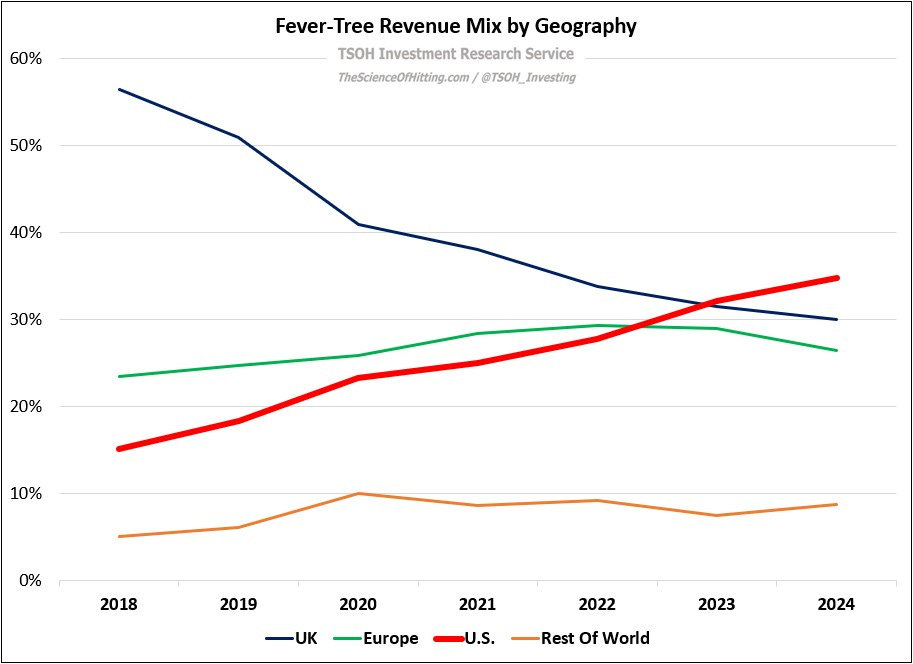

As discussed in “Spreading Our Wings”, Fever-Tree’s business has greatly changed over the past five years. From a geographic perspective, the primary driver has been U.S. expansion: the region generated £128 million in FY24 revenues, with a ~22% trailing five-year CAGR. The U.S. is Fever-Tree’s largest region, and it is their primary growth engine in the years ahead. (“The U.S. premium spirits market, by volume, is ~12x the size of the UK market.”)

But while there was much to be excited about as Fever-Tree made continued progress across its core U.S. range, I’ve also expressed disappointment on untapped opportunities in emerging categories. One example is premium soft drinks, a market being led by Poppi and Olipop, who collectively generated ~$1 billion in FY24 U.S. retail sales. The problem for Fever-Tree is that they were not well positioned to truly pursue this opportunity: they had enough on their plate in premium mixers, a challenge made much more difficult due to production / supply chain issues that arose as they grew the U.S. business.

As we dissect the transformative deal struck between Fever-Tree and Molson Coors, I think the above example provides an indication of how we ended up here, along with the divergent path that Fever-Tree is now heading down.