Roblox: Growing Up

In “Bigger Than Play”, I wrote the following: “The important thing to note, in my opinion, is that Roblox is making these moves from a position of strength. Simply put, they’re investing aggressively in pursuit of what they believe is a massive long-term global opportunity: hundreds of millions of DAU’s spending multiple hours a day on the platform and collectively generating tens of billions of dollars in bookings. At a time when many of the traditional gaming companies are curtailing spend / investment in light of a difficult macro environment, Roblox is marching forward… That said, this still presents near term challenges, particularly for market participants / investors who are not following the story closely or who have become skittish as a result of significant volatility around some key numbers (TTM FCF margins have contracted ~1,500 basis points over the past year; at ~11%, FCF margins are well below the long-term target of 25%+).”

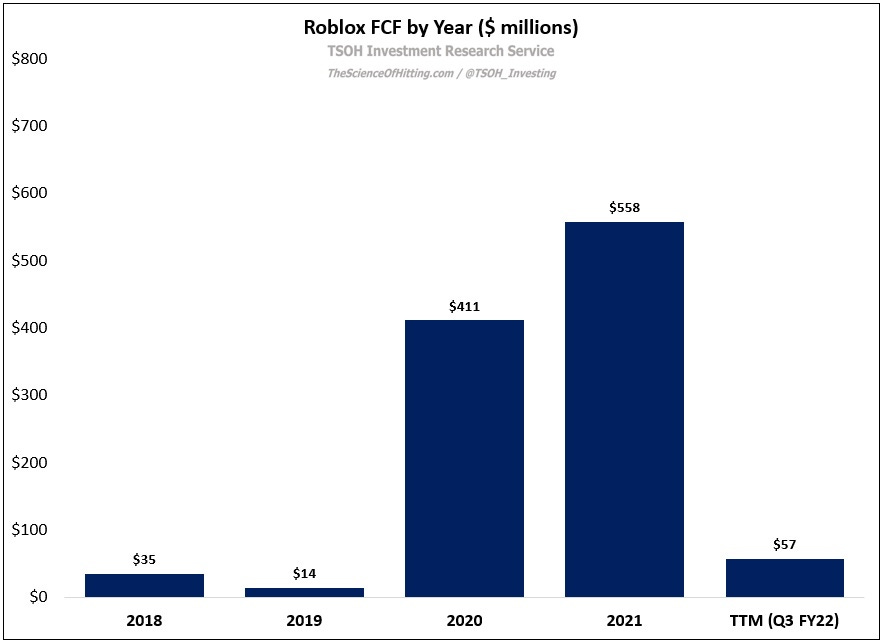

The Q3 results at Roblox, along with the commentary on the call, provided a clear indication that the current state of affairs will remain for the foreseeable future. As noted in the shareholder letter, management expects EBITDA margins to remain below 10% “at least through 2023”. A look at the company’s free cash flow is revealing: after reaching a record high of $558 million in 2021 (with 20%+ FCF margins for the year), FCF has been negative in each of the last two quarters (with TTM FCF of $57 million).

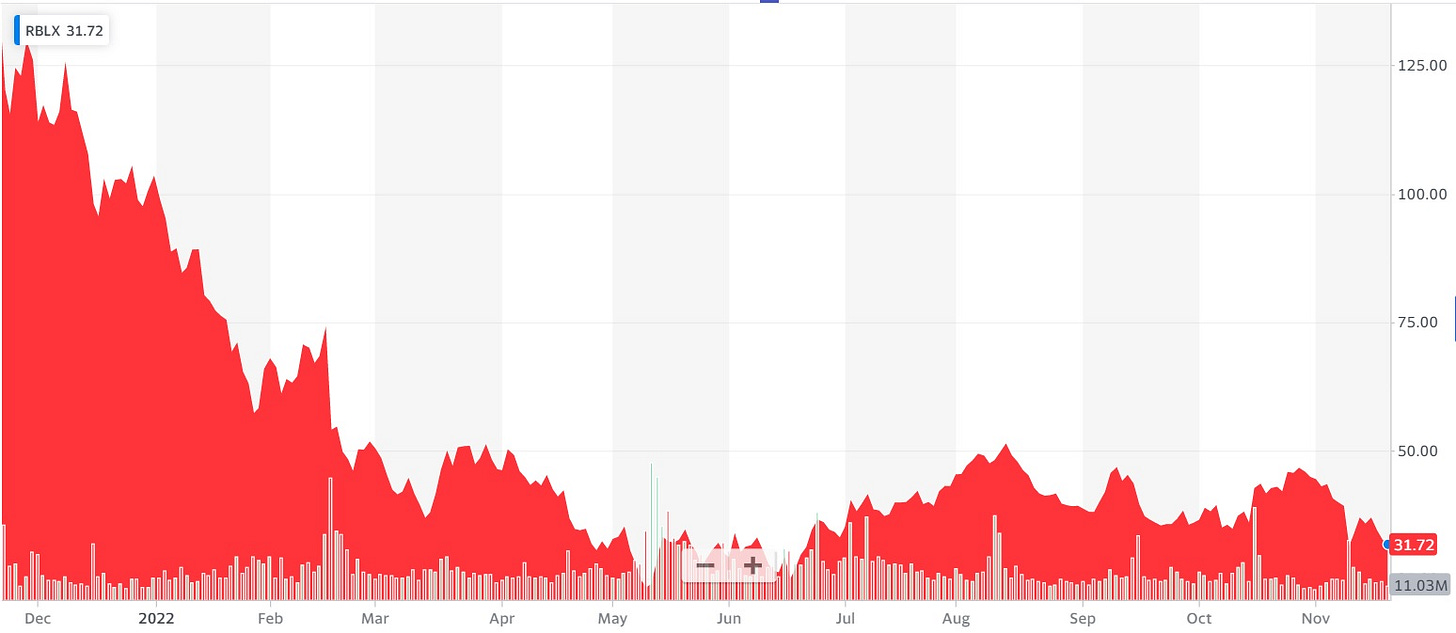

Based on this metric, or by looking at the ~75% decline for the stock over the past year, one might conclude that Roblox is yet another busted COVID story. My contention, as I’ll discuss in today’s write-up, is that this conclusion misses the mark. The real story is that Roblox’s business is evolving, most notably as it relates to older users (aging up). Management is making large investments in pursuit of an opportunity that has changed significantly from what existed a few years ago (or, at a minimum, their ability to compete in certain pockets has clearly improved). If they’re successful - with signs in the recent results that suggest they’ve made meaningful progress against that objective - I think Roblox’s business could end up being multiples of its current size by the end of this decade. (“Our investments compound at incredible rates when funneled through the creator community.”)