Roblox: "Extremely Efficiently"

Note: Here’s the link to prior Roblox (RBLX) research from TSOH

Roblox management has an audacious long-term vision for its platform: one billion daily active users (DAU’s) of all ages and across various form factors (mobile phones, PC’s, video game consoles, VR, etc.). With photo-realistic avatars and voice communication, they want to make the experience nearly indistinguishable from the real world. Finally, they want users to truly live on Roblox – to play, to work, to learn, to date, to shop, and to connect socially.

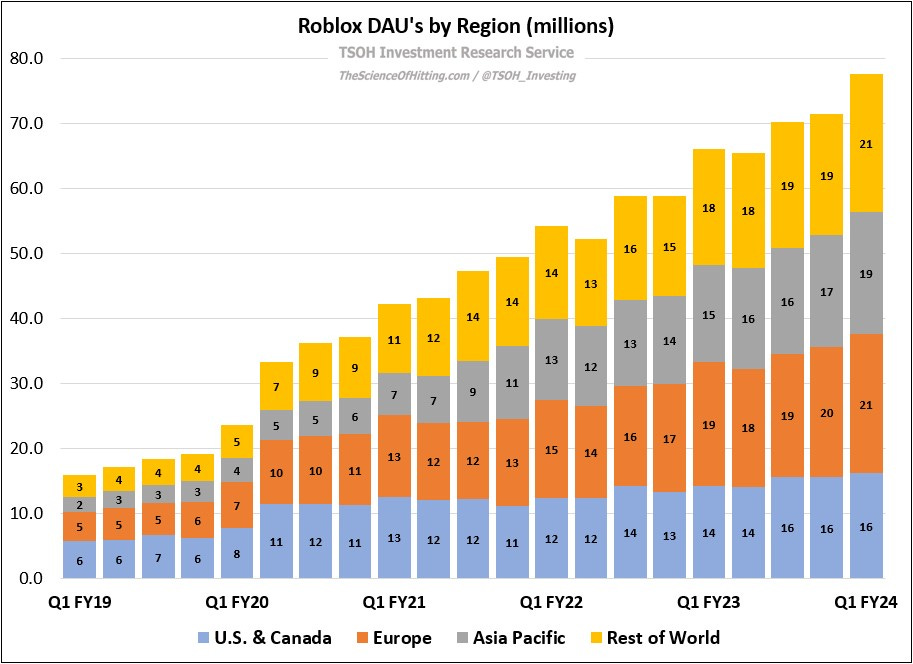

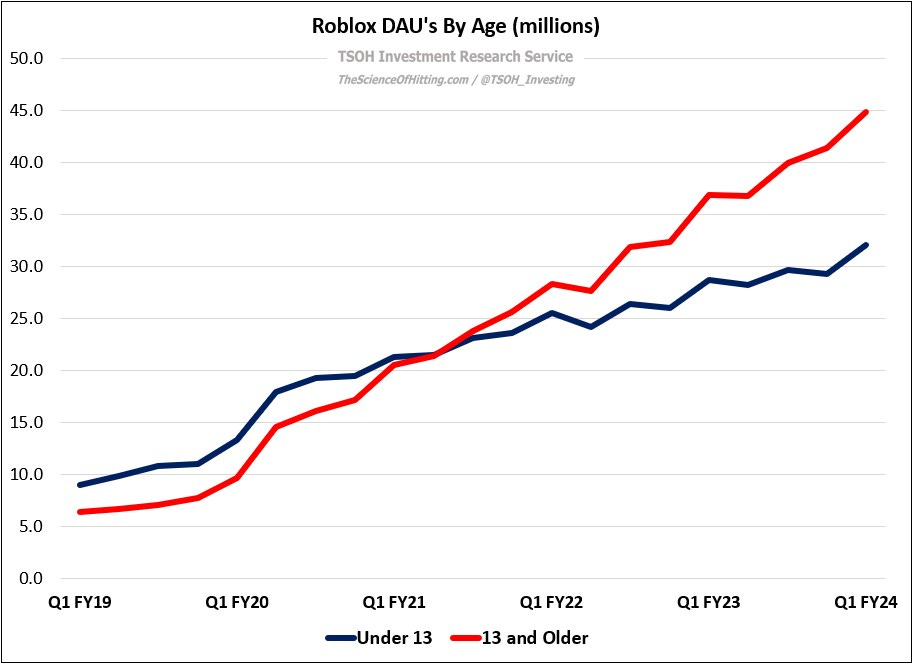

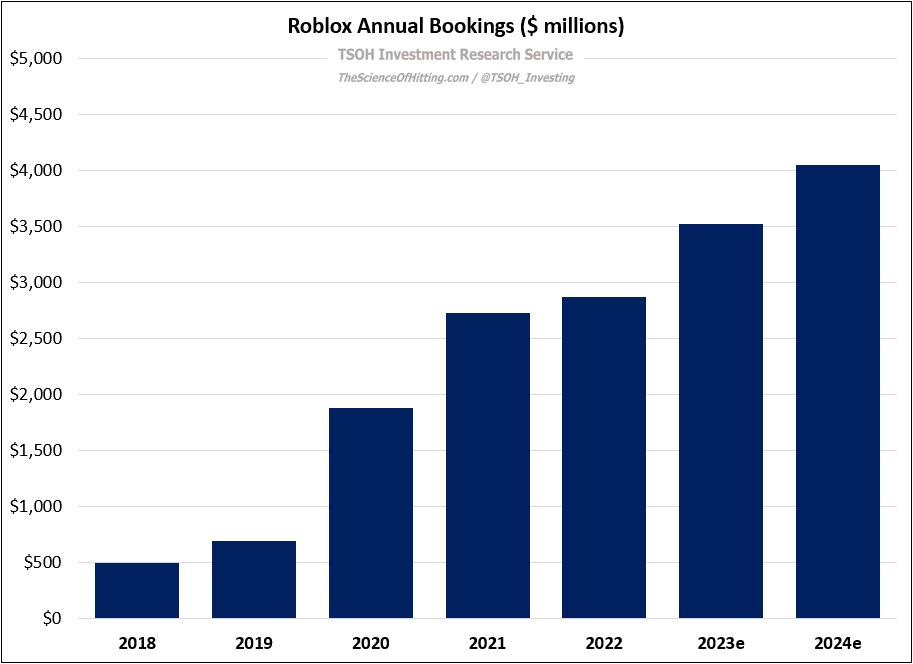

To their credit, they have made great strides towards those objectives over the past five years. Roblox ended Q1 FY24 with 78 million global DAU’s, a roughly 5x increase from 16 million DAU’s in Q1 FY19 (~38% CAGR). Over that time, a number of other encouraging developments have taken place: hours per average DAU increased ~10% to ~2.4 hours per day, bookings per hour of engagement increased ~15%, and the mix of 13+ year old DAU’s as a percentage of total DAU’s increased from ~40% to ~60% (a key development as we think about long-term opportunities with advertising, commerce, etc.).

In combination, those factors drove significant top line growth: from $700 million in FY19, FY24 bookings will likely exceed $4 billion (>40% CAGR).

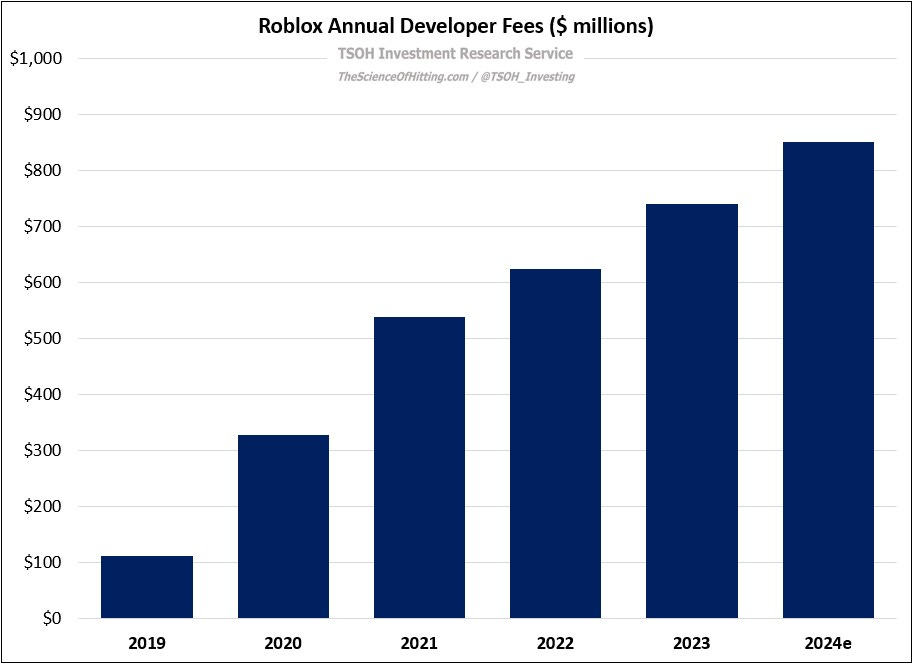

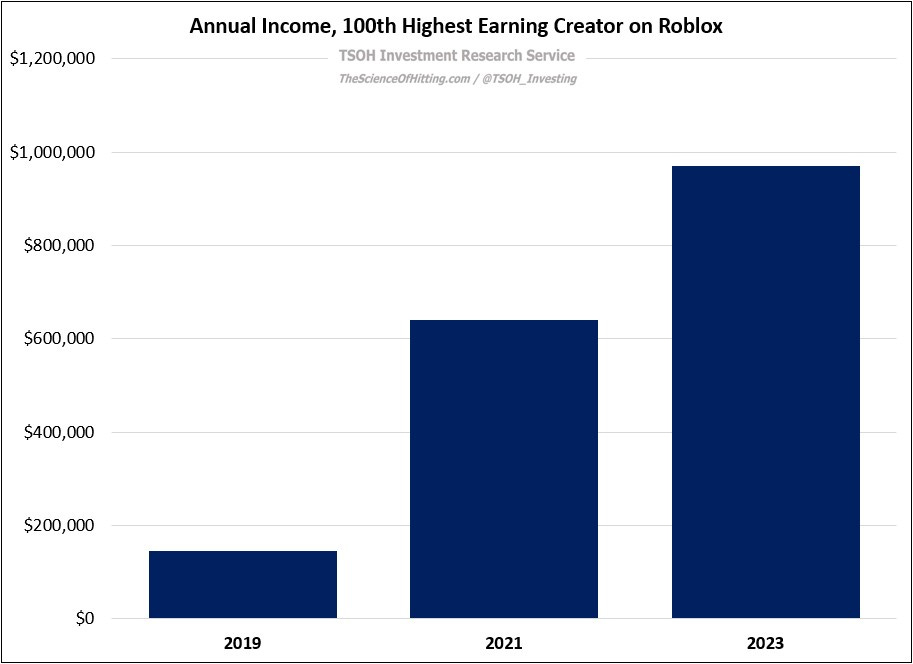

The combination of user growth, engagement, and monetization propels the Roblox flywheel. The platform relies upon creators / user-generated content (UGC), and their financial incentive comes from developer fees: Roblox is on pace to spend ~$850 million on developer fees in FY24, a significant increase from the ~$100 million spent in FY19. It’s helpful to think about what this means at the individual developer level: for the 100th most successful creator on the platform in 2019, their earnings for the year were roughly $150,000; fast forward to 2023, and that same developer (the 100th most successful) generated nearly $1 million of earnings. This is critical for convincing new and current creators to commit their time and resources to building on Roblox.

By any reasonable measure, this part of the story was a huge success… but you wouldn’t know it from looking at the stock: after reaching a high of ~$135 per share following the March 2021 direct listing, it has since fallen ~75%.