Spotify: "Retain Optionality"

From “Spotify: Win-Win” (May 2023):

“Recent commentary from the labels suggests that this outcome - better terms for the DSP’s - may be more likely than I appreciated (if so, that’s very good news). For now, Spotify seems intent on holding out on pricing, which strikes me as a sensible decision at the moment (I’d also note that they’ve tussled with some labels in the past, most recently with Zee Music in India). If the outcome here is more favorable for Spotify, along with continued MAU and premium subscriber growth, it would be a major tailwind to gross profits.”

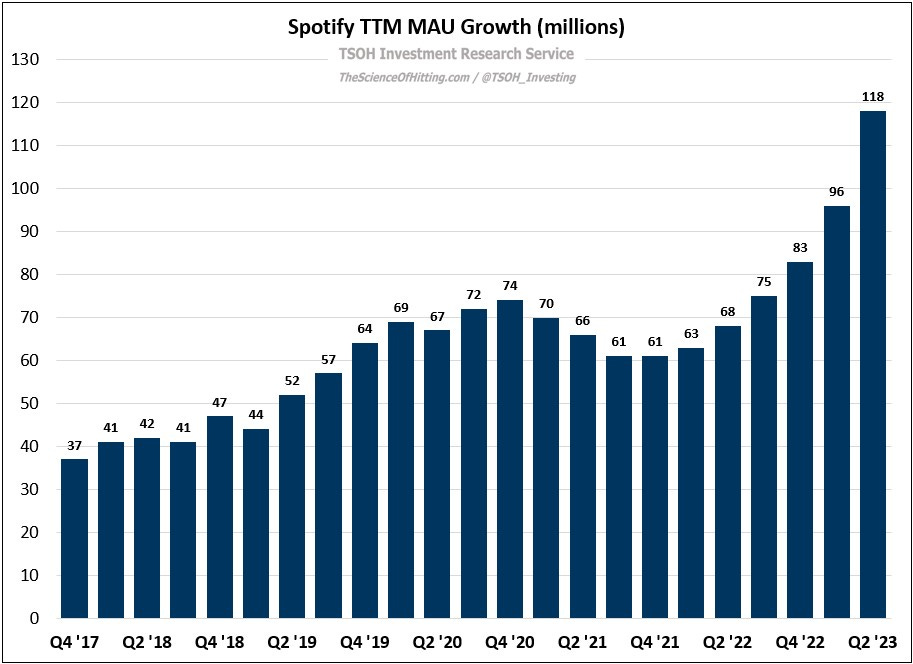

Let’s start with MAU and premium subscriber growth, where Spotify continues to see very strong results. The global leader in audio streaming ended Q2 FY23 with 551 million global MAU’s, an increase of 118 million versus Q2 FY22 – by far the strongest TTM MAU growth in its history (works out to ~325,000 net new MAU’s per day, on average, over the past 12 months).

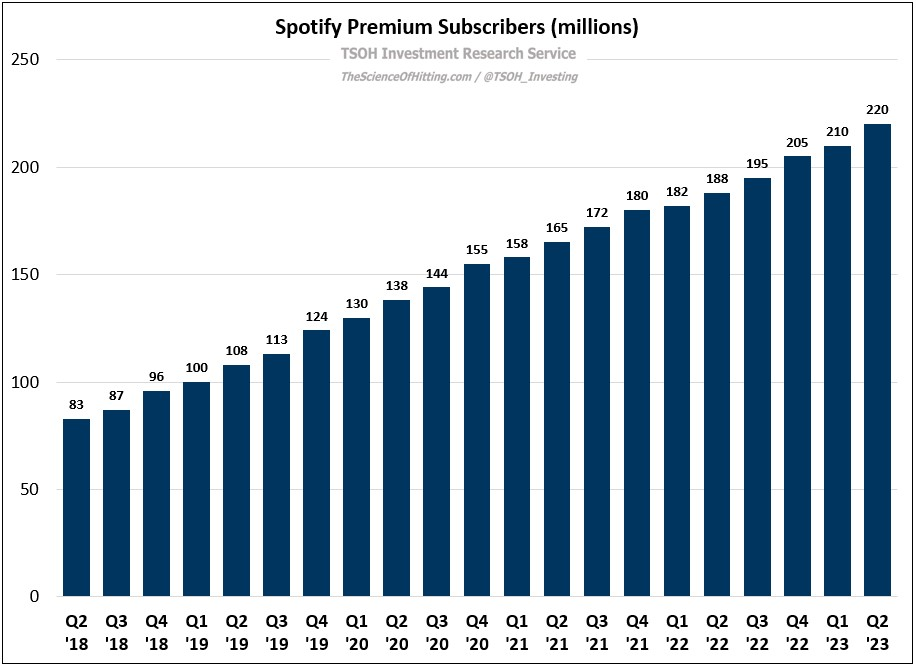

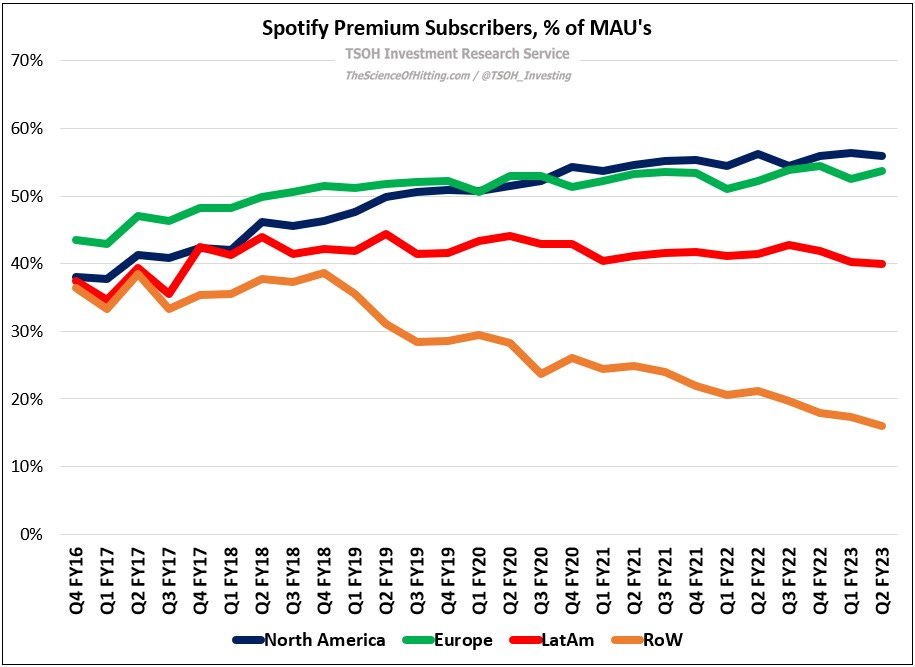

This outcome primarily reflects ongoing success in the “Stream On” markets, with the Rest Of World region up to 165 million MAU’s (+130% over the past two years). While questions around incremental premium penetration remain, particularly in Rest Of World, the results in more mature markets have stayed within a reasonable zone; overall, Spotify ended Q2 FY23 with 220 million premium subs (a trailing five-year CAGR of +22% per annum).

While management undoubtedly deserves a lot of credit for their success on MAU and premium subscriber growth over the past few years in the face of intense competition from tech giants like Apple, Amazon, Google (YouTube), and TikTok, the simple fact is that user growth alone isn’t sufficient. That was evident in the market’s reaction to the quarter, with the stock falling 10%+. Clearly, Mr. Market’s focus has shifted: can Spotify demonstrate power? If that question is answered affirmatively, there’s good reason to believe that shareholders have a bright future ahead. As I wrote last May, I think the primary way to get there is through higher pricing / ARPU’s: “As Ek noted on the Q1 FY22 call, they’ve invested aggressively to increase the value of the service; given that conclusion (which I think is accurate), what will it take to capture a reasonable amount of that incremental value?”

That brings us to the news that Spotify announced on Monday: the company will be increase prices in 50+ countries, including the United States. For the U.S. individual plan, the $1 increase to $10.99 per month is in-line with the pricing changes that have been previously announced at Apple (October 2022), Amazon (January 2023), and Google / YouTube (July 2023). In light of this decision, remember what CEO Daniel Ek said on the company’s Q1 FY23 call about a potential price increase: “We're ready to raise prices, and I think we have the ability to do that - but it really comes down to those negotiations… We're working with our partners to figure out what's the best opportunity for us to do that… When the timing is right, we will raise it.”