Walmart: Full Steam Ahead

Note: TSOH Investment Research will be off on Thursday for Thanksgiving. We’ll be back on Monday, December 2nd, with an update on Celsius (CELH).

From “Walmart: Turning The Titanic” (June 2021): “We can put CEO Doug McMillon’s major accomplishments - the things Walmart had to address in order to position the company for long-term success - into three buckets: (1) stabilize the core Walmart U.S. business; (2) build an omni-channel retailer / e-commerce company; and (3) reposition the international business.”

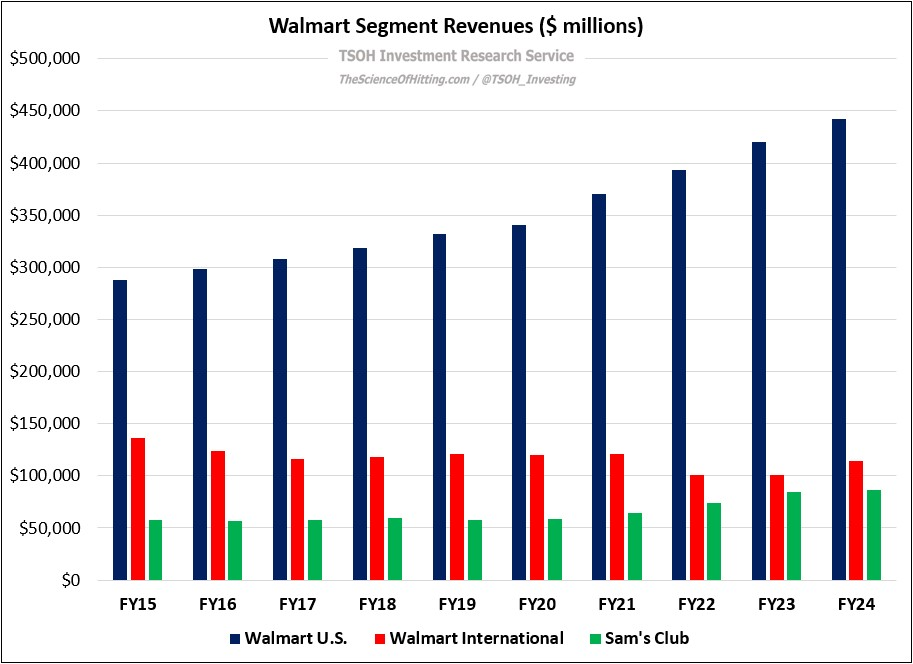

Given some of the portfolio changes I’ve made in recent months, I think it may be helpful to update on the ongoing evolution at Walmart, which has implications for competitors in the retail industry. Today, I will focus on Walmart U.S., which accounted for ~69% of its FY24 revenues (Walmart International and Sam’s Club accounted for ~18% and ~13%, respectively).

Here’s the short summary: in a highly competitive industry that is navigating structural change, along with other sources of significant near term volatility, Walmart has consistently delivered best-in-class results. That is most evident when looking at comps (SSS), which have typically held in the mid-to-high single digits for the past five years – a particularly impressive feat of late as peers like Target are simply fighting to hold their SSS in positive territory.

In my opinion, two key factors explain Walmart’s continued outperformance: