Match Group: Swipe Right?

With roots to the start of online dating (mid-1990’s), Match is the industry leader in a business that has greatly benefited from the global explosion of internet access and smartphone usage, as well as changing societal norms.

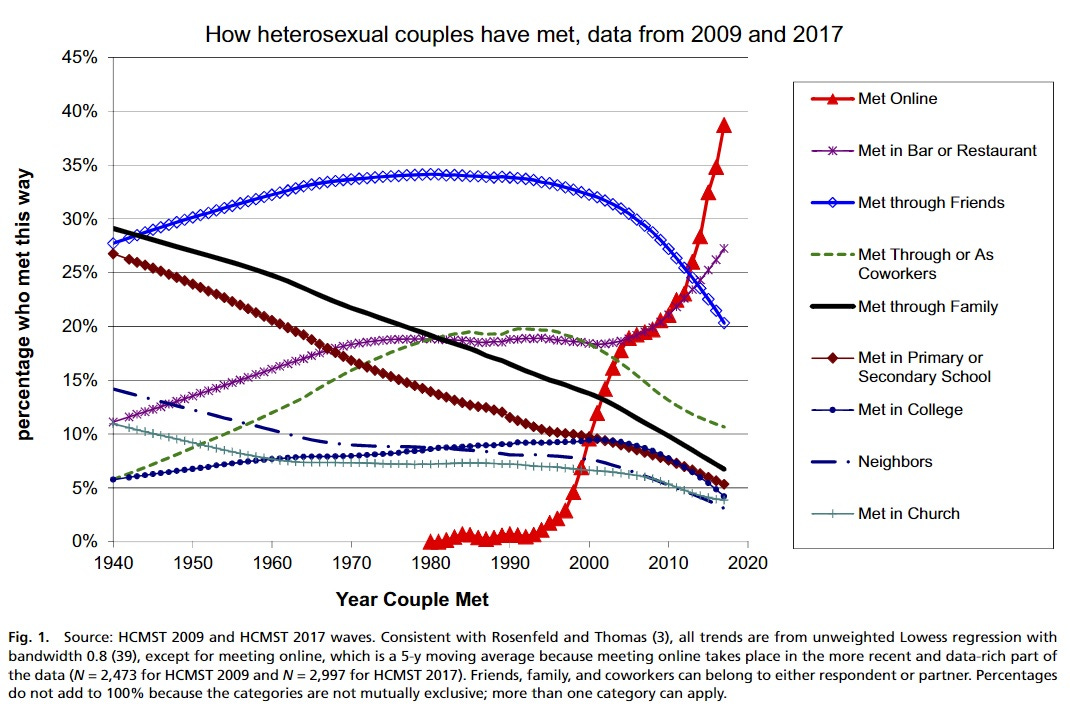

The collectively impact of these developments can be captured in a single data point: over the past 25 years, the internet has become the primary way couples meet, “displacing the roles family and friends once played in bringing couples together”. But despite significant global adoption over the past quarter-century, management estimates that there are still 400 million internet-connected singles around the world who’ve yet to try online dating.

For Match, which owns many of the leading online dating websites / apps, this presents an attractive long-term opportunity for ongoing value creation.

As noted in Match’s annual report, the company has built a broad portfolio (10+ brands in 40+ languages) focused of serving a wide range of users:

“Consumers’ dating preferences vary significantly, influenced in part by demographics, geography, cultural norms, religion, and intent (for example, seeking casual dating or more serious relationships). As a result, the market for dating products is fragmented, and no single product has been able to effectively serve the dating category as a whole.”

Despite Match’s diverse product portfolio, which has been built over the past two decades through a combination of organic and inorganic growth (acquisitions), the majority of its value is attributable to one brand: Tinder.

There’s a messy backstory to the Match / Tinder relationship, which ultimately led to a $441 million settlement with Tinder’s co-founders, among other plaintiffs, in December 2021; thankfully, that’s water under the bridge now.

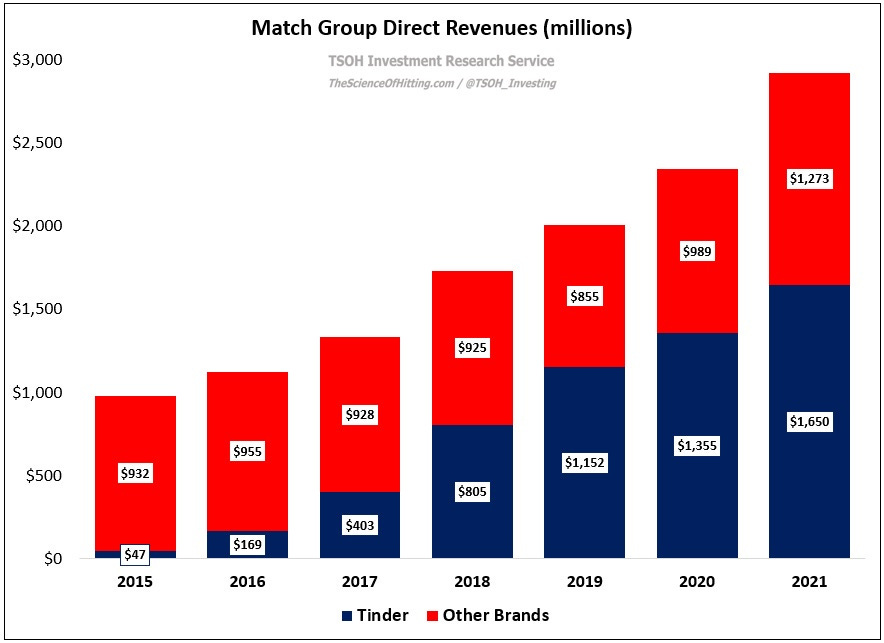

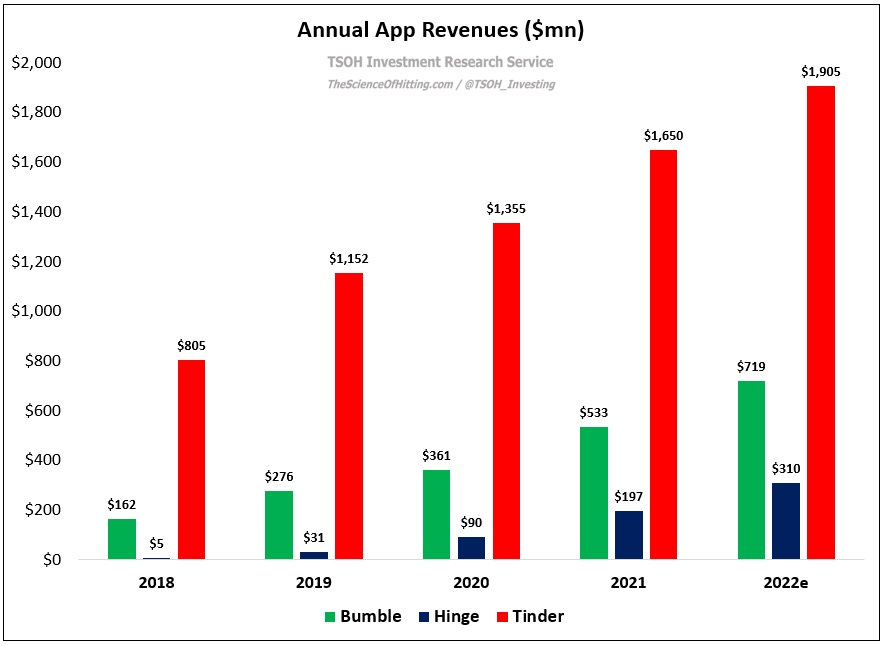

What’s important for our analysis is to recognize just how valuable Tinder has become: the app, which generated $47 million in FY15 revenues, will likely generate ~$1.9 billion in FY21 revenues (as shown below, it accounted for ~60% of the company’s revenues in FY21). While “no single product has been able to effectively serve the dating category as a whole”, Tinder has reached a level of user adoption (global scale) that’s unmatched in the industry: as of Q1 FY22, it has ~10.7 million paying customers. (By comparison, Bumble (app) ended Q1 with ~1.8 million paying customers).

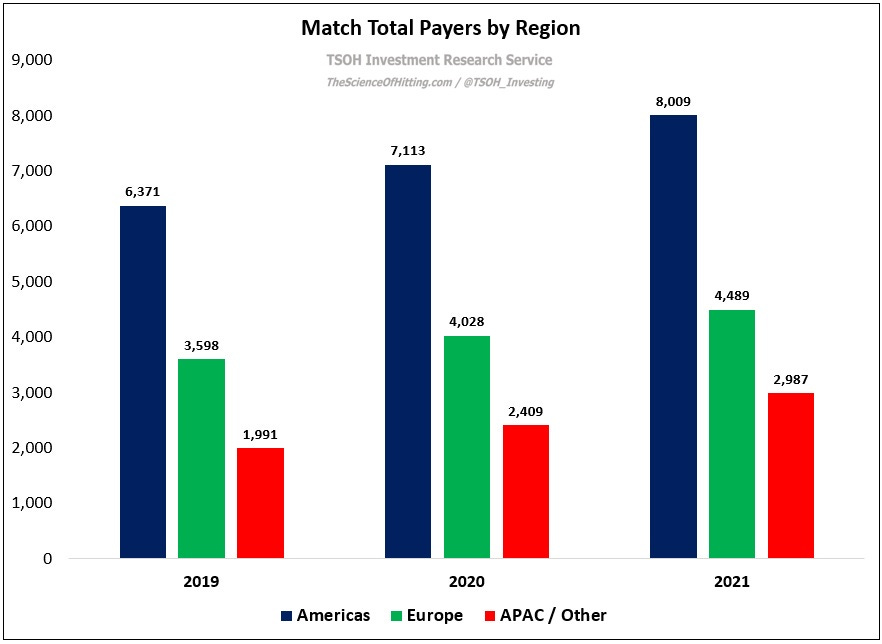

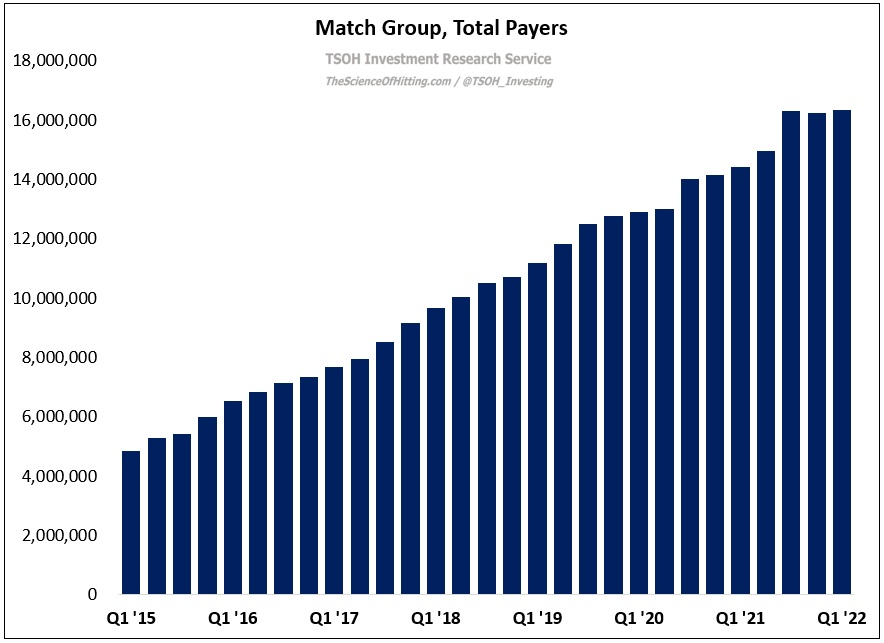

In total, Match had ~16.3 million Payers as of Q1 FY22 (up ~50% from Q1 FY19), which implies mid-teens penetration of its monthly active user base (“approaching 100 million… Tinder accounts for the vast majority of these users”). As shown below, each region has reported strong Payer growth over the past two years, with the Americas +26% (cumulatively) to 8.0 million, Europe +25% to 4.5 million, and Asia Pacific & Other +50% to 3.0 million.

(Note: For years, management reported Subscribers, which only included users who paid for a subscription. In Q2 FY21, they switched to reporting Payers, which includes Subscribers and users with à la carte purchases. In Q2 FY20, when we had data under both conventions, Payers were ~30% larger than Subscribers; I’ve assumed a similar gap in all prior periods.)

Tinder, like many Match offerings, employs a freemium business model: while the core product features are available for free, there are premium options like Plus, Gold, Platinum, and Super Likes / Boosts that offer incremental value to users (i.e. a higher likelihood of finding matches through the app).

Other Brands

While Tinder accounts for the majority of Match’s value, the company’s Other Brands have also reported strong results as of late: after stagnating from 2015 – 2019, Other Brands reported ~50% cumulative revenue growth over the past two years. The ~$400 million increase in Other Brands’ revenues from 2019 - 2021 is primarily attributable to the company’s Emerging Brands (includes Hinge, Pairs, Hyperconnect, and the Swipe Apps), which generated ~$525 million in 2021, up from $100 - $150 million in 2018. In short order, Emerging Brands have become a material driver of the business – and will likely surpass the revenues of the Established Other Brands (Match, OKCupid, etc.) in 2022. When viewed collectively, Tinder and the Emerging Brands account for >75% of FY22e revenues, while collectively reporting 20%+ revenue growth. As those numbers suggest, Match is in place to deliver attractive top-line growth in the years ahead. (“[Positioned] to achieve consistent mid-to-high teens revenue growth...”)