"Portrait of a Disciplined Investor"

A look at the life and career of GEICO's Lou Simpson

On January 8th, 2022, Lou Simpson passed away at the age of 85.

Lou, who grew up in Highland Park, Illinois, attended Northwestern University for a short stint before transferring to Ohio Wesleyan University, where he earned a double major in accounting and economics in 1958; two years later, he earned a master’s degree from Princeton (Lou was an economics professor at Princeton from 1960 - 1962). Following Princeton, Lou returned to Chicago to work at Stein, Roe, and Farnham, becoming a partner at the investment firm in 1969; a few years after, Lou moved to Los Angeles, where he became president and CEO of Western Asset Management.

In August 1979, Lou joined GEICO as an investment manager after meeting with Warren Buffett (“Stop the search. That’s the fellow.”). He clearly made a quick impression at GEICO: in the 1982 shareholder letter, Buffett called Lou “the best investment manager in the property-casualty business”.

Over the next three decades, Lou was responsible for managing the auto insurers’ investments, which grew to $5 billion by his retirement in 2010.

How was Lou’s track record at GEICO? In a word, astounding.

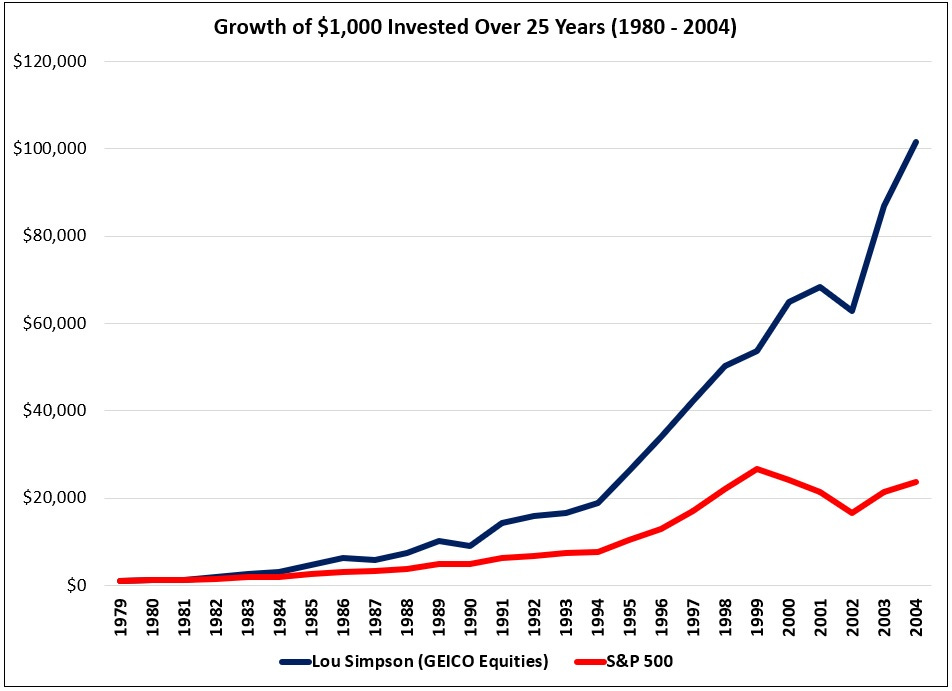

In the 2004 shareholder letter, Buffett disclosed the annual performance of GEICO’s equities portfolio under Lou’s management (the section was titled “Portrait of a Disciplined Investor”). As shown below, an investment of $1,000 in 1979 was worth ~$101,600 by 2004, compared to ~$23,700 if it had been invested in the S&P 500 (compounded returns of ~20.3% for GEICO’s equities, or roughly 700 basis points higher than the ~13.5% annualized for the index over the same 25-year period).

That was the last time Buffett disclosed detail performance figures for GEICO’s portfolio, but we received this tidbit when Lou retired: “When pressed, Simpson said his stock portfolio has outperformed the S&P 500 in aggregate since [2004].”

As Buffett wrote in the 2010 shareholder letter, “Simply put, Lou is one of the investment greats. We will miss him.” Notably, if it wasn’t for Lou’s age, he would’ve likely succeeded Buffett and Munger in the investments role that Todd Combs and Ted Weschler now share at Berkshire; here’s what Buffett wrote in the 2006 shareholder letter: “At one time, Charlie was my potential replacement for investing, and more recently Lou Simpson has filled that slot. Lou is a top-notch investor with an outstanding long-term record... But he is only six years younger. If I were to die soon, he would fill in magnificently for a short period. For the long-term, though, we need a different answer.”

How did Lou generate such astounding investment results?