"The Magic Happens On The Screen"

On February 8th, Peloton announced that co-founder and CEO John Foley, who had led the company since its founding back in 2012, was stepping down (the company also announced plans to “right-size the organization”, which will lead to a workforce reduction of ~2,800 employees). Foley’s replacement, 68-year old Barry McCarthy, is well known in the investment community; he was the CFO at Netflix from 1999 – 2010 and the CFO at Spotify from 2015 – 2020. McCarthy’s hiring is the primary reason why I decided to look at Peloton. As I’ll discuss in today’s write-up, I believe McCarthy was a great hire for Peloton, particularly given his experience at Netflix in the 2000’s.

(The “shotgun marriage” was well received by the market, with the stock climbing from ~$25 per share to ~$39 per share in a week; it has since given back a lot of those gains, and currently trades at ~$28 per share - more than 80% below its December 2020 highs. Also note that Foley’s exit came just 24 hours after Blackwells Capital published a deck lambasting the CEO.)

A week after he was hired, McCarthy was interviewed by the FT.

In that discussion, there were two key points that stood out to me.

First, he doesn’t want Peloton to be sold (which likely puts to rest, at least in the short-term, speculation about a deal with Amazon or Nike): “If I thought it was likely that the business was going to be acquired in the foreseeable future, I can’t imagine it would be a rational act to move across the country. There are lots of other things I could do with my time that are [more] lucrative than hanging out with a business that’s about to be sold.”

Second, he believes strategic changes are required: “McCarthy said his growth strategy would focus on content, explaining that “where the magic lives” is on Peloton’s digital screens, not its connected bikes or treadmills. Expanding the digital community and enhancing content could make Peloton ‘a very fast-growing business with very high margins’. His playbook will include developing ‘product line extensions’ so customers could own multiple machines… ‘An entirely different pricing structure’ could replace the $39 monthly subscription… McCarthy declined to comment on specific launches but emphasized Peloton was ‘a connected fitness company, not a bike company’.”

Following a roller coaster ride for the business (and the stock price) over the past 24 months, Peloton is at an inflection point; as McCarthy wrote in his first email to employees, “Now that the reset button has been pushed, the challenge ahead of us is this... do we squander the opportunity in front of us or do we engineer the great comeback story of the post-Covid era?”

Financials

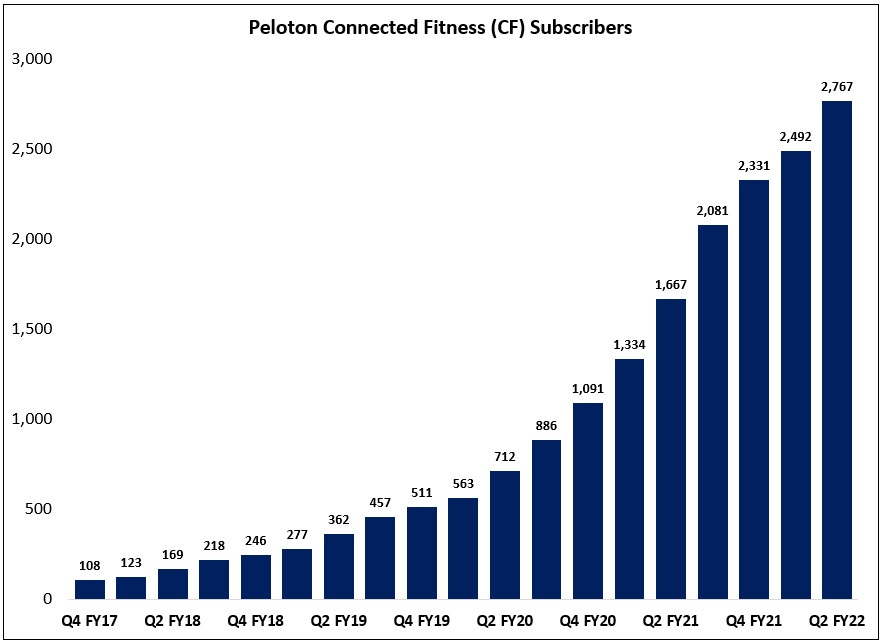

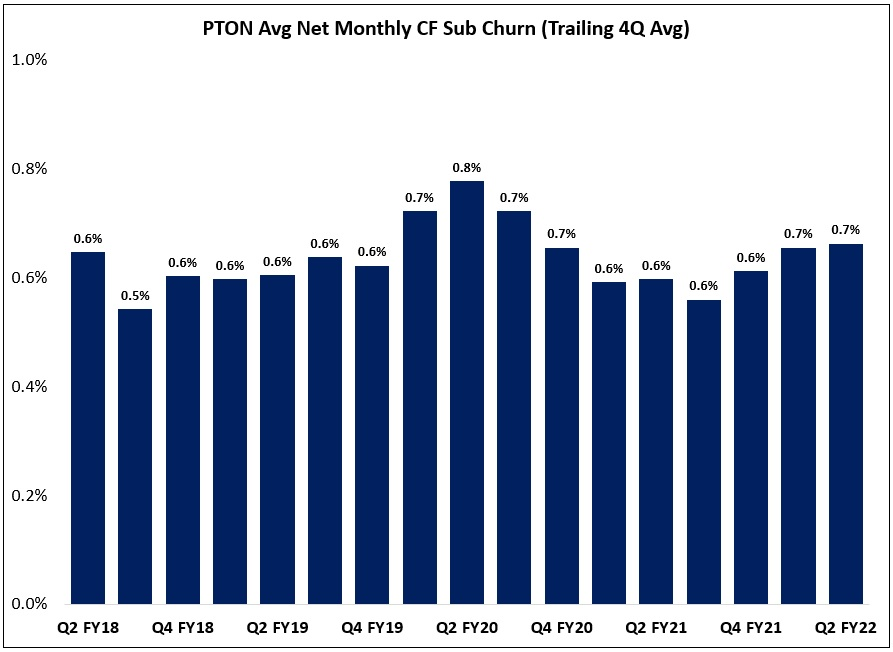

Peloton ended Q2 FY22 with ~2.8 million Connected Fitness (CF) subscribers, a roughly 4x increase in 24 months. I don’t think it’s an overstatement to say that Peloton is loved by its core customers, with U.S. NPS scores in the high-80’s. With a $39 per month fee for ongoing access to the company’s digital content and instructors / classes, the CF sub base generates ~$1.3 billion in run rate revenues, with monthly churn below 1%.

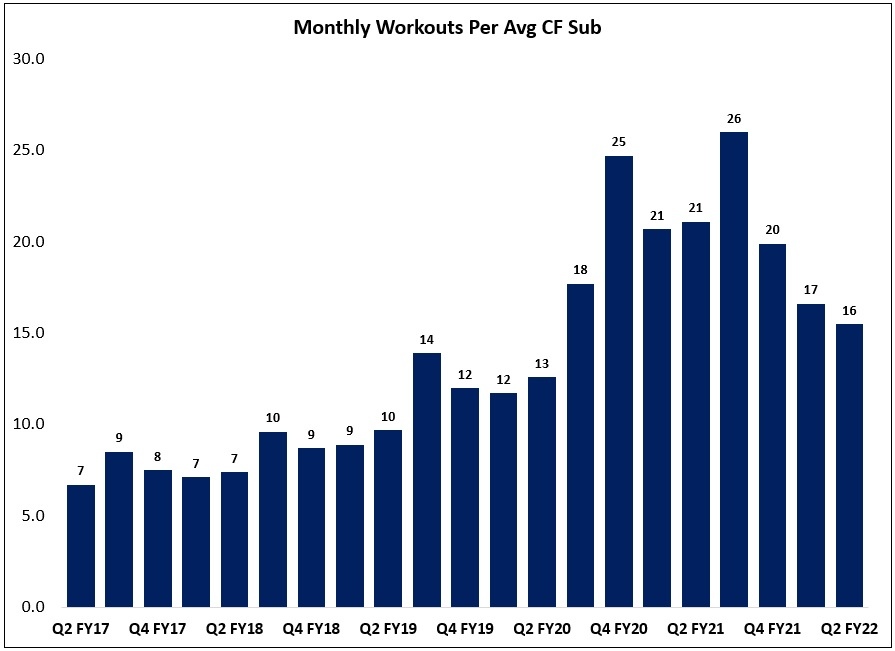

As shown below, the number of workouts per average subscription ramped during COVID, climbing ~2x to a peak of 26 workouts per month. But that tailwind is fading: as the world reopened, average workouts per subscription fell ~35%. (As disclosed in the 10-K, the average subscription covers 2.2 members; that implies an average of seven monthly workouts per member.)

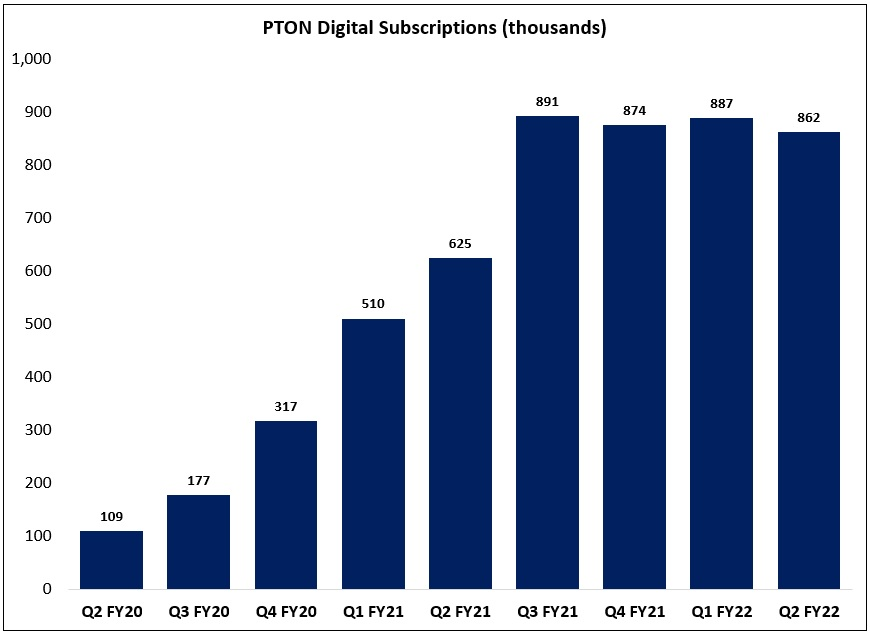

In addition to the CF subscribers, the company has ~900k subscribers who pay ~$13 a month to access Peloton’s digital content without the company’s hardware (run rate revenues of ~$140 million). As noted on the Q3 FY21 call, the Digital to CF upgrade path has been a nice source of growth for Peloton over the past year (“Over 20% of our Digital subscribers ultimately upgrade to CF… We can think of no better way to introduce fitness-minded consumers to the amazing quality, breadth and depth of our content offering.”). However, growth has stalled for the digital sub base; following a rapid ascent over 15 months, digital subs have been flat since Q3 FY21.

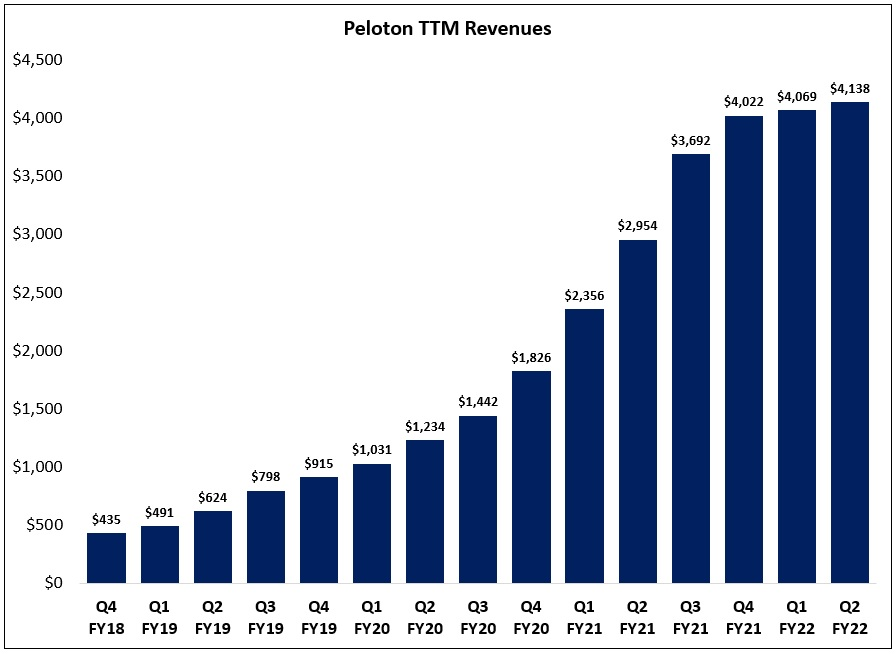

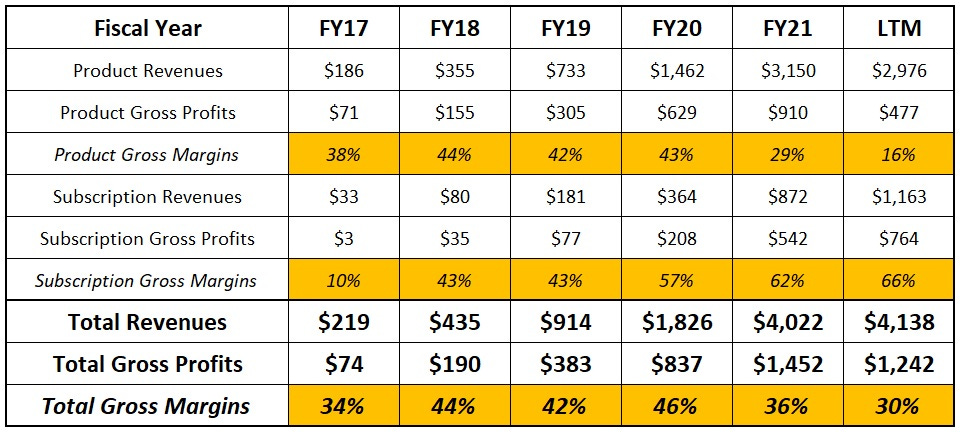

In total, Peloton generated $4.1 billion in TTM revenues in Q2 FY22 – roughly 10x higher than at year-end FY18 (FY22 guidance calls for revenues of ~$3.8 billion). While the business “ran off the rails”, it’s still worth noting that this company put up impressive growth over the past few years.

McCarthy’s Vision

Peloton has lived through a handful of high profile issues in the past year, most notably a delayed response to safety concerns for the Tread+ (after calling the CSPC’s warnings “inaccurate and misleading”) and a $1 billion stock offering just 12 days after CFO Jill Woodworth assured the market it did not need outside funding (“we don't see the need for any additional capital”).

Not to be flippant, but I don’t think these events had a meaningful impact on brand perception among customers; for that reason, our time is best spent focusing on the future, not the past. Which brings us to McCarthy’s vision for Peloton. Luckily, interviews with the FT and the NYT have provided a lot of color on the opportunities that he sees; in addition, his work at Netflix and Spotify may offer some insight into how he will run Peloton. At a high level, these are the three key points I’ve taken from the interviews and from thinking about McCarthy’s prior executive experience:

1) McCarthy is primarily focused on the software / content opportunity. When asked about his long-term vision for Peloton, McCarthy replied:

“The magic doesn’t happen in the sheet metal. It needs to be good enough, but it’s not sufficient. If it’s just NordicTrack, you’re not winning. The magic happens on the screen… It’s the music, it’s the instructors, it’s all the social aspects that we have only just begun to develop - and that’s where we’re going to spend our money. Today, it’s a closed platform - but it could be an open platform... Could it be running an app store?”

While “the magic happens on the screen”, I think Peloton’s hardware still matters; what truly differentiates the Peloton experience is the integration of hardware and software. In addition, product line extensions provide the opportunity to expand the TAM (“Mr. Foley said he expects the Tread to eventually outsell bikes as the market for treadmills is 3x bigger than for stationary bikes [over the last two decades in the U.S., ~5 million treadmills sold per year and ~1.6 million stationary bikes sold per year]… We believe there are 35 million American households with a treadmill in their basement”). So, while the end goal is to grow the sub base, which demands even larger investments into the stuff that happens behind the screen (classes / instructors, software, etc.), it will be interesting to see what that means in terms of McCarthy’s focus (as it relates to CF growth versus digital growth).

2) The company is going to test different pricing strategies. In August 2021, for the second time in less than a year, Peloton announced that it was reducing the cost of its core bike offering by another 20%; as a result, the cost of the core Peloton bike is now at $1,495 – a third lower than what it cost in mid-2020. (Note that the company introduced a $250 delivery and setup fee in January 2022, meaning that the effective price for the bike is $1,745 – still more than 20% below the mid-2020 price.) But it doesn’t sound like the August 2021 price cut is the end of the line. When McCarthy was asked about the potential need for additional capital; this was his response:

“The answer is maybe… Regardless of what the strategy is, you need a capital structure to support it. So if it becomes this enormously capital-intensive business because you’re giving away a $2,000 bike and then recouping it over time, you can absolutely raise capital around it. It would be some combination of debt and equity - mostly debt like we used at Netflix, because the bigger the subscriber base gets, the more predictable the revenue stream gets. And the more predictable the revenue stream gets, the more leverage you can put on it.”

As management wrote in the Q4 FY21 shareholder letter, “We know price remains a barrier and are pleased to offer our most popular product at an attractive everyday price point. We are also introducing a longer 43-month 0% financing term option for Bike+ and Tread across all regions.” Despite a 20%+ (all-in) price cut on the bike and attractive financing terms, it sounds like McCarthy believes there’s still work to be done on pricing.

3) McCarthy will look to a well-worn playbook. In a 2019 WSJ interview, while still at Spotify, McCarthy was asked how the long-term strategy at the company compared to Netflix. This was his reply (bold added for emphasis):

“For more than a decade, the Netflix strategy was low price, at the expense of margin, to drive increased share of market and faster growth. We’re pursuing a similar strategy. I often get the question, why don’t you increase the price? And many record labels feel like we’re undervaluing their music. It’s very similar to the feedback we got from studios at Netflix. The investment in new content to drive growth for Netflix was in streaming content on top of the DVD content. For Spotify, the investment is in podcasts. Original podcasting content for Spotify comes with a fixed cost, just like the streaming investment for Netflix came with a fixed cost, and over time, as it became a large percentage of the business, it shifted the Netflix cost structure from variable to fixed. That had some profound implications for the evolution of that business model.”

The strategy at Netflix and Spotify was: (1) low prices, at the expense of margin, to drive global subscriber growth and high market share; (2) as the business scales, find a fixed cost lever; (3) rely on that combination of scale, fixed cost leverage, and a point of differentiation to sustain that dominant market position, with “profound implications” for the business model.

Much like at Spotify and Netflix, it will take many years for this long-term vision to result in consistent and meaningful profitability / FCF, particularly if McCarthy acts as aggressively as I suspect he’d like to (in pursuit of unit / subscriber growth). As McCarthy said on Spotify’s podcast strategy, “What you’ll see first is an investment in content and growth in engagement, and monetization will follow.” I expect to see a similar approach at Peloton.

Betting on Management

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

I took that Warren Buffett quote as gospel as a young investor. But over time, I’ve come to a more nuanced view: truly great managers have a knack for finding and building attractive businesses. An instructive example is Jeff Bezos: if Amazon never moved beyond its roots (first-party e-commerce, let alone a narrow category focus), it would be a small fraction of its current size. But along the way, Amazon built a wonderful business that caters to the needs of third-party sellers (fulfillment, advertising, etc.); in addition, they discovered a massive new market opportunity in AWS by commercializing their internal tech capabilities.

McCarthy’s experience at Netflix and Spotify follows a similar storyline. Without vision and execution, those are completely different companies than what we see today (and that assumes they’d still be in business). That outcome was largely due to management, culture, and a willingness to make bold bets, not business reputation. (Unsurprisingly, McCarthy agrees: “The thing I learned early in my career is that being a successful investor is all about picking the right guy or gal, because as an outsider you never know enough to really make an informed decision; you’re almost entirely dependent on the abilities of the people you’ve invested behind.”)

How does that relate to Peloton? It’s not apparent to me that this is destined to be a “good business” or a “bad business”. Instead, when we look back in ten years, I think the outcome will largely be dependent upon management’s strategic decision-making and internal execution.

Product Market Fit

As McCarthy told the NYT, “I know from my experience that product market fit is the hardest thing on the planet to find. And once you find it, it’s almost impossible to screw it up no matter how hard you try.” Customer data supports this conclusion, particularly among the CF subs. But how deep does this love run? How big can Peloton’s subscriber base become?

On the digital subs, I believe they’ll remain a secondary consideration (lead generation for CF). The true Peloton experience comes from the integration of hardware and software. (“Foley first considered developing just a software platform, but he discovered that by being vertically integrated they’d be able to deliver a dramatically better experience for consumers.”) In addition, I’d note that many use cases for a standalone fitness app, like yoga or strength, do not offer the measurement / gamification / social component that’s a big value add for the bike and Tread (“the motivating power of a community and integrated metrics that push riders to be their best”).

If you agree with that conclusion, the focus is expanding the TAM for the integrated offering (CF subs); how can Peloton serve the broader fitness market, the ~200 million people around the world with a gym membership, as opposed to 5-10 million high-end, “serious about fitness” customers?

One approach McCarthy has spoken about is significantly reducing upfront product (hardware) costs with a focus on lifetime value (“Playing around with the relationship between the monthly recurring revenue and the upfront cost to find some sweet spot in the value proposition… instead of $39, it’s maybe $70 or $80… the upfront cost is dramatically lower”).

But Peloton was already moving in this direction. “Greater [hardware] affordability” was a key part of the long-term plan for reaching 100 million subscribers (“Our aim is to break down barriers to purchase and broaden our reach, and we have implemented strategies along the way to achieve both of these goals”). As noted above, they’ve already cut the bike price by $500, inclusive of the $250 delivery and setup fee. In addition, they offer 0% financing, which means you can buy a Peloton bike for less than $50 per month with no money down (excluding the $39 per month for a CF sub).

Is current product (hardware) pricing a major deterrent for somebody who is comfortable paying $39 per month for access to instructor-led bike rides? Would their willingness to buy change if the upfront cost was reduced (another) ~$500 with the monthly subscription increased ~$10?

Or is the TAM for a stationary bike that has an all-in cost over the first 36 months of more than $3,000 simply a lot smaller than the ~200 million people around the world with a gym membership (“90 million of those are in our four current markets: the U.S., U.K., Canada and Germany”). As a point of comparison, note that Planet Fitness just reported that 9.7 million people currently pay for their Black Card membership, which costs $22.99 per month (over a three year period, that’s still an all-in cost of less than $1,000).

Conclusion

Given that Peloton’s “special sauce” is the relationship with instructors and the gamification / social aspect of workout streaks and leaderboards, McCarthy’s vision – “expanding the digital community and enhancing content” – seems appropriate. Getting “the product” in the hands (on the feet?) of a wider customer base is a huge opportunity for Peloton. In addition, they’ve clearly establish brand / product differentiation in the marketplace; it’s the reason why Peloton has been able to sell millions of bikes while charging ~2x more than competitors.

But how do they get to 10 million CF subs, let alone 100 million?

With “high NPS and low churn”, reducing the CF subscription fee might be a tough pill to swallow, especially in the short-term (and that assumes it would have a meaningful impact on bike / treadmill purchases, which isn’t a given). If that’s off the table, we’re left with lower hardware pricing… a continuation of Peloton’s recent strategy. (“The company said in a confidential presentation dated January 10th that demand for its connected fitness equipment has faced a “significant reduction” around the world due to shoppers’ price sensitivity and amplified competitor activity.”) That doesn’t seem to fit McCarthy’s vision of an “entirely different pricing structure”. Is there some way to tweak the equation, both in terms of the dollar amount spent over the product’s useful life and the mix between upfront and recurring monthly costs, that results in a more attractive customer value proposition and a sustainable long-term business model for Peloton? I suspect McCarthy and the team are working through this as we speak (“I think there’s enormous opportunity for us to flex the business model and dramatically increase the TAM by lowering the cost of entry and playing around with the relationship between monthly recurring revenue and the upfront revenue.”)

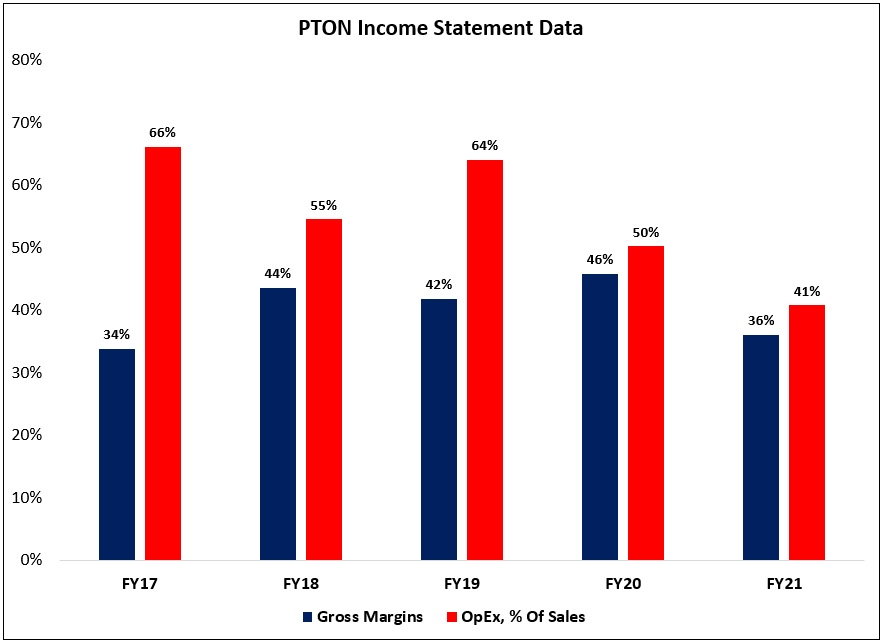

At the end of the day, Peloton has a better mouse trap than competitors who just sell “dumb” hardware. Subscription revenues result in much higher lifetime gross profits per customer relationship; in combination with scale and (some much needed) operating efficiency, this should give Peloton the ability to price more aggressively, while still maintaining differentiation and high NPS scores. (“We are at a critical inflection point in our business. These are the early days of a significant transformation of our operating model to achieve a better balance of growth and efficiency.”)

Finally, I think McCarthy has an ability to see what matters and to clearly communicate his ideas, which will be important internally (with employees) and externally (with investors) given that this situation will require buy-in from key stakeholders (see McCarthy’s comment on Netflix’s funding / capital structure). He will need that trust if he announces a radical change, such as an “entirely different pricing structure”. This comment, which McCarthy made back in 2010 while at Netflix, is worth thinking about (as shown above, Peloton’s subscription business now has gross margins in the mid-60’s):

“We’ve been playing a market share game… When we attached streaming to the service, we didn't increase the cost. We just increased the benefits, and, in effect, lowered the margins to what amounts to a price cut in order to continue to drive fast growth and penetrate the consumer marketplace and build the brand and scale, anticipating that there would be competition… Over the long run we will be a more profitable business with very large share and relatively low margins than we would be with relatively small share and high margins.”

As a long-term, concentrated investor who started looking at this company a few weeks ago, patience seems warranted; importantly, I suspect it won’t be long before we see notable changes at Peloton. (McCarthy: “In the months ahead, you can expect to hear from me about our strategy and the choices we’re planning to drive our success.”) Looking forward, my focus as an analyst is to further understand how pricing and business model tweaks can potentially help to attract tens of millions of CF subscribers over time.

To reiterate, I think McCarthy is a great fit for this role given what he lived through at Netflix (the economics of DVD distribution, pricing strategy in competition with Blockbuster, and the early days of video streaming); if that’s proven correct, I believe Peloton will capitalize on a massive long-term market opportunity. I’ll leave the new CEO with the last word:

“It’s a religion. If we can’t figure out what to do with that, then shame on us.”

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

Alex, thanks for sharing your great insights !! I believe product differentiation(Over the air software upgrades or feature unlocks like TSLA for customer lock-in) and gaming/social aspects of fitness would be important for Peloton to be successful. It would be interesting to observe how the leadership will balance brand development and affordability to gain market share