The "Life Out Here" Retailer

In 1938, 26-year old Charles E. Schmidt Sr. started a mail order business selling tractor parts from his kitchen table in Chicago, Illinois. The following year, Schmidt established a retail presence for his business in Minot, North Dakota. Over the ensuing 85 years, Tractor Supply continued to expand its retail footprint throughout the U.S.; as of yearend 2022, the company now has 2,300+ total stores across 49 states, with 2023e sales of $15.2 billion.

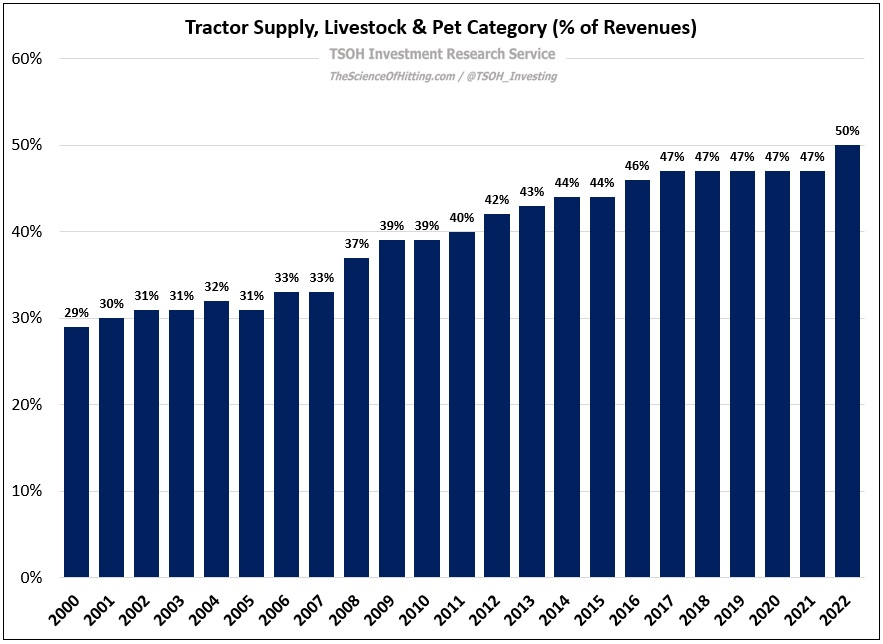

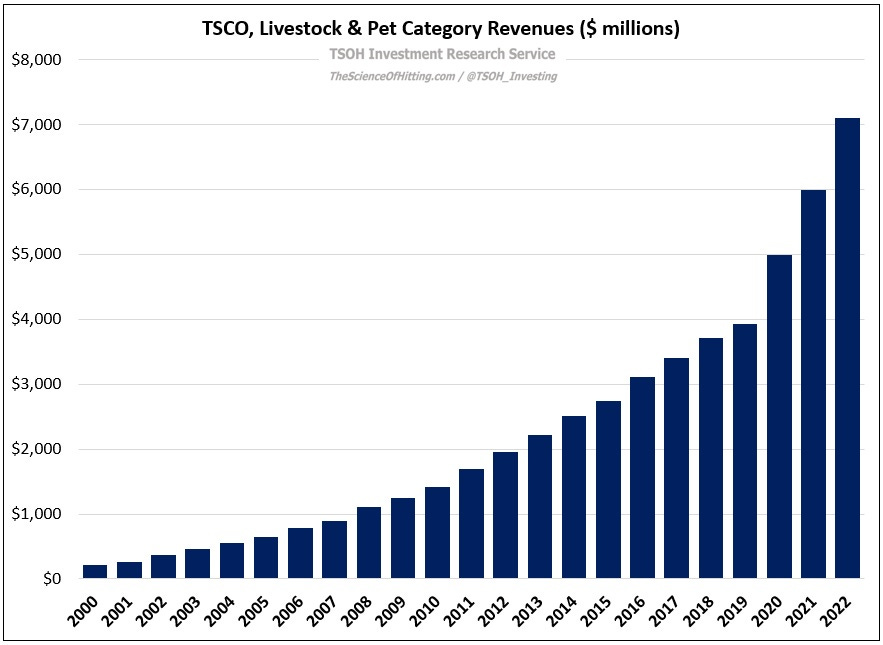

As noted in the annual report, Tractor Supply is focused on serving the needs of recreational farmers, ranchers, and all those who live the rural lifestyle. As CEO Hal Lawton said in a recent interview, “we’re much like a grocery store for our customers animals.” Importantly, the company’s stores, which average 15,000 – 20,000 square feet, are primarily located in small towns and rural communities - a real estate footprint / strategy that rhymes with Dollar General. The primary product category at Tractor Supply is “Livestock & Pet” (L&P), with FY22 revenues of $7.1 billion (a nearly 20x increase from the $375 million in L&P revenues that TSCO generated in 2002). The category is focused on providing a full range of products for the care and protection of animals (equine, livestock, pet, etc.); as you can see on the company’s website, this includes feed / food, bedding, grooming supplies, fencing materials, etc. – anything that you’d need to care for a chicken, a horse, a dog, or even a llama. As shown below, the L&P category mix has increased meaningfully over the past 20+ years; these results are tangible evidence of Lawton’s vison (“a grocery store for our customers animals”).

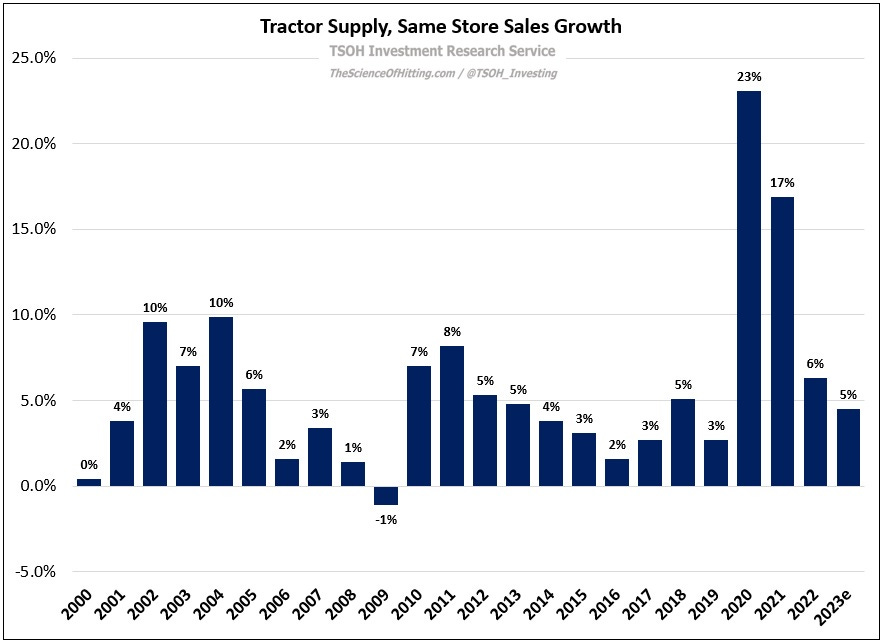

Tractor Supply’s revenues have exploded over the past few years. In 2017, nearly 80 years after the company was founded, revenues crossed $7 billion for the first time; over the next six years (2018 – 2023e), TSCO added ~$7.9 billion in incremental revenues (~$15.2 billion at the 2023e midpoint). This outcome has largely been attributable to same store sales (SSS) growth, most notably the +23% and +17% reported in 2020 and 2021, respectively; as shown below, SSS declined in a single year over the past two decades.

What explains these astounding recent results? At a recent analyst event, Lawton discussed one key component underlying TSCO’s recent revenue growth (up ~70% cumulative from 2019 to 2022) - millennial customers: