"Portrait of a Disciplined Investor"

A look at the life and career of GEICO's Lou Simpson

This post was sent to TSOH subscribers in February 2022; I’ve removed the paywall because Lou Simpson’s story deserves a wider audience. There’s no doubt Lou Simpson was a great investor. But what he did with the fruits of his labor speaks to a more important point: who Lou was as a person.

On January 8th, 2022, Lou Simpson passed away at the age of 85.

Lou, who grew up in Highland Park, Illinois, attended Northwestern University for a short stint before transferring to Ohio Wesleyan University, where he earned a double major in accounting and economics in 1958; two years later, he earned a master’s degree from Princeton (Lou was an economics professor at Princeton from 1960 - 1962). After Princeton, Lou returned to Chicago to work at Stein, Roe, and Farnham, becoming a partner at the investment firm in 1969; after, Lou moved to Los Angeles, where he would eventually be named president and CEO of Western Asset Management.

In August 1979, Lou joined GEICO as an investment manager after meeting with Warren Buffett (“Stop the search. That’s the fellow.”). He clearly made a quick impression at GEICO: in the 1982 shareholder letter, Buffett called Lou “the best investment manager in the property-casualty business”.

Over the next three decades, Lou was responsible for managing the auto insurers’ investments, which grew to $5 billion by his retirement in 2010.

How was Lou’s track record at GEICO? In a word, astounding.

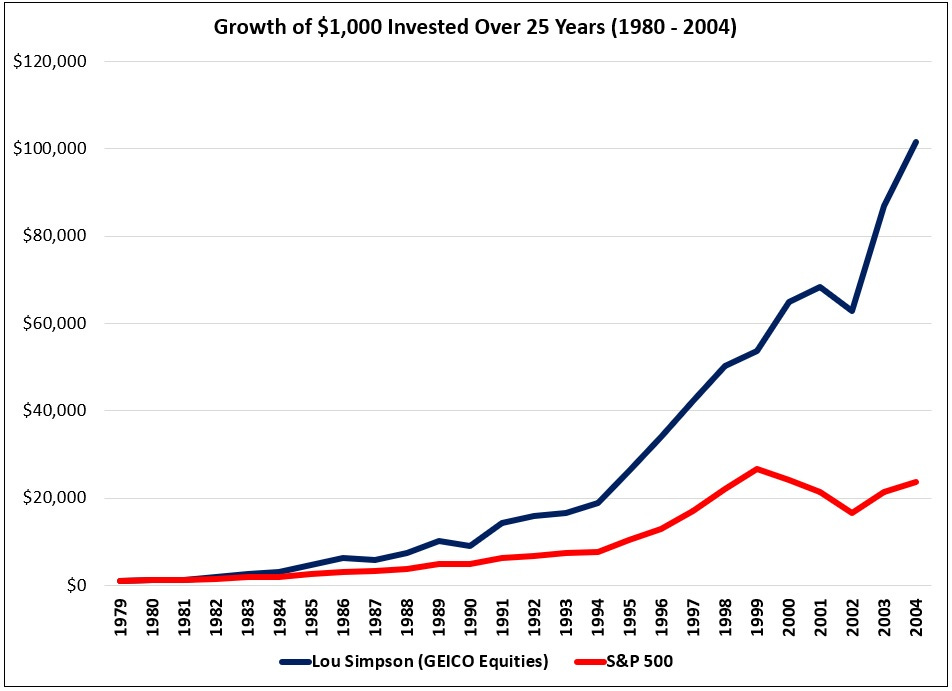

Thankfully, in the 2004 shareholder letter, Buffett disclosed the annual performance of GEICO’s equities portfolio under Lou’s management (the section was titled “Portrait of a Disciplined Investor”). As shown below, an investment of $1,000 in 1979 was worth ~$101,600 by 2004 (>100x growth), compared to ~$23,700 if it had been invested in the S&P 500 (compounded returns of ~20.3% for GEICO’s equities, or roughly 700 basis points higher than the ~13.5% annualized for the index over the same 25-year period).

That was the last time Buffett disclosed GEICO’s investment performance, but we received this tidbit when Lou retired: “When pressed, Simpson said his stock portfolio has outperformed the S&P 500 in aggregate since [2004].”

As Buffett wrote in the 2010 shareholder letter, “Simply put, Lou is one of the investment greats. We will miss him.” Notably, if it wasn’t for Lou’s age, he would’ve likely succeeded Buffett and Munger in the investments role that Todd Combs and Ted Weschler now share at Berkshire; here’s what Buffett wrote in the 2006 shareholder letter: “At one time, Charlie was my potential replacement for investing, and more recently Lou Simpson has filled that slot. Lou is a top-notch investor with an outstanding long-term record... But he is only six years younger. If I were to die soon, he would fill in magnificently for a short period. For the long-term, though, we need a different answer.”

How did Lou generate such astounding investment results?

As outlined in GEICO’s 1986 annual report, Lou’s investment approach had five key guidelines: (1) Think independently; (2) Invest in high-quality businesses run for the shareholders; (3) Pay only a reasonable price, even for an excellent business; (4) Invest for the long-term; (5) Do not diversify excessively (Lou has often mentioned Buffett’s 20-hole punch card idea).

Here’s how Lou described his process (applying those guidelines): “My approach is eclectic. I try to read all company documents carefully. We try to talk to competitors. We try to find people more knowledgeable about the business than we are. We do not rely on Wall Street-generated research. We do our own research. We try to meet with top management… What we do is run a long-time-horizon portfolio comprised of ten to fifteen stocks. Most of them are U.S.-based, and they all have similar characteristics. Basically, they’re good businesses. They have a high return on capital, consistently good returns, and they’re run by leaders who want to create long-term value for shareholders while also treating their stakeholders right.” (We also know that he liked to operate with a small team, not an army of research analysts: “He supervises only two employees, an assistant and an analyst… ‘The more people you have, the more difficult it is to do well.’”)

In addition, Lou considered management quality a key part of the investment decision: “One of the things I’ve learned over the years is how important management is in building or subtracting from value. We will try to see a senior person and prefer to visit a company at their office, almost like kicking the tires. You can have all the written information in the world, but I think it is important to figure out how senior people in a company think.”

In discussing Lou’s performance in the 1986 shareholder letter, Buffett wrote the following: “These are not only terrific figures, but fully as important, they have been achieved in the right way. Lou has consistently invested in undervalued common stocks that, individually, were unlikely to present him with a permanent loss and that, collectively, were close to risk-free.”

Lou’s portfolio was consolidated with Buffett’s on Berkshire’s 13-F filings, so we can’t say much (in detail) about his holdings at GEICO; but we can get a sense for his preferred approach by looking at SQ Advisors, the firm that he started after leaving Berkshire. (“I did retire for a day… but I would drive myself and my wife crazy if I really retired and didn’t do anything.”)

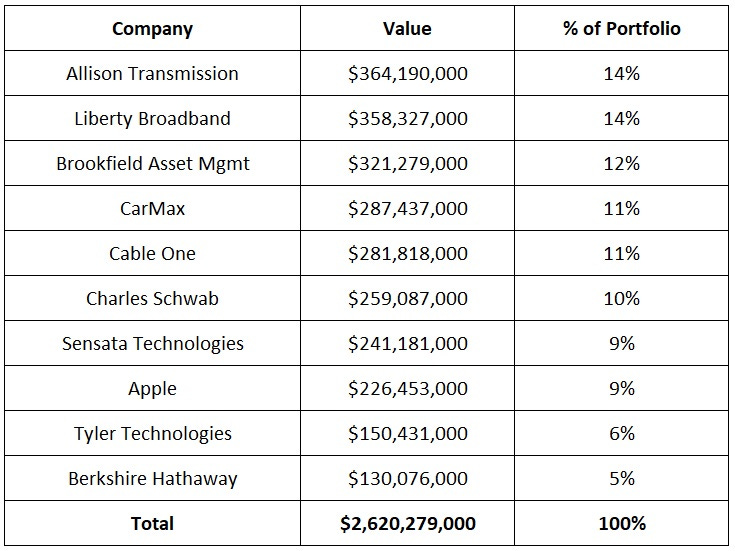

For example, here’s the full holdings list from SQ’s 13-F at yearend 2018.

As you can see, Lou preferred a concentrated portfolio, with the majority of its value at YE2018 attributable to the four largest positions (“He gets one or two really strong ideas a year and then likes to swing very hard.”). This approach aligns with Buffett’s commentary in 2004, which suggested Lou liked to take big swings: “Lou Simpson manages about $2.5 billion of equities… Customarily his purchases are in the $200 - $300 million range.”

(And from page 53 of GEICO’s 1986 annual report: “Good investment ideas - that is, companies that meet our criteria - are difficult to find. When we think we have found one, we make a large commitment. The five largest holdings at Geico account for more than 50% of the stock portfolio.”)

Conclusion

While this audience, myself included, knew Lou for what he achieved as an investor, what he did with the fruits of his labor also deserves attention (at GEICO, Lou was paid a salary plus a contingent payment based on his rolling three-year performance relative to the S&P 500; given that he trounced the index for decades, he was paid handsomely). Most notably, along with his wife Kimberly, Lou has given more than $250 million to Northwestern University (they have also been supporters of the Big Shoulders Fund, which provides financial assistance to in-need schools in the city of Chicago).

Morton Schapiro, Northwestern’s President, said the following about Lou:

“He distinguished himself as a giant in the world of investing, then went on to become one of the foremost champions of our University, alongside his beloved wife, Kimberly. Northwestern couldn’t be what it is today without him, and his name will live on in perpetuity on our campuses because of his vision for funding world-class work in science, medicine, engineering and business. He was also one of the most faithful and loyal supporters of Wildcat athletics. I will miss him dearly as a friend, as will countless others.”

John Rogers Jr. of Ariel Investments also shared his condolences: “First and foremost, Lou was just an extraordinary investor… He truly was a legend.”

While Lou’s success as an investor at GEICO is the part that’s most relevant to the focus of this service, reading about Lou over the past few weeks has revealed that he was much more than that; simply, he was an extraordinary person. And while Lou added significant value for Berkshire Hathaway shareholders over the decades, that impact pales in comparison to what he did for the world at large (along with his wife) through his charitable giving.

As Buffett wrote at Lou’s retirement, “We will miss him.”

We will indeed.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.