On Thursday, The Walt Disney Company (DIS) reported results for Q3 FY21.

As I noted last quarter, the current financial results at Disney are quite messy. Most notably, the theme park and movie theater businesses face continued headwinds from the pandemic. In addition, Disney is incurring meaningful costs as they ramp their direct-to-consumer (DTC) businesses around the world (those efforts will continue for the foreseeable future, and rightly so).

As always, its important not to place too much weight on the results in any given quarter or year; instead, we should remain squarely focused on the long-term earnings power of the enterprise. So, with that, as we think about Disney’s future, let’s start with the company’s foremost strategic priority: DTC.

Direct-to-Consumer

As shown below, each of Disney’s DTC services – Disney+, ESPN+, and Hulu (SVOD + Hulu Live) - reported sequential growth in Q3, with the Disney+ user base doubling over the past year to 116 million paid subs.

While this is an encouraging outcome at a high level, most notably the 12.4 million sequential adds for Disney+, we need to peel back the onion. The following chart breaks down the Disney+ subscribers between the Disney+ Hotstar markets (India, Indonesia, Malaysia, and Thailand) and what I’ll call the core Disney+ markets (places like North America and Western Europe).

As you can see, Disney+ Hotstar has been the primary growth driver, accounting for more than 80% of the roughly 21 million Disney+ paid subscribers added over the past six months.

This is a noteworthy development because there’s a major difference between these two offerings in terms of average revenue per user (ARPU). Consider this comment from CFO Christine McCarthy on the call:

“Disney+'s overall ARPU this quarter was $4.16 [per month]. Excluding Disney+ Hotstar, the ARPU was $6.12 [per month], or an increase of about $0.50 versus Q2, reflecting a benefit from recent price increases, both domestically and abroad.”

With those data points, we can estimate the ARPU for Disney+ Hotstar.

Despite an average sub base that was about 60% of the size of the core Disney+ average sub base (40.5 million vs 69.3 million), we can estimate that Disney+ Hotstar generated about $100 million in Q3 revenues – less than one-tenth of what core Disney+ generated in the same period. The reason why, as you can see, is that the ARPU for core Disney+ subs is nearly eight times higher than the ARPU for Disney+ Hotstar subs ($6.1 vs $0.8).

As we think about what this means for Disney’s DTC business over the long run, consider the FY24 Disney+ guidance from the 2020 Investor Day:

“We now expect that by the end of fiscal 2024, we will have between 230 million and 260 million total paid Disney+ subscribers globally… I'll note that our prior outlook did not anticipate the launch of Disney+ Hotstar, which we now expect could be between 30% and 40% of our subscriber base by the end of fiscal 2024.”

At the midpoint (245 million), and assuming 40% is attributable to Disney+ Hotstar (comparable to today), that’s 100 million subs; at an estimated ARPU of $1 per month, that would give Disney+ Hotstar run rate FY24 revenues of $1.2 billion per year. The remainder would consist of roughly 145 million core Disney+ customers; at an estimated ARPU of $7 per month, the core Disney+ business would generate $12.4 billion in run rate FY24 revenues.

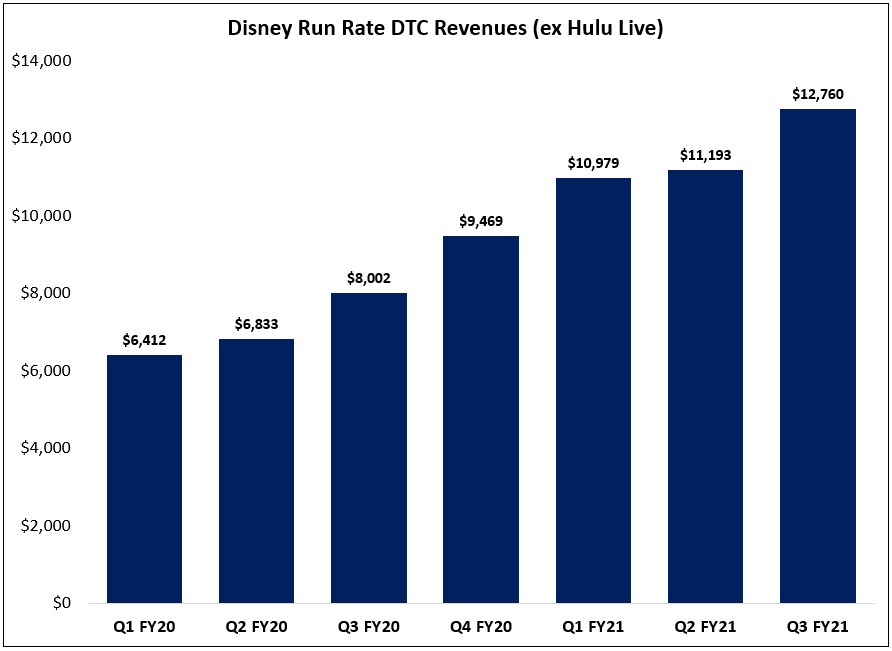

Here’s another way to frame it: currently, with 170 million total paid subscribers across Disney+, ESPN+, and Hulu SVOD, Disney’s DTC business is at roughly $12.8 billion in run rate annual revenues (note that this estimate is based on the ARPU disclosures, which do not include Premier Access revenues from Black Widow, Jungle Cruise, etc.).

At a similar point in Netflix’s history – the company crossed 170 million global paid members in early fiscal 2020 – it was generating nearly $6 billion in quarterly streaming revenues (run rate of roughly $24 billion). This stark difference reflects a meaningfully higher blended ARPU at Netflix; it should serve as an important reminder that all paid subs are not created equal.

U.S. Pay-TV

A major focus for Disney shareholders (and even more so for investors in some of the other legacy media companies) is the structural decline of U.S. pay-TV. Despite a sustained drop in ratings, with average viewership in the 18-to-49 demo down by roughly 50% over the past decade (per data from eMarketer), the price of pay-TV continues to climb (at Hulu Live + SVOD, ARPU’s in Q3 FY21 were up by more than 40% versus Q3 FY19). As I’ve argued previously, I believe the days for linear pay-TV in the U.S. are numbered; whether that takes three years or eight years to happen will have major implications for legacy media companies (Disney included).

For now, the declines remain manageable. As noted on the call, domestic affiliate revenues increased by roughly 4% in the third quarter, with higher rates (+8%) offset by a 3% decline in subscribers. Through the first nine months of FY21, the linear channels have generated $21.4 billion in revenues and $6.8 billion in operating income – up mid-teens (+17% and +19%, respectively) compared to the Media Networks segment results through the first nine months of FY19 (note that this is inclusive of a tailwind from 21CF).

The takeaway is that continued high-single digit per sub affiliate fee rate increases, in a world where pay-TV subs decline low-single digits (annualized), is a stable situation for Disney. Effectively, it buys them the time needed to continue the transition to DTC (expand the subscriber base, secure better distribution, negotiate sports rights agreements that give them the flexibility to place content where they see fit, etc.). I don’t think low-single digit pay-TV sub declines will last, but I’ll enjoy it while we have them.

Parks, Experiences and Products

Considering the difficulties that Disney still faces in its theme parks business, it was encouraging to see the Parks, Experiences, and Products segment return to profitability in Q3. Consumer demand remains strong (attendance levels “were generally at or near daily capacity levels” for WDW), and per caps continue to grow at double digit rates relative to the comparable period in FY19. Despite significant operational constraints, the facts on the ground suggest there’s pent up demand for Disney’s parks, hotels, and cruise ships.

Long-term, I remain convinced that Disney’s Parks business has a bright future. This commentary from CEO Bob Chapek on the Q3 call, which was in response to a question about Disney Genie, the new mobile app for visitors to the company’s theme parks, was noteworthy:

“You used the correct word, transformational. MyMagic+ [the prior app] was us sticking our toe in the pond on this type of transformational work. Disney Genie is that program on steroids. This is going to revolutionize our guest experience. Guests are going to spend less time waiting and more time having fun in our parks with a dramatically improved guest experience. It’s going to make their navigation and planning of their day much easier… it will not only lead to that improved guest experience, but at the same time lead to substantial commercial opportunities for us as the guest navigates their days. So, it certainly qualifies in my mind for both materiality and transformational impact on our business from a yield standpoint.”

As I noted in the April 2021 Portfolio Review, Bog Iger (Chapek’s predecessor) once said the following about Michael Eisner (Iger’s predecessor):

“Michael’s biggest stroke of genius might have been his recognition that Disney was sitting on tremendously valuable assets that they hadn’t yet leveraged. One was the popularity of parks. If they raised ticket prices even slightly, they would raise revenues significantly without any noticeable impact on the number of visitors.”

With initiatives like Disney Genie, as well as through dynamic pricing and other efforts to segment the product offering, Disney will create significant incremental value in the Parks business. The “tremendously valuable assets” that Eisner recognized will become ever more important to The Walt Disney Company in the decades ahead (and with structurally higher profit margins).

Conclusion

I don’t particularly care about short-term market moves, but I find it interesting that Disney shares reacted strongly to the print (up 5% or so after hours), but ultimately ended marginally higher for the day (+1%).

Personally, I think the more subdued reaction was understandable: this was a good quarter, and it was nice to see a sequential improvement in DTC sub growth following some lackluster guidance from management on the Q2 call. That said, there’s a long way to go on this journey – Disney+ is only available in 61 countries, compared to 190 countries for Netflix - and success in the global DTC business will require continued execution (Chapek: “we're in the first inning of the first game of a very long season”).

Honestly, my biggest takeaway from the quarter is further appreciation for Netflix’s competitive position. As mentioned earlier, Disney - the clear number two player in this industry - currently has run rate DTC revenues of $12.8 billion (excluding Hulu Live). Netflix, on the other hand, is now at $30 billion in run rate revenues. In addition, while legacy media companies like Disney, NBCU, WarnerMedia, and ViacomCBS will be forced to navigate choppy waters during this transition given their large exposure to linear pay-TV in the U.S., Netflix will continue to focus 100% of its time and attention on the structural tailwinds in DTC. (I mention Disney alongside those other companies, but it’s worth reiterating that they are miles ahead of their legacy peers in terms of truly building a global DTC video business.)

Given that conclusion, why do I continue to own Disney? The answer is that I believe Disney’s unrivaled IP and its ability to fully monetize the output from its content creation efforts has been, and will continue to be, a sustainable competitive advantage. It will be very difficult to replicate what Netflix has already achieved (and with no signs of slowing down) – but my bet is that it’s even more difficult to try and replicate what makes Disney’s unique.

For that reason, I see no reason to tinker with my position.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial adviser or in any fiduciary capacity.

Do you have any thoughts on ESPN's reported affiliate fees of $7-9 a box per month? Aren't those a huge risk to Disney down the line as people cut the cable?