Roku: A Clearer Picture

From “Roku: Surfing The Streaming Wave” (December 2023):

“While there’s a lot of work left to be done on operating expenses, we are seeing early and meaningful signs that management recognizes progress must be made on this front to build a highly profitable business (in terms of real profitability, not an adjusted EBITDA metric that excludes nearly $400 million of annual stock based comp)… It may take some time before a clearer business picture emerges, but I think the pieces are starting to fall into place.”

As noted in that write-up, a lot had changed at Roku over the prior 15 months. As we approach the one year anniversary of that update, I’d say the same has been true in 2024: as management’s primary focus on scale has become more balanced, the Roku story and investment thesis are evolving.

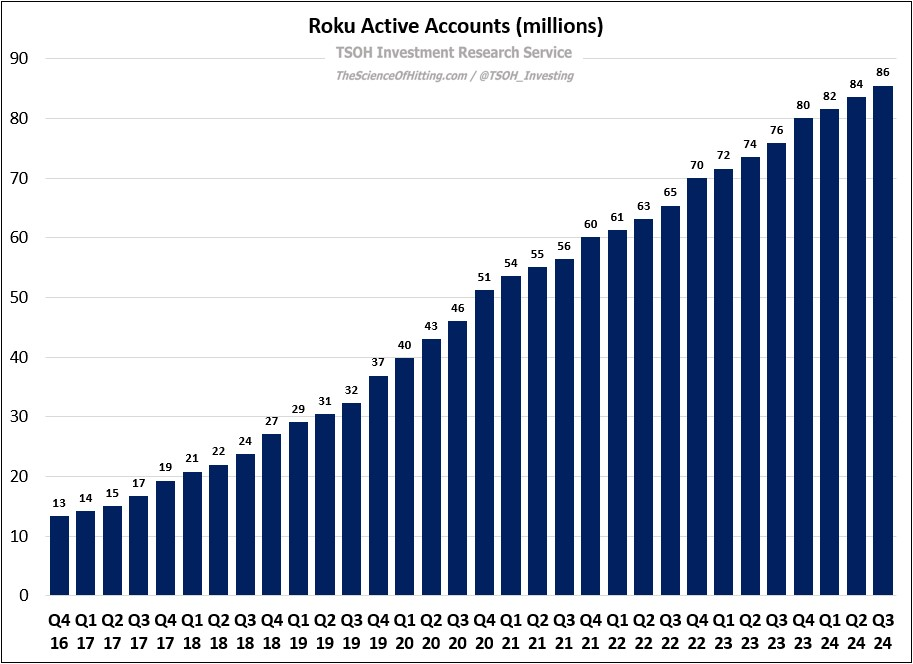

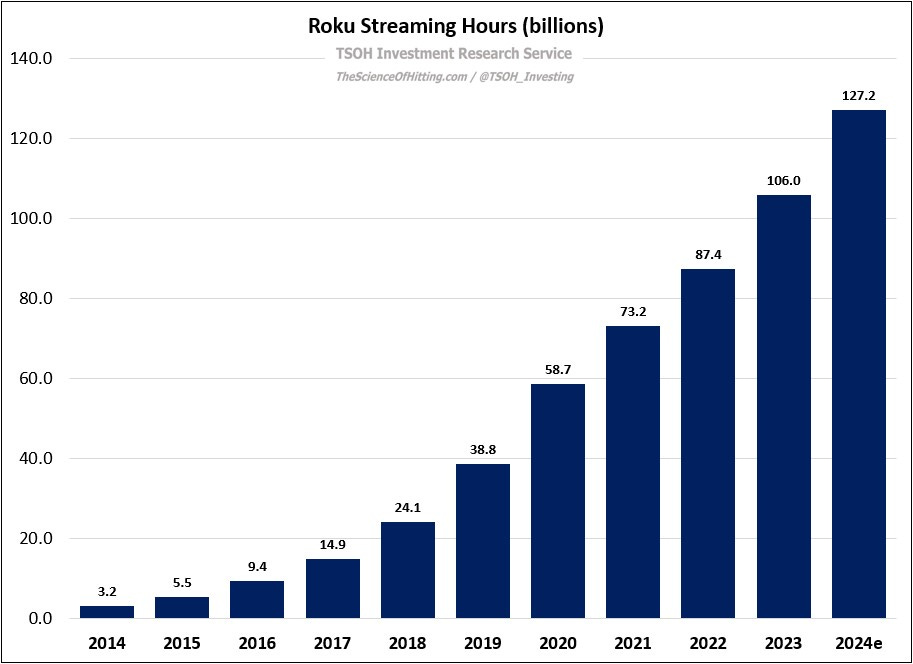

Let’s start with an update on some key metrics. Roku ended Q3 FY24 with ~86 million active accounts (trailing five-year CAGR of +21%), with those accounts streaming 4.1 hours per day, on average. In total, that will drive ~127 billion hours of FY24e total platform consumption, or >5x higher than in FY18. The key takeaway here is that Roku continues to hold a strong position in its most important markets, specifically the U.S. (Q3 FY24 letter: “Roku has been the #1 selling TV OS in the U.S. for more than five years. In Q3, sales of TV units powered by Roku OS were greater than #2 and #3 combined.”)

While Roku is seeing pockets of international success, most notably in Canada and in Mexico (#1 selling TV OS in both markets), this comment from CEO Anthony Wood provided some context on Roku’s international plans: