Surfing The Streaming Wave

From “Focus First On Scale” (published in September 2022): “Roku caught a massive wave over the past decade, and smartly used that opportunity... The key question, in my opinion, is how to translate their current position into a defensible and profitable business over the long run… Despite impressive growth over the past five years, I think Roku holds a pretty difficult hand… As we get further clarity on Roku’s evolving relationship with leading content suppliers… it will provide an opportunity to test / update my conclusions.”

A lot has happened over the past 15 months.

Most notably, the streaming wars have cooled, with a shift in focus from growth to DTC profitability resulting in smaller content budgets and lower marketing spend. In addition, while the next leg of U.S. media industry consolidation has remained elusive, we’ve seen another change that is relevant for Roku: a growing emphasis on ad-supported (AVOD) services. This includes the free options - The Roku Channel (TRC), Tubi, and Pluto - as well as cheaper AVOD offerings from each of the major SVOD players.

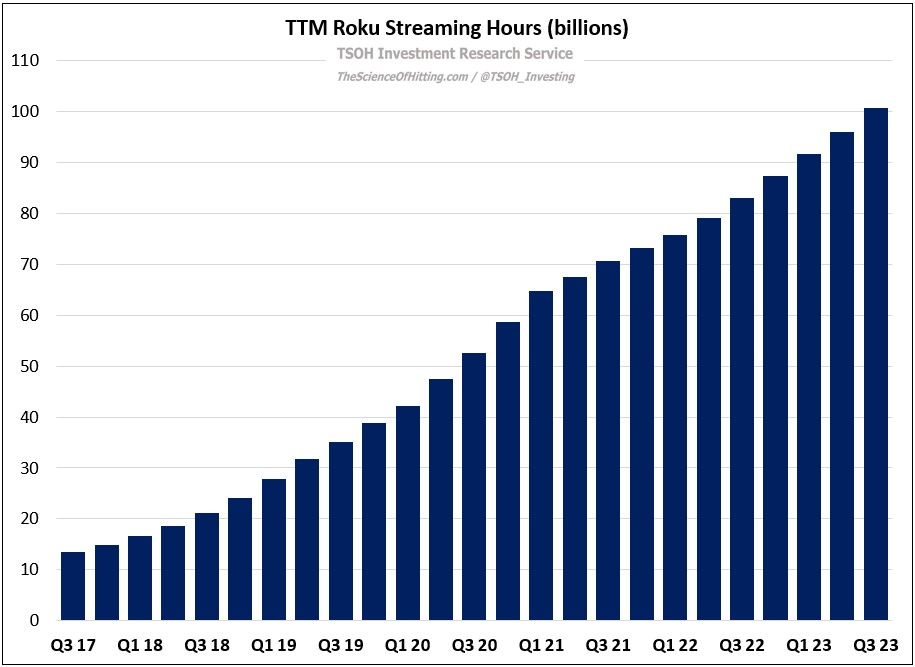

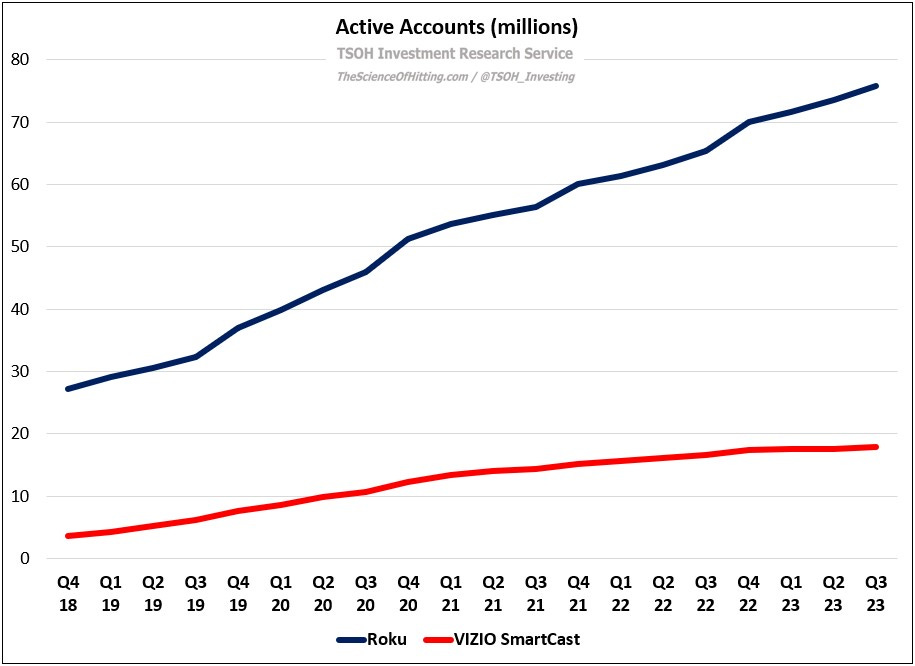

The shift from linear to streaming has continued (even for those who still watch linear TV, the vMVPD’s are taking significant share). In addition, technological hardware advances march on, with cable set-top boxes and dongles quickly being replaced by connected TV’s (CTV’s). Both of those trends, which have supported Roku’s growth over the past 15 years, remain in full force. The financial output for the company has been impressive: Roku ended Q3 FY23 with 76 million active accounts, up >3x from five years ago.

In addition, the average Roku account now streams ~3.9 hours per day, up from ~2.9 hours per day in Q3 FY18. The combination of significant active accounts growth and a ~140% increase in average annual revenues per account (ARPA) led to TTM revenues in Q3 FY23 of $3.4 billion – a trailing five-year CAGR of +39% per annum. (Importantly, that reflects significantly outsized growth for Roku’s Platform revenues, which increased >50% p.a.)

Roku’s success to date has largely come from North America (“the #1 TV streaming platform in the U.S., Canada, and Mexico”). In its home market, the company has recently been grabbing >40% TV volume (unit) share – a larger position than the next three OS competitors combined, and up from ~20% in 2017. Roku’s success is reflective of the fact that they have consistently executed at a high level on a few key things: for example, developing an intuitive and easy to use purpose-built OS, providing access to all major streaming apps (including TRC and hundreds of linear FAST channels), and maintaining good relationships with 20+ TV OEM’s like TCL that positions Roku to sell high quality TV’s that are often perceived as the best value in the market. Roku unquestionably faces tough competition, a list that includes Amazon, Google, LG, Samsung, and VIZIO; that said, this makes their undeniable success over the past five years that much more impressive. The question for investors is the following: how can Roku translate their strong and seemingly defensible position into a profitable business over time?

Roku Financials

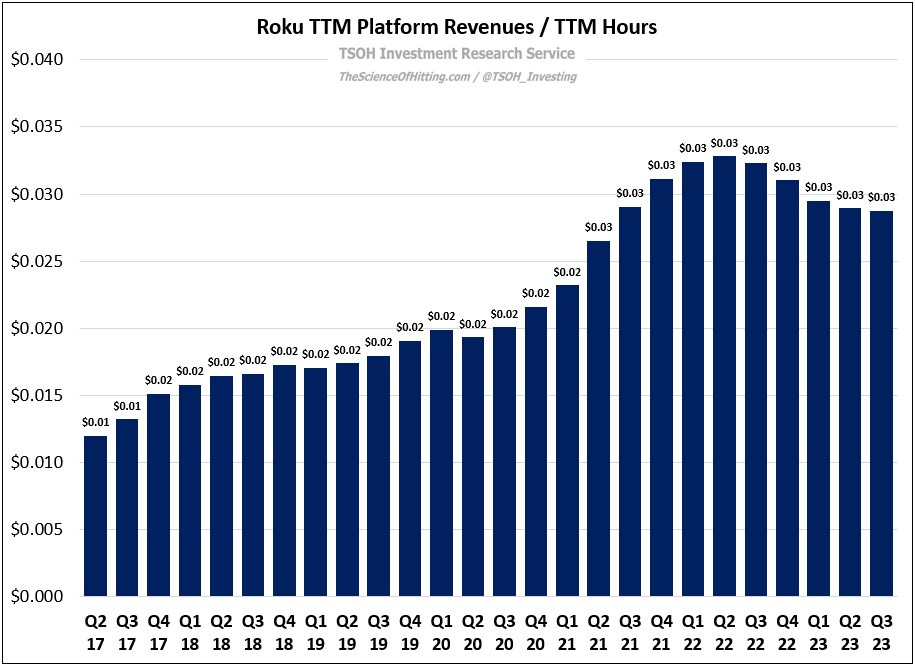

As noted earlier, Roku has seen very impressive revenue growth over the past five years, driven by a combination of active accounts growth and ARPA. If we dig in on ARPA, it consists of two variables: total hours per user and average revenues per hour of engagement (streaming). As noted above, the first metric has increased by ~35% over the past five years (from ~2.9 hours per day to ~3.9 hours per day). The second variable, revenues per hour, has also seen a material gain (up ~70% from Q3 FY18 to Q3 FY23). That said, as you can see below, it has fallen in recent periods from the Q2 FY22 highs.

It’s interesting to think about this data point: in Q3 FY23, at a time when we’re now past the heights of a particularly aggressive / promotional environment for DTC streaming services (see WBD taking an ax to DTC SG&A), and at a time when many advertising-related businesses have been calling out macro headwinds, Roku has increased its per hour platform revenues at a ~12% CAGR over the past five years. How? For one, they benefit from a rising payout (in dollars) from their content distribution revenue share agreements as media companies raise SVOD pricing. Second, while we don’t have a quantified breakdown, I think they’ve also done a good job expanding their ad business to serve a broader range of customers (like McDonald’s, Coca-Cola, and Intuit). Third, with a clear shift towards AVOD, they’ve become an even more important partner to certain media companies who see an immediate and direct connection between engagement and revenues. All-in, I think Roku has done a great job improving its UI / platform features in a way that makes it easier for consumers to find content that they want to watch tonight, which presents commercial opportunities with the media companies, alongside broader opportunities with other advertisers. (On the breakdown, VIZIO’s Q3 FY23 deck shows that ~80% of SmartCast revenues are from advertising.)