Roblox: The Path To Profitability

From “The YouTube of Gaming?”: “This disconnect between my personal experience on the platform and the reported results is telling. It demands that we answer a seemingly straightforward question: what is Roblox? The answer is key to determining whether this business is worth investing in.”

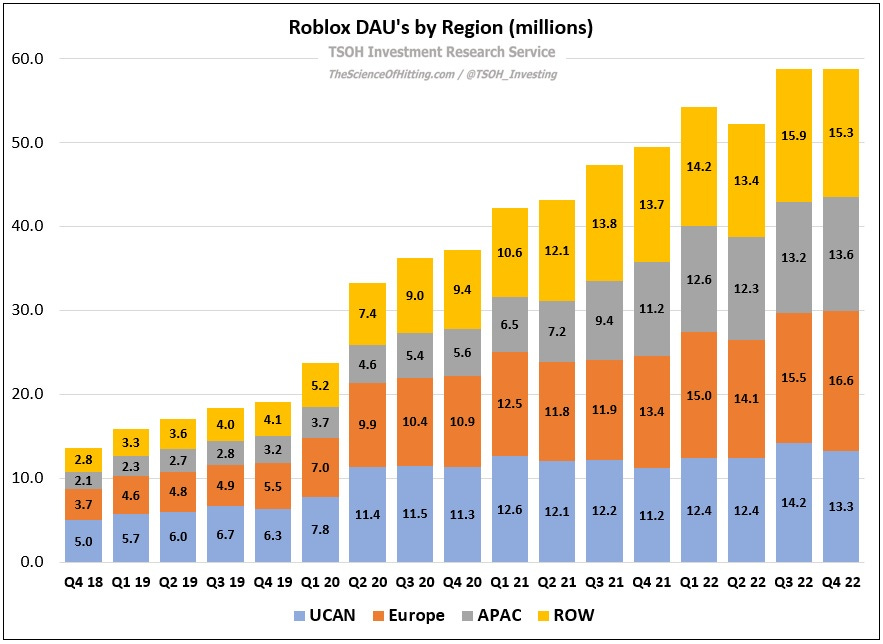

In addition to understanding the business / its long-term opportunities, the answer to that question is a key input for setting reasonable expectations on the amount of time and the level of investment likely required to make that vision a reality. On the Q4 FY22 call, co-founder and CEO Dave Baszucki made a comment that points to his long-term aspirations for Roblox: “There is enormous long-term headroom in our business. We're focused on getting to one billion daily active users on the platform.” (To put that number into context, Satya Nadella disclosed on Microsoft’s Q2 FY23 call that Xbox Live had ~120 million monthly active users; whether that’s an appropriate comp brings us back to the “seemingly straightforward” question asked above.)

That provides a clearer indication of Baszucki’s vision: in the years ahead, he believes Roblox will be much more than a pre-teen gaming platform (that may not be an accurate description of what the platform is today, but it’s my sense of how it’s still generally perceived). Given the recent financial results, we’re already seeing reason for that perception to evolve: the older cohort of Roblox users (13+ years old) has quadrupled over the past three years, to 32.4 million DAU’s in Q4 FY22. (Tegus interview: “Roblox kickstarted the reason for developers to create games for aged-up users. When these games come onto the platform, you'll see more aged-up users come to the platform; when more aged-up users come to the platform, more games will be made for them by developers… The [flywheel] begins.”)

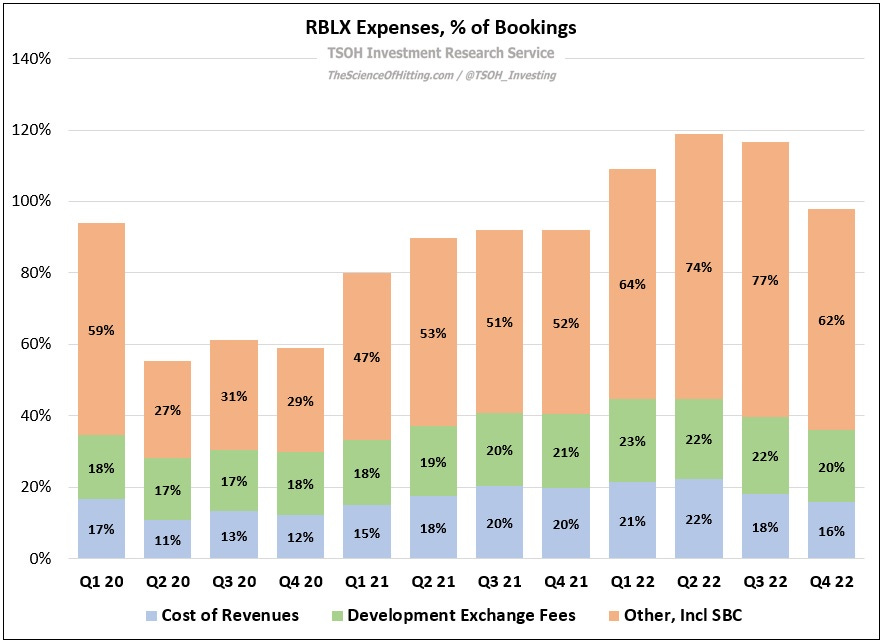

In my opinion, there’s another relevant consideration for Roblox: as a public company, it’s difficult for management to be completely unbothered by Mr. Market’s short-term scorecard. (The stock price is still down ~70% from the November 2021 highs.) To me, the Q4 FY22 results suggest management is cognizant of that fact (it also helps to have bookings growth reaccelerate, as they did in the back half of 2022). The company is taking action to ensure its financials / profitability do not become completely untethered from the underlying strength of the platform KPI’s for an extended period of time.

One might quibble with that decision: in theory, management’s sole focus should be maximizing the long-term value of the business, no matter its impact on short-term results. I can appreciate that perspective. That said, I’m less of a purist than I once was: my personal view is that management deserves some credit for adjusting to the realities / worries expressed by Mr. Market. (And importantly, I do not think these changes will materially impact the company’s ability to deliver against its long-term opportunities.)

2022 Financials

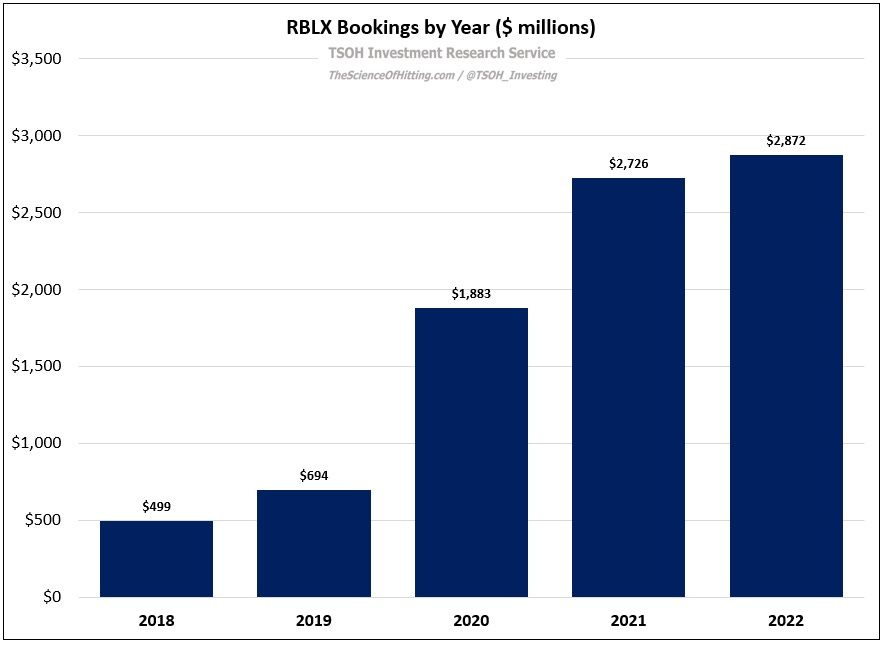

The company ended 2022 on a strong note, with constant currency bookings up ~21% YoY (with ~19% DAU growth, to 58.8 million, and higher payer penetration). As shown below, while Roblox faced very difficult comparisons coming out of the pandemic, they grew bookings by ~5% in 2022 – with a trailing three-year bookings growth CAGR of more than 60%. (Note that the broader gaming industry faced heightened pressures throughout 2022.)