"This Is Microsoft's Moment"

From “The Ultimate Tailwind” (October 2022): “At a time when the investment community is obsessively focused on quarterly results (even more so than usual), a review of the long-term results serves as a useful reminder that this is what ultimately matters. In the case of Microsoft Cloud, I’d argue you can own a best-in-class competitor operating in a structural growth market with an immense TAM; that doesn’t tell us much about how the results will shake out over the next few quarters, but it leaves me highly confident the Cloud businesses will be much stronger when we look back in five years.”

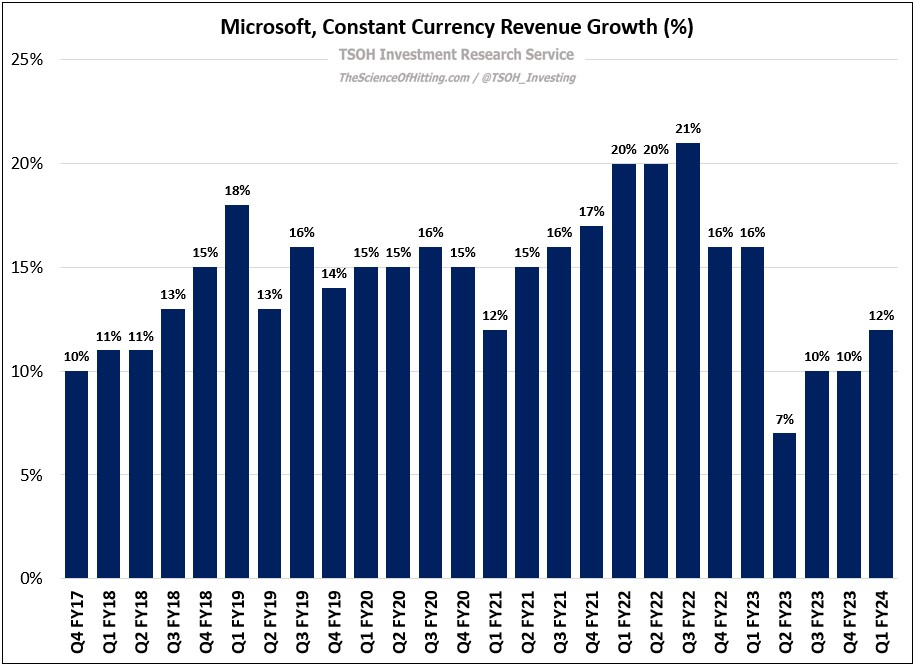

With a year behind us since that was written, we can see that Microsoft’s results have improved from the toughest point in FY23. In Q1 FY24, the company reported +12% constant currency (CC) revenue growth - bringing the tally for 10% or higher CC top-line growth to 25 of the past 26 quarters.

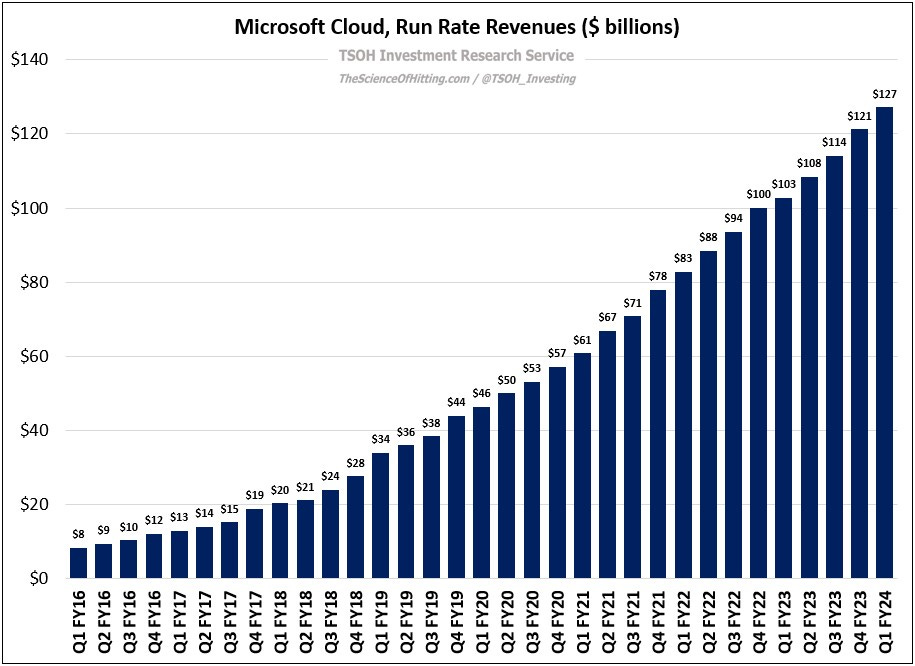

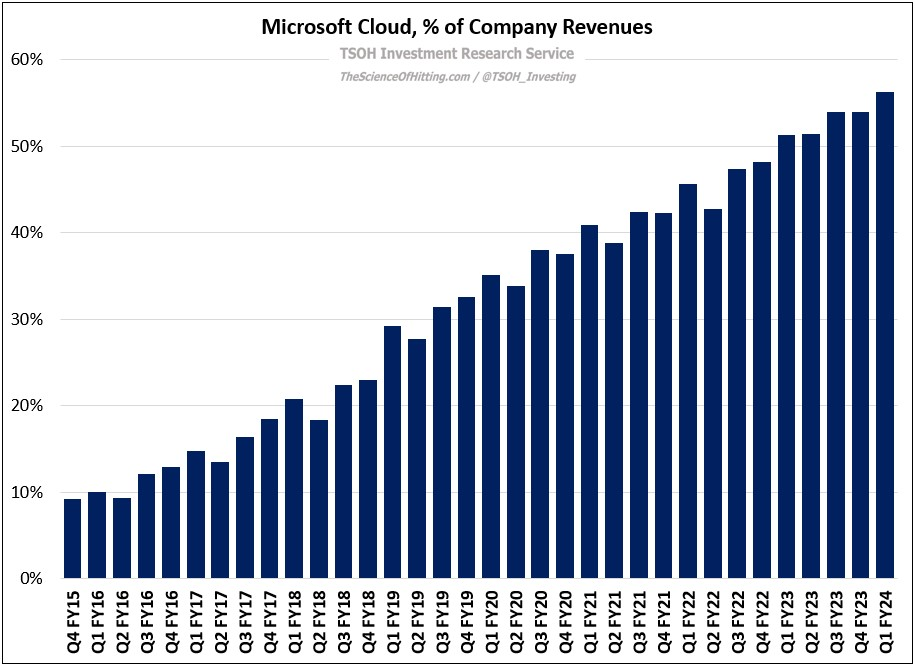

The primary driver continues to be Microsoft Cloud. When Satya Nadella became CEO in 2014, the Commercial Cloud businesses – primarily Azure and Office 365 Commercial - generated less than $5 billion in annualized (run rate) revenues. A year later, in April 2015, management set a goal of $20 billion in run rate Commercial Cloud revenues by YE FY18. As shown below, they exceeded that target by a wide margin, with Q4 FY18 run rate revenues of ~$28 billion – and they’ve kept marching forward ever since. As of Q1 FY24, run rate revenues for Microsoft Cloud are now at ~$127 billion – larger than Microsoft’s total annual revenues just five years ago (~$126 billion in FY19). Put differently, this was a ~$61 billion business in Q1 FY21 – and it more than doubled in size over the next three years. Naturally, this astounding growth had led to mix shift: Microsoft Cloud accounted for the majority (56%) of their Q1 FY24 revenues, up from ~30% in Q1 FY19.

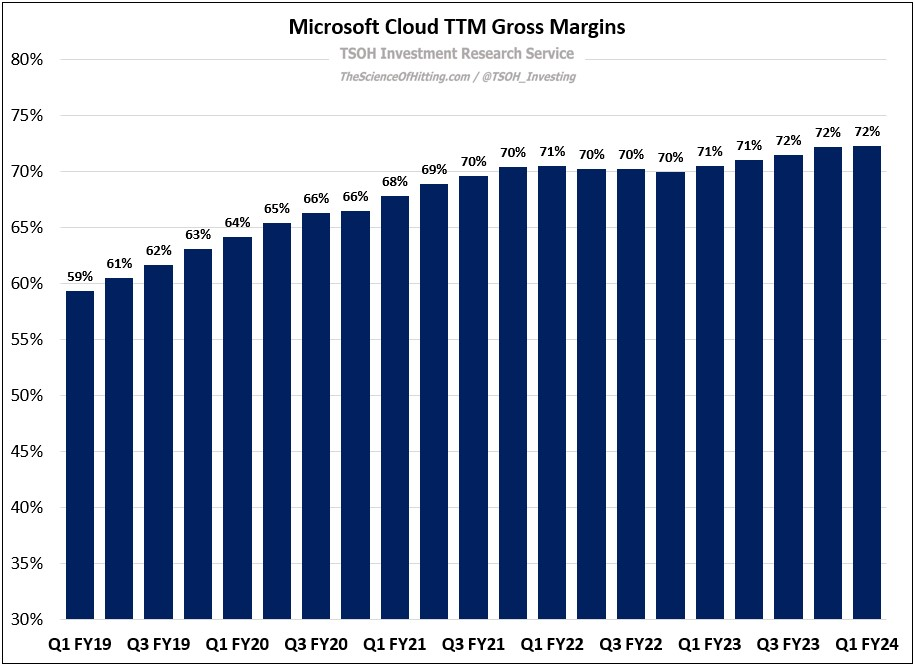

In addition to the ~30% Cloud revenue CAGR over the past five years (despite some notable industry headwinds like customer “cost-optimizing”, macro pressures, and price wars), the benefits of scale and efficiency are apparent: Cloud gross margins have steadily improved, reaching ~72% in Q1 FY24 (TTM). As a result, run rate Cloud gross profits reached $93 billion in Q1 FY24 – a >5x increase since the end of fiscal 2018 (~$16 billion).