Peloton: "Unwelcome Surprises"

From “Turnarounds Are Hard Work” (March 2023): “In summary, Peloton experienced massive tailwinds during the pandemic, but they proved fleeting. They got caught offsides when demand fell off a cliff, with some of prior management’s decisions making today’s problems much worse than they would’ve been otherwise (‘they always had this blind optimism’)… This could be an attractive business – but there are two big assumptions embedded in that statement: (1) Peloton can cost effectively produce and sell its hardware to consumers at prices that are significantly lower than a few years ago (in mid-2020, the core Bike model cost $2,245; today, you can buy it with delivery and installation included for $1,445); and (2) Peloton can maintain, and ideally continue growing, its CF subscriber base. (‘A significant portion of our content creation costs are fixed... We expect the fixed nature of those expenses to scale over time as we grow our CF Subscription base.’)”

On a number of relevant metrics, Peloton has been a massive success over the past five years. Most notably, its subscriber base has increased ~12x, to more than three million CF (“All-Access”) subscribers, with subscription revenues up ~20x over the same period, to nearly $1.7 billion in FY23.

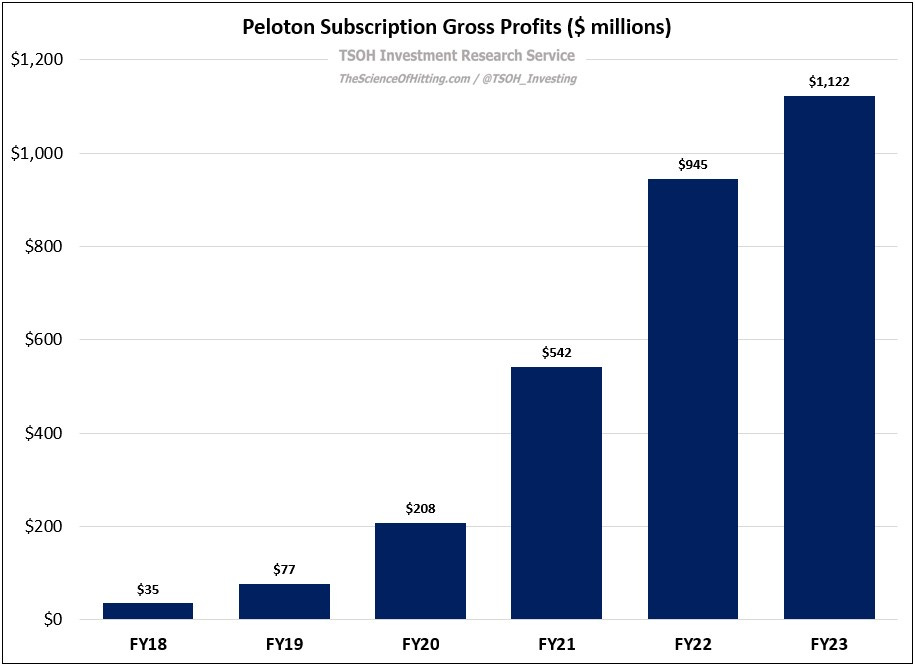

Those three million CF subscribers undergird a subscription business that generated ~$1.1 billion in FY23 gross profits for Peloton - compared to less than $200 million in gross profits for the entire company back in FY18.

That’s the good news.

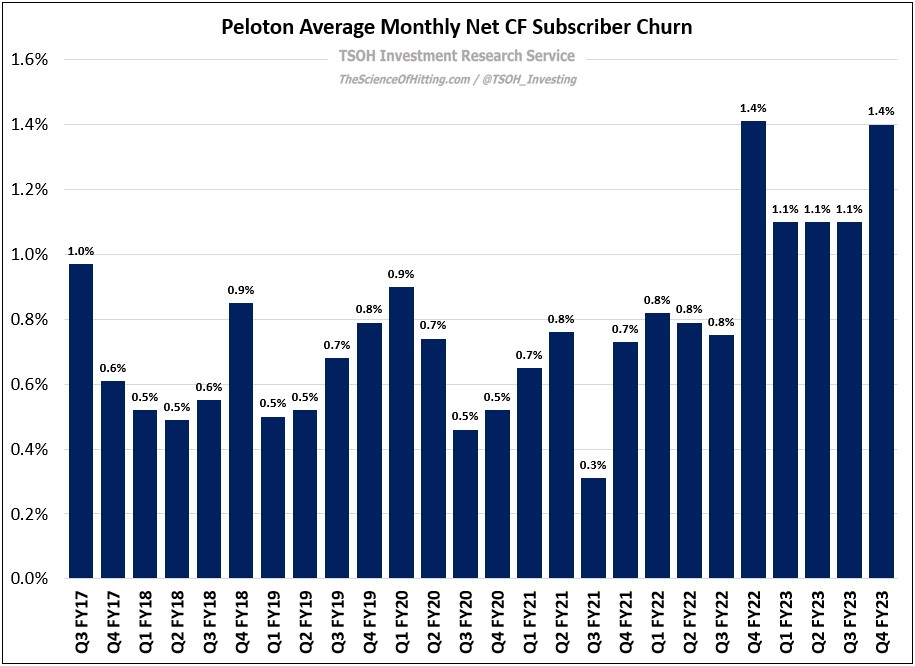

But the Peloton story of late has been dominated by the bad news. It’s a long list which includes stalled CF subscriber growth, significant losses in the hardware business (FY23 product sales of ~$1.1 billion, down ~$2 billion from FY21), excess inventories, the Bike seat post recall (which has led to customer replacement requests on ~750,000 bikes), an unproven digital app strategy, and financial leverage. All-in, Mr. Market has clearly had enough: at $5.1 per share, the stock price has declined ~97% from where it traded at the end of 2020. The company’s current market cap is equal to ~1x sales for the subscription business (which has ~67% gross margins). Amidst significant uncertainty, is Peloton an attractive risk / reward here for long-term investors?

Financials

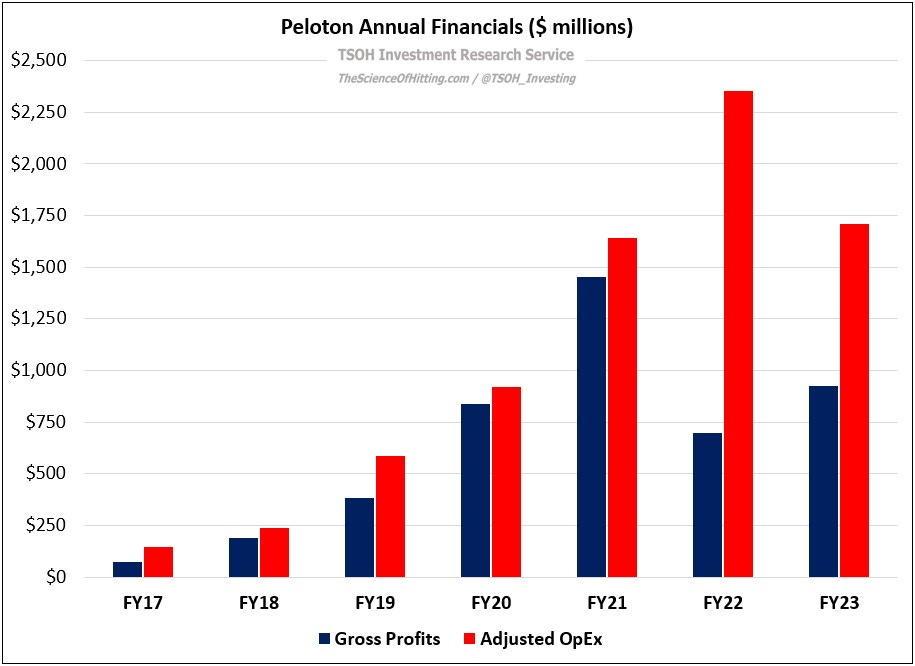

The following chart shows Peloton’s annual gross profits and adjusted operating expenses for each of the past seven years. As you can see, the first five years (FY17 – FY21) consisted of large gains in gross profits offset by OpEx increases to support growth, with the net result being relatively small operating losses (in FY21, EBIT was -$188 million). FY22 is when major problems arose: as hardware sales rolled over (the aforementioned ~$2 billion decline from FY21 to FY23), it took time to adjust the cost structure.

In FY23, despite an improvement on both ends of the equation, the gap between gross profits and OpEx was still ~$800 million (and that calculation excludes another ~$400 million of restructuring and impairment charges).