"We're In The Discovery Business"

An update on Spotify

From “We’re Doing Much Better Than You Think”:

“Consider this data in light of what I shared above: from FY18 - FY21, music revenues increased from €5,259 million to €9,468 million, or cumulative growth of €4,209 million. Over the same period, music gross profits increased from €1,353 million to €2,679 million - cumulative growth of €1,326, with incremental gross margins of ~31.5%. That number - the 31.5% - was ~330 basis points higher throughout this period due to Marketplace. Naturally, if the Marketplace contribution significantly outpaces revenue growth, that benefit will expand over time... This is an important revelation; it shows the clear path to 30%+ Music gross margins at Spotify.”

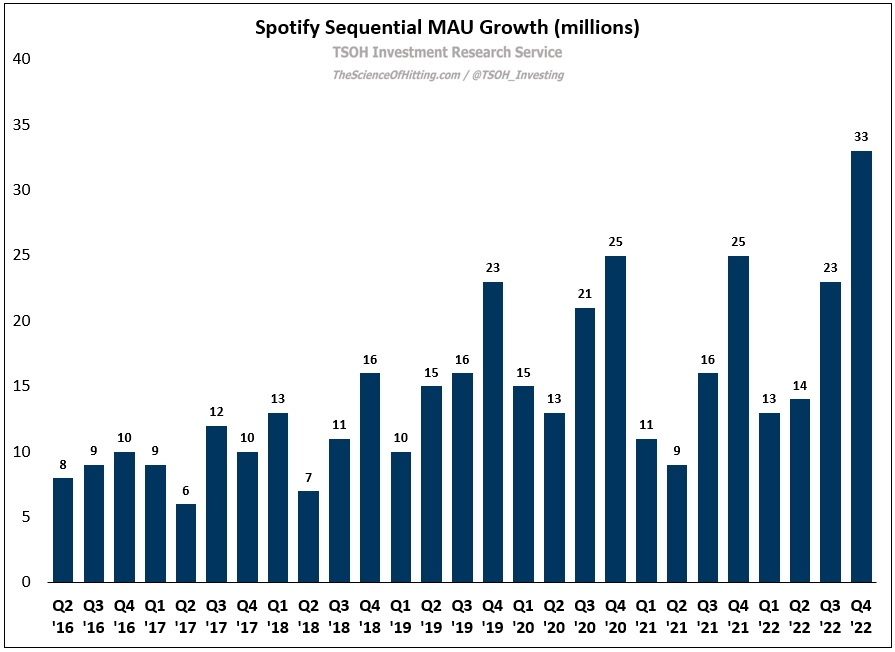

In Q4 FY22, Spotify reported its strongest monthly active user (MAU) growth – by far – in its history. Long time readers may remember that I previously worried about MAU growth following the “Stream On” market launches; with the benefit of hindsight, it turns out that I just needed to be patient. (Adjusted for the Russia exit, Spotify added roughly 88 million net MAU’s in FY22.)

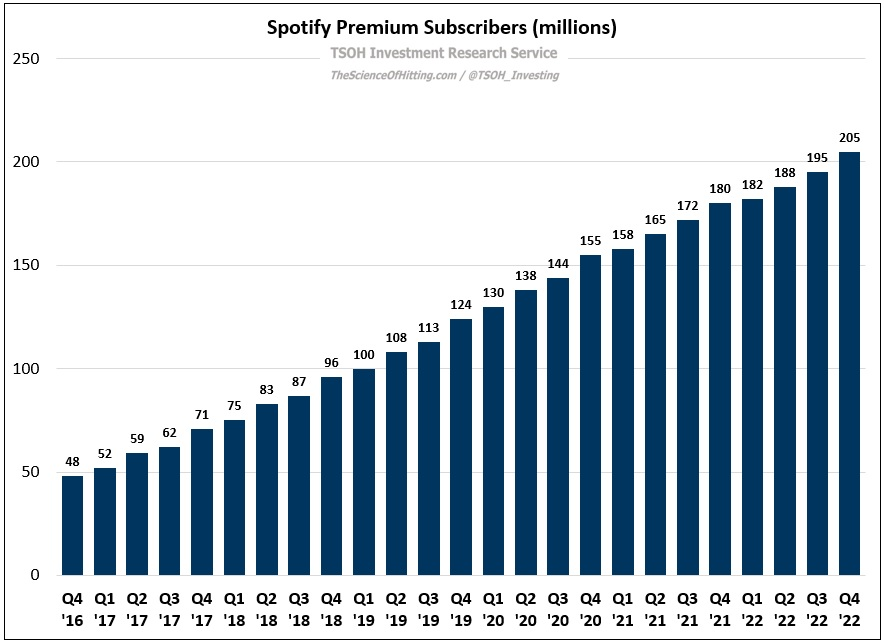

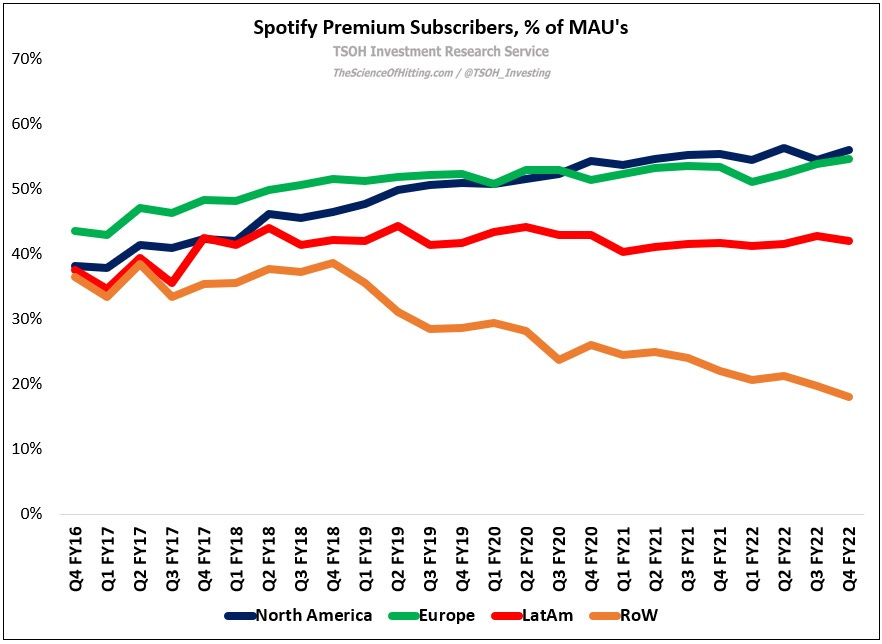

While MAU growth is a great starting point, ad-supported users generate significantly lower revenues than Spotify’s premium subscribers (the premium ARPU is roughly 10x higher than the ad-supported ARPU). Over time, it’s critical that Spotify demonstrates continued success with driving premium penetration (providing enough value to convince ad-supported users to subscribe to the premium offering). As shown below, Spotify hit a major milestone in Q4 FY22, with the company crossing 200 million premium subscribers; Spotify’s premium subscriber count has quadrupled since the end of 2016. (“[In 2014], Ek began to concede that Spotify’s paid tier was the key not only to its longevity, but to its very survival.”)

While penetration rates continue to track nicely in the U.S. and Europe, with both regions at >50% premium mix, there’s work to be done in LatAm and Rest of World. Some of this is timing (there’s a lag between when a user joins Spotify and when they typically decide to become a paid sub / engagement reaches a threshold to justify paying); that said, it’s also important to recognize that these are geographies where “free” may be a major selling point for users. This is a key metric to track in the quarters ahead.

MAU and premium sub growth are both important – the underlying drivers of mid-teens constant currency revenue growth for Spotify in 2022 – but they are one part of the story. Another notable metric is profitability (or lack thereof), with the company reporting a €659 million operating loss for the year. With Spotify expected to reach half a billion MAU’s in Q1 FY23, inclusive of more than 200 million premium subs, they have absolute and relative scale (if this isn’t scale, I don’t know what is). That position should confer certain advantages to Spotify (as CEO Daniel Ek likes to say, “everything changes at scale”). The key question to answer in the years ahead, as I wrote in “The Power Question”, is whether Spotify can leverage product-market fit to establish a power opportunity in the audio industry.

A Power Opportunity?

WMG CEO Robert Kyncl: “Since 2011, the price of Netflix's standard service has roughly doubled… In contrast, the price of a music subscription has stayed the same since streaming was introduced over a decade ago.”

In January 2023, Robert Kyncl became CEO of Warner Media Group. For the prior 12 years, Kyncl worked at YouTube, most recently as its Chief Business Officer. On WMG’s Q1 FY23 call, following a “tough quarter” for the company (constant currency revenues fell 3%), Kyncl said the following on WMG’s relationship with digital service providers (DSP’s) like Spotify, Apple, etc.: