Scale & Discipline In The AI Era

An update on Microsoft (MSFT)

From “Microsoft: Transition Period” (November 2024): “While it’s understandable that a lofty headline valuation will lead to some uneasiness on less than perfect results, I remain confident that short-term uncertainty is an opportunity for investors (as much as one can reasonably expect from a ~$3 trillion company). Microsoft shares surely won’t match the ~10x increase that they saw over the past decade, but they can still be expected to generate reasonable long-term returns as the business sustains double digit growth.”

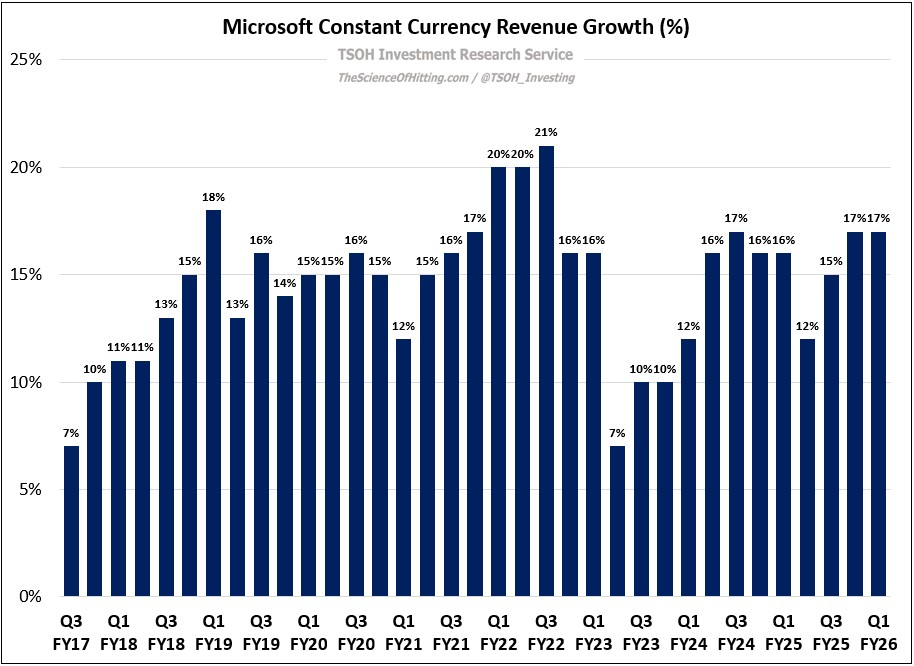

A year later, and another inning into the AI era, I think that framing remains valid. With ~17% constant currency revenue growth in Q1 FY26, a result that extended Microsoft’s streak of double digit YoY growth to 33 of the past 34 quarters (nearly nine years running), we’re seeing continued evidence of its competitive strengths and its long-term incremental growth opportunities.

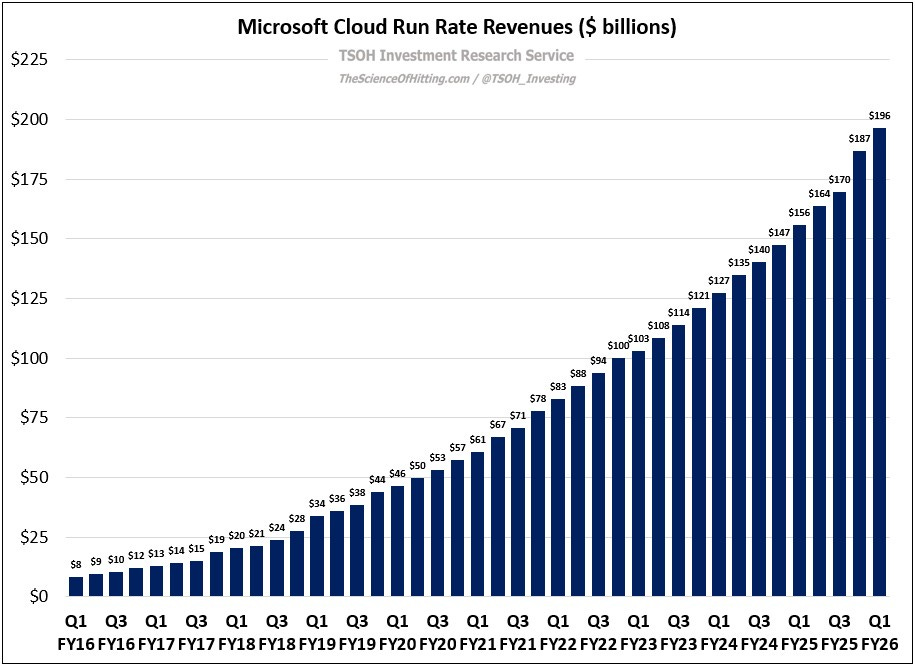

This growth was once again led by Microsoft Cloud, with run rate revenues climbing ~26% YoY to nearly $200 billion, and with the commercial remaining performance obligation (RPO) increasing 51% to $392 billion (with an average duration on the RPO balance of just ~2 years). As CFO Amy Hood said on the call, “Demand signals across bookings, RPO, and product usage are accelerating faster than we expected. We’re investing to capture that momentum and to expand our leadership position… Our need to continue to build out our infrastructure is very high – that’s for booked business today.”