Spotify: "Win-Win"

From “We're Doing Much Better Than You Think” (June 2022):

“With a few days to reflect on the company’s evolution over the past five years, along with my expectations for the next five years, I find myself with a renewed sense of optimism [following the June 2022 Investor Day event].

To revisit the power question discussed last month, Marketplace is becoming a notable example of showing power in the music business. In addition, while price increases were not discussed in the prepared remarks, I think the commentary during Q&A points to a long-term path for broadly demonstrating power across Spotify’s platform… In summary, this investment reflects my belief that the combination of Spotify’s strong relative competitive position in the streaming audio business and best-in-class management (specifically CEO Daniel Ek) will, over time, result in even further differentiation from competitors [other DSP’s] and an ability to generate meaningful profitability.”

Spotify’s Q1 FY23 results were a good encapsulation of the broader questions that surround this investment. On the one hand, the service is reporting unprecedented user growth, with more than 250,000 net new MAU’s (monthly active users) joining per day, on average, over the past year.

On the other hand, the mechanisms for effectively monetizing those users, in terms of revenues and - more importantly – profitability, remains a work in progress. As Ek has said in the past, “everything changes at scale”. The question is whether that’s an accurate assessment; with >200 million paid subscribers and >500 million total MAU’s (inclusive of paid subs) globally, is Spotify close to demonstrating consistent and meaningful profitability?

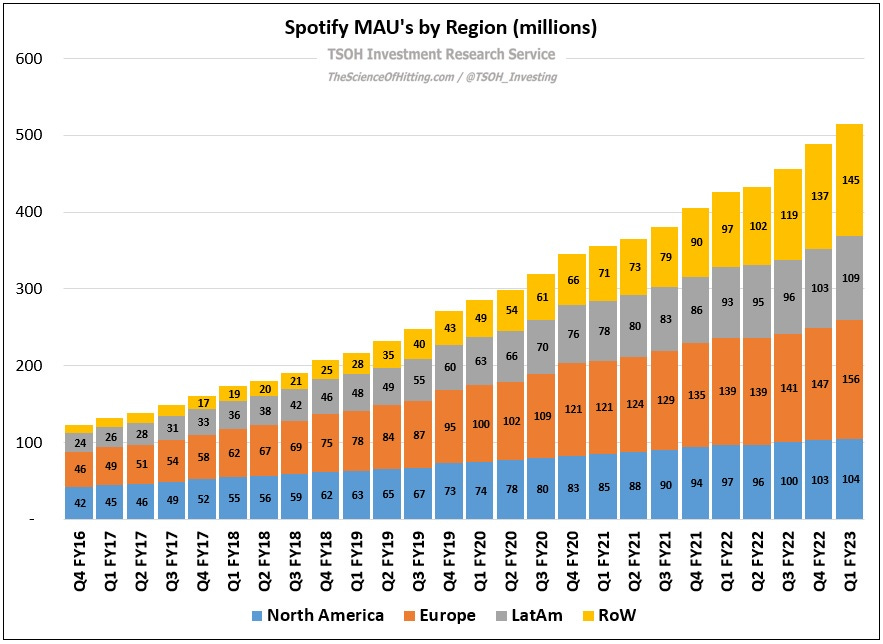

Let’s start with the user base: Spotify added ~96 million (net) MAU’s over the past 12 months, by far the strongest rate of net adds in the company’s history. As you can see below, the company now has more than 100 million MAU’s in each of its four reported geographies; to put that in context, the largest region (Europe) had less than 50 million MAU’s at the start of 2017.

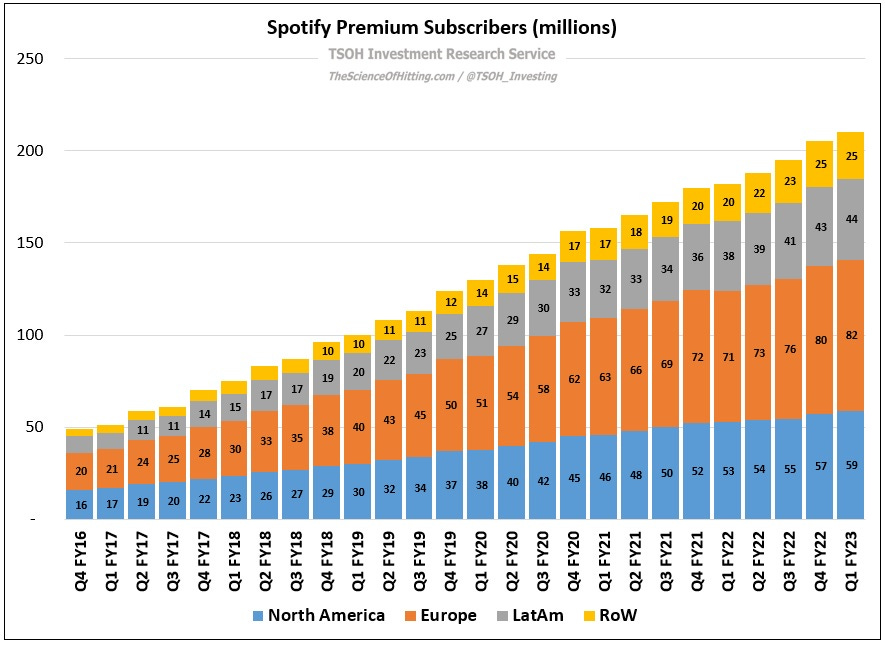

The trajectory has been similar on premium (paid) subscribers: as shown below, Spotify ended Q1 FY23 with a paid subscriber base of ~210 million, or more than 4x larger than the total at yearend FY16 (with each of the four geographies contributing significantly to that growth over the past five years).

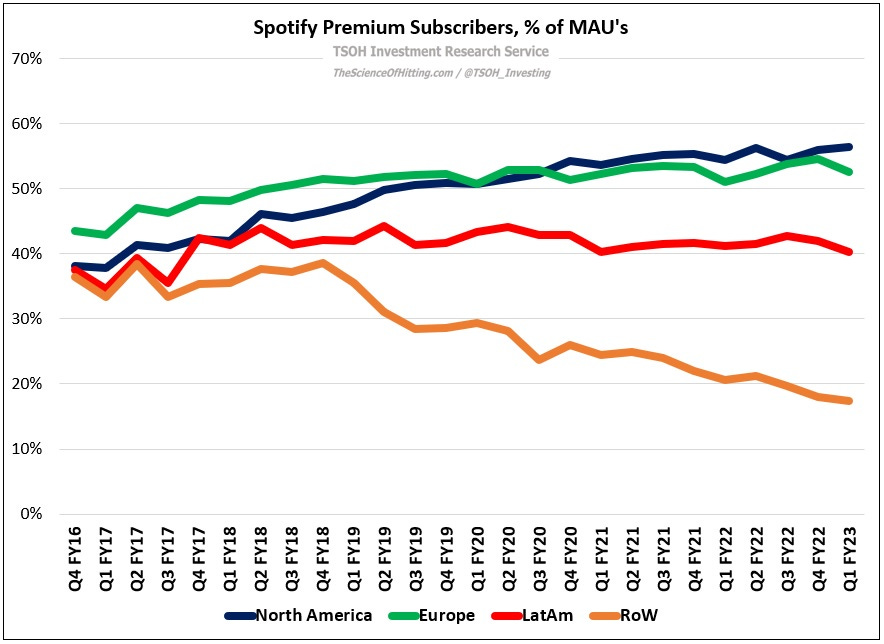

As I noted in February, a key consideration here is the company’s ability to drive premium penetration (paid subscribers as a percentage of MAU’s), particularly in LatAm and Rest of World. (Premium subscribers account for the majority of MAU’s in North America and Europe.) As you can see below, Latin America has held up surprisingly well (at ~40% premium penetration), particularly after considering the natural lag between MAU adds and premium subscriber growth (LatAm MAU’s have increased by more than 30% over the past 18 months). The problem area is Rest of World (RoW), where premium penetration has fallen from nearly 40% at yearend FY18 to ~17% today.

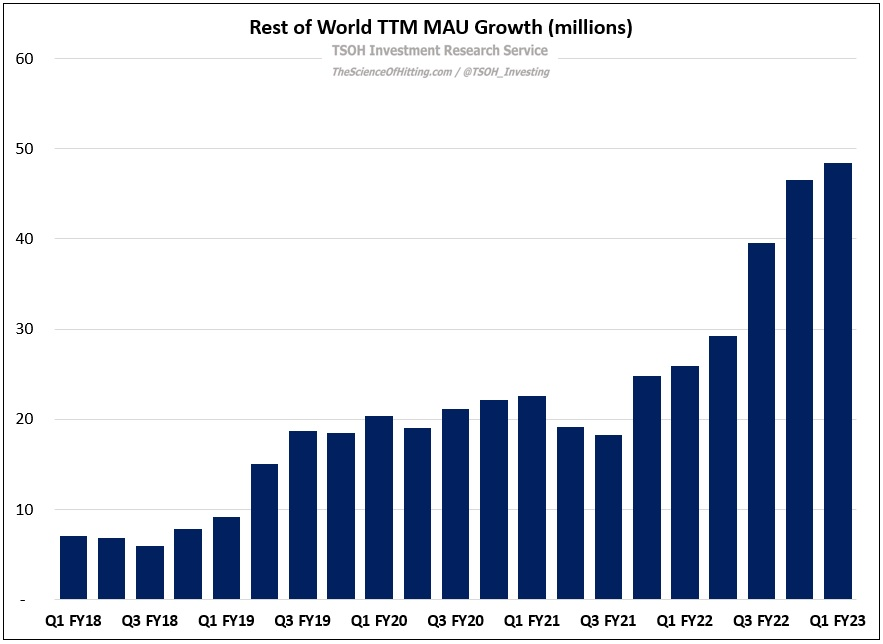

A big question here is timing: given that nearly 50 million net MAU’s were added in Rest of World over the past year, will we see improved conversion rates over the coming quarters? If so, even if the overall RoW penetration rate only rose back to ~25%, that would result in >11 million additional Rest of World subscribers on today’s MAU base (total RoW paid subs ended Q1 FY23 at 25 million). My hunch is that much of this MAU growth has been in markets where propensity to pay for an audio streaming service is lower than in regions like the U.S. or Europe (that said, pricing is also much lower; for example, the Individual plan in India costs ~$1.45 per month). Hopefully, the results over the coming quarters will disprove that thesis. Here’s Ek on this topic, from the Q1 FY23 call: “Healthy [MAU] growth is the leading indicator of our ability to achieve future success on all other financial metrics. When we attract new users, it's only a matter of time before conversion rates increase, which then drives revenues upwards over the long term. This formula has worked exceptionally well for us, and I fully expect it to play out again.”

ARPU’s and Pricing (“Win-Win”)