"Sadie Hawkins" Goes Digital

Note: I published a deep dive on Match Group on 06/06/22 (link)

In 2014, 24-year old Whitney Wolfe Herd found herself back at square one.

The co-founder and former VP of Marketing at Tinder was now focusing her time on building a female-only social network called Merci (“It was the antidote to what I felt I experienced online”). Given her painful and widely publicized exit from Tinder, it was understandable why Wolfe Herd wanted to move beyond the world of online dating. But after a meeting with Andrey Andreev, the founder of dating app Badoo, she ultimately returned to what she knew best: in late 2014, with help from two former Tinder executives, the dating app Bumble was born. (“I immediately fell in love with Whitney's passion and energy… My original idea was to get her as CMO at Badoo.”)

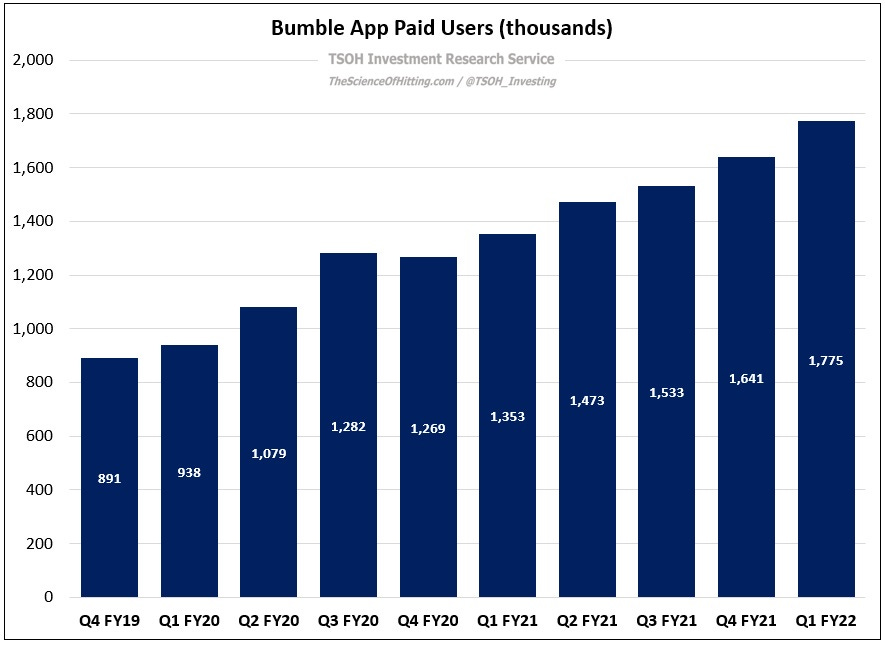

Bumble’s point of differentiation was to empower female users: “I always wanted to have a scenario where the guy didn't have my number but I had his. What if women make the first move, send the first message? And if they don't, the match disappears after 24 hours… It'd be symbolic of a Sadie Hawkins dance… What if we could hardwire that into a product?” The app, which went live in December 2014, attracted more than 100,000 downloads in its first month. Today, Bumble is used by more than 15 million people around the world (MAU’s), with 1.78 million paid users as of Q1 FY22, up 31% YoY (we have to guesstimate on the top of funnel user data / MAU’s because this KPI isn’t consistently provided by management). As Wolfe Herd noted on the company’s Q4 FY21 call, Bumble is the 3rd most downloaded dating app globally, up from 7th at the start of the pandemic; like most online dating apps, Bumble’s services are monetized through a freemium business model, i.e. selling premium subscriptions and a la carte offerings to users.

The rocky backstory between Wolfe Herd / Bumble and Tinder / Match Group didn’t end in 2014. In August 2017, Forbes reported that Bumble rejected a $450 million buyout offer from Match (as discussed in the MTCH deep dive, inorganic growth is a key pillar of the company’s long-term strategy). Shortly after, Match upped its offer to “well over $1 billion” – and got turned down again. Over the next two years, the companies engaged in a public spat and a few legal battles (June 2020: “The two companies have reached an agreement to settle all litigations… both companies are pleased with the amicable resolution”). Needless to say, while the lawsuits are now behind us, the bad blood remains. (“We swipe left on you. We swipe left on your multiple attempts to buy us, copy us, and now, to intimidate us. We’ll never be yours. No matter the price tag, we’ll never compromise our values.”)

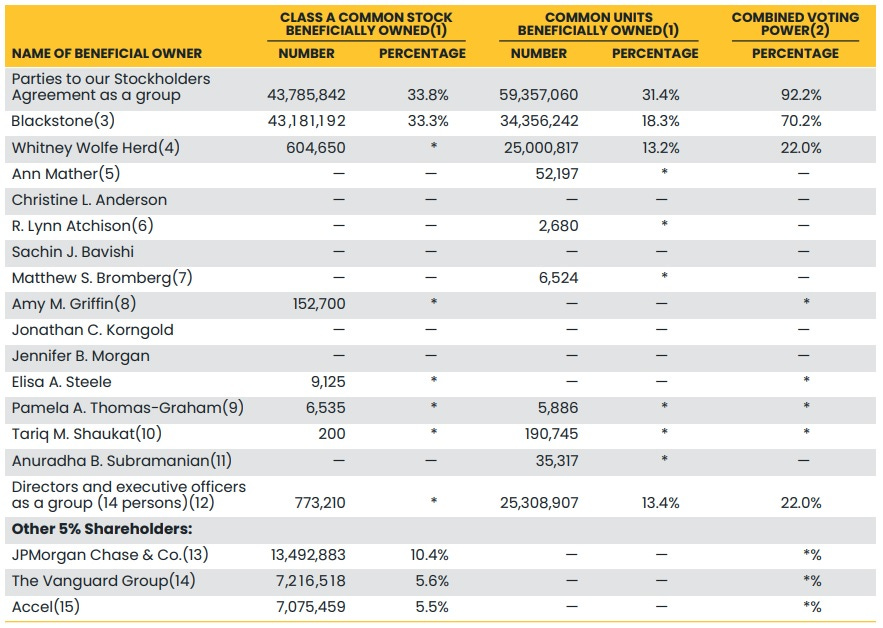

In February 2021, eight months after the lawsuits were settled, Bumble went public. The company raised $2.2 billion, with the stock climbing more than 60% on its first trading day to ~$70 per share and a market cap of ~$13 billion. But amidst broader stock market pressure, the Bumble buzz has faded: on Friday, the stock closed at ~$32 per share, giving the company a market cap of ~$6.1 billion. (It’s also worth noting that Blackstone took a majority stake in the business in late 2019 at a $3 billion valuation; as of the most recent proxy, they still have ~70% voting power at Bumble.)