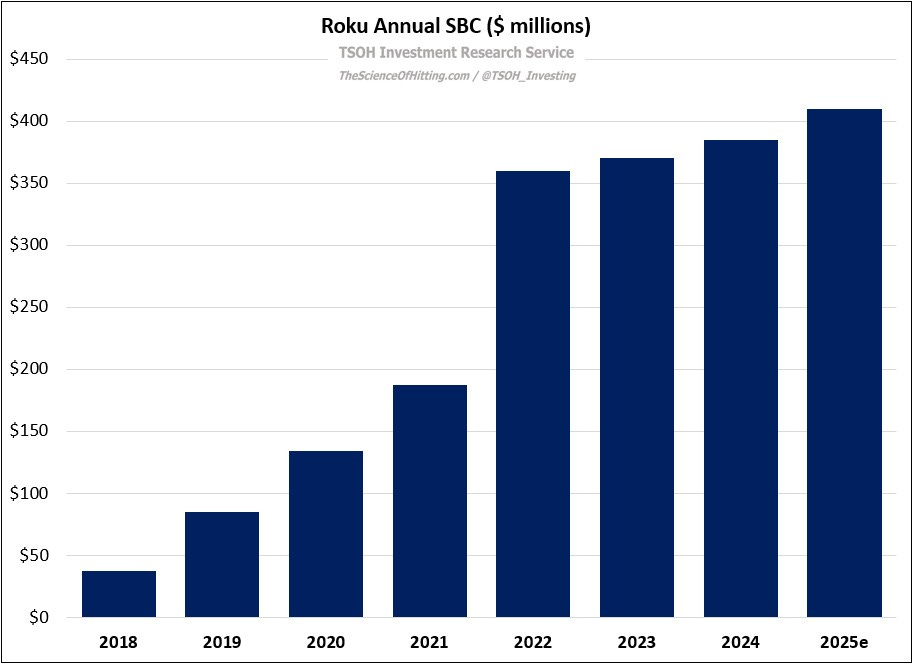

From “Roku: A Clearer Picture” (November 2024): “My interest in Roku is higher today than it has ever been. The primary factor that led to this positive inflection is a management team which now appears more focused on the business opportunity, both in terms of revenue / monetization and the need for operating expense efficiency to drive meaningful profits / free cash flow.”

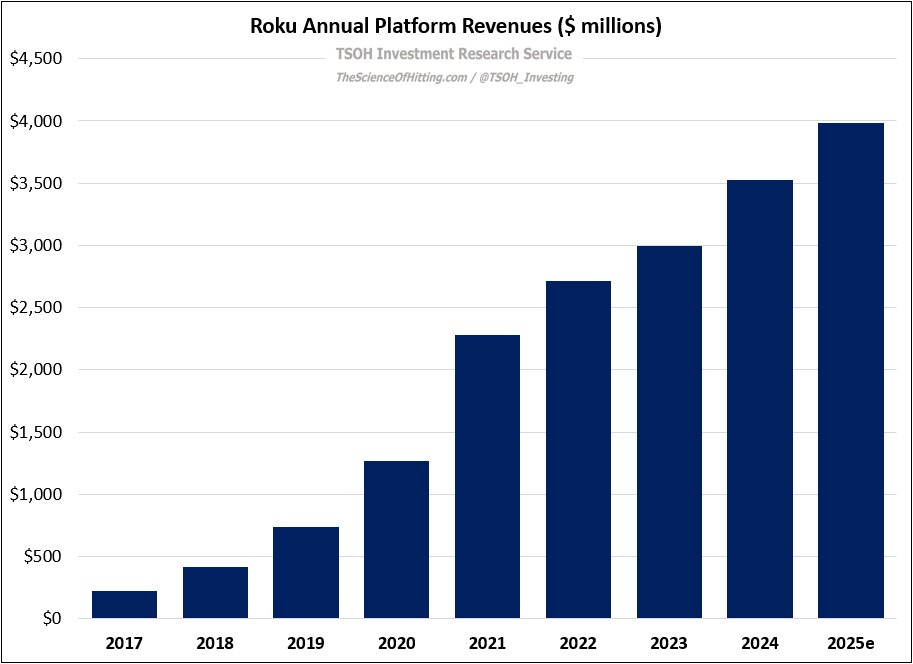

Five years ago, in FY19, Roku reached an important financial milestone: annual revenues eclipsed $1 billion for the first time ($1.13 billion). This outcome was led by the company’s Platform segment, which ended the year with ~37 million accounts at ~$23 in average annual revenues per account (ARPA). At that time, Mr. Market was clearly enthused about Roku’s future as a leader in the CTV / streaming business: at ~$134 per share (12/31/19), Roku’s market cap was nearly $16 billion, or >20x TTM Platform revenues.

Fast forward to FY24, with another important financial milestone for Roku: annual revenues eclipsed $4 billion for the first time ($4.11 billion). This result reflects continued growth in Platform revenues, which passed $3.5 billion for the year – up nearly 5x since FY19. The source of that improvement was continued expansion in the account base, with active accounts up ~145% to ~90 million. In addition, Roku has delivered a meaningful improvement in per user monetization - ARPA up ~80% to ~$42 - with nearly half of that lift from growth in time spent (it would be helpful if Roku management provided ARPA composition disclosures like VIZIO - see slide 15 of their Q3 FY24 deck).

But one notable disappointment for Roku has been the stock: at ~$89 per share, the stock price has declined by ~35% since the end of 2019. On a ~$12.9 billion market cap, Roku’s valuation has retreated to less than 4x TTM Platform revenues. (Roku’s stock price decline has outpaced the market cap decline because the share count increased >20% over the past five years.)