Roblox: "Bigger Than Play"

In “The YouTube of Gaming?”, I wrote the following:

“As Reed Hastings once said, ‘What happens to people is that they associate you as you are, not what you can become if the technology matures.’ It’s easy to write off Roblox as a ‘less than’ gaming platform (that feeling I had when playing the shooter that resembled a low-quality version of ‘Call of Duty’). But that misses the technical evolution of the platform over the past decade, as well as the incremental improvements that are likely in the years ahead. (‘Today's supercomputer is tomorrow's PlayStation.’)

For Roblox, the holy grail is a future where the platform extends well beyond pre-teens and gaming… Can Roblox reach a point where its platform seriously rivals the most popular games on PC’s / gaming consoles?

That may seem like an unrealistic goal from where we stand today, but I think the arc of technological progress and time are both on Roblox’s side.”

On August 9th, Roblox reported its Q2 FY22 financial results.

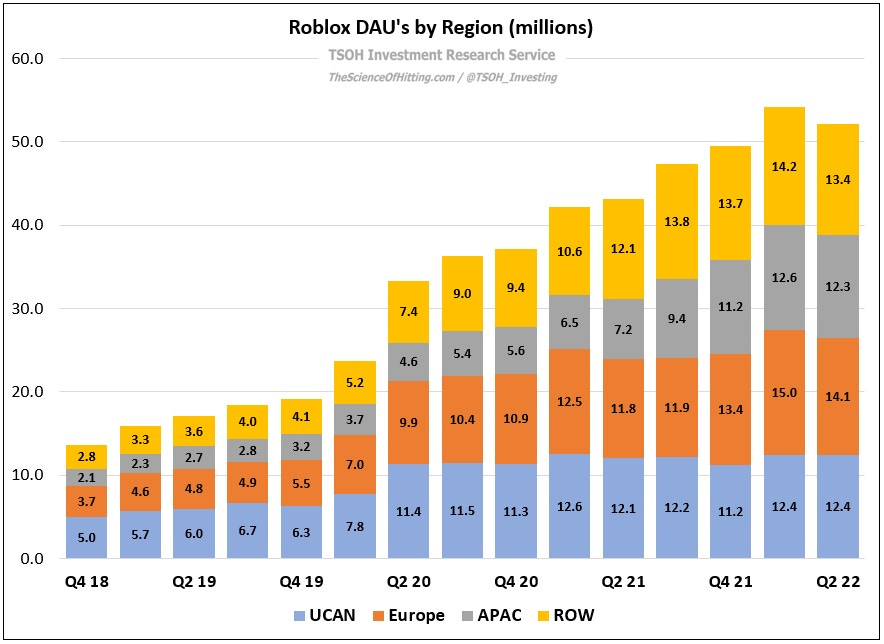

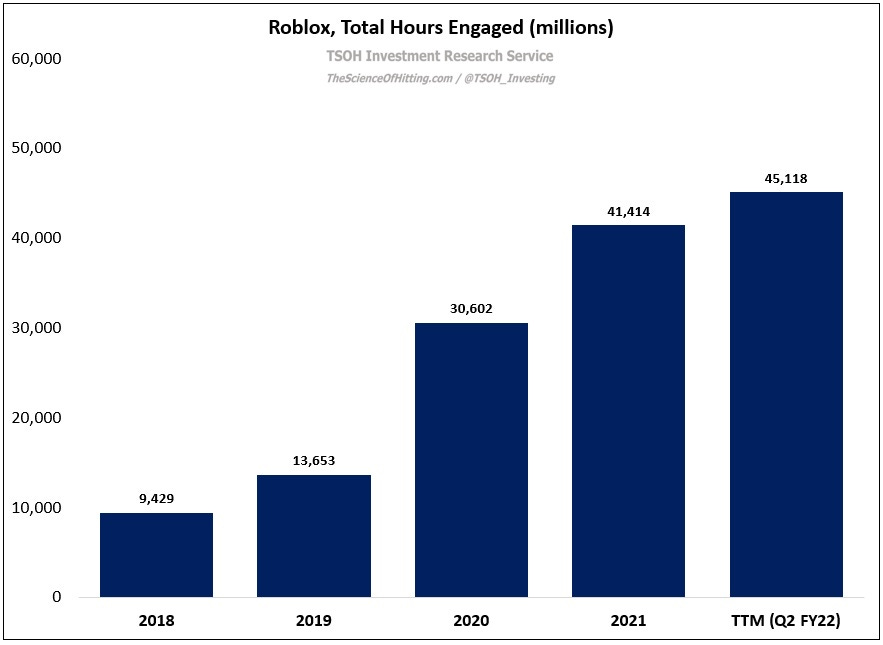

The company ended the quarter with 52.2 million global daily active users (DAU’s), up 21% from the year ago period. Importantly, as noted in the Q2 letter, DAU’s improved meaningfully after quarter end: in July (a seasonally strong month), Roblox reached an all-time high of 58.5 million DAU’s (+26% YoY). Notably, this was inclusive of a strong UCAN print, with DAU’s +15% YoY and total hours of platform engagement +23% YoY (“the absolute level of users and engagement hours [in UCAN] in July exceeded those of any prior month, even during the peak periods of the pandemic”).

These results have given management the confidence to predict that the major COVID swings are largely behind us (outside of some small Omicron impacts in Q4); as CFO Mike Guthrie noted on the call, “All that growth we benefited from during COVID, we've absorbed. We've retained the vast majority of it; now we’re growing on top of that across all age demos.”

The ongoing adoption of Roblox by older users, which is a critical part of the long-term vision and investment thesis, has also been encouraging. As shown below, ~53% of Roblox’s user base in Q2 FY22 was 13+ years old, compared to ~40% three years ago. (CEO Dave Baszucki: “We’re getting to the point where our 17 - 24 cohort is going to pass our 9 - 12 cohort in size.”) Platform usage is evolving to reflect this development; as noted in the shareholder letter, nearly 50% of the top 1,000 experiences on the platform saw the majority of their engagement from users who were 13+ years old in June 2022; by comparison, that number was ~10% in September 2020.

A large number of older users isn’t just a path to DAU growth; we’re starting to see that older users may also present significant incremental opportunities on monetization and the economic viability of the ecosystem. (As a reminder, Roblox is fueled by user generated content, or UGC; attracting and retaining developers is critical, and the economic opportunity offered on the platform is a primary concern of these individuals.) The most notable example is the company’s vision for building out an advertising business within Roblox. Here's Baszucki talking about that opportunity on the call: