"Turnarounds Are Hard Work"

An update on Peloton (PTON)

From Peloton: “What’s Next?” (May 2022):

“The customer reaction to the CF [Connected Fitness] price hike on June 1st will be telling. If Peloton sees meaningful churn in response to the $44 U.S. price point (up from $39 per month), it will put the company in a very difficult position. That outcome would demand a return to the drawing board (and it’s unclear to me what good options would remain to truly reimagine the CF business and reignite growth). On the other hand, if it’s successful, it may suggest Peloton has real flexibility on product pricing…”

Peloton, which sported a market cap of roughly $50 billion at the end of 2020, has fallen from grace. But despite a stock price that has declined by more than 90% from the highs, I think there are a few interesting developments happening under the surface. As CEO Barry McCarthy continues to adjust the company’s business model and operations to align with his long-term strategic vision, is there reason to believe that Peloton has a bright future?

Let’s start with the bad news.

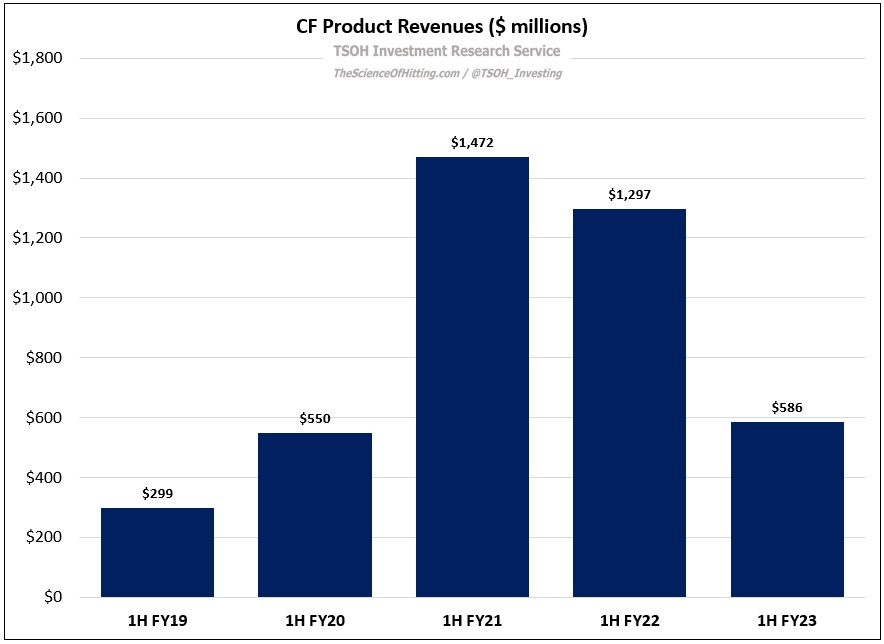

First, CF Products (hardware) revenue continues to decline precipitously: as shown below, revenues in 1H FY21 were $1.47 billion – a 170% increase from the prior year period (1H FY21 for Peloton aligns with the six months ended 12/31/20). But as the pandemic tailwind faded, that reversed: on top of a low double digit decline in 1H FY22, CF Products revenues declined 55% in 1H FY23, to $586 million. Compared to the pre-pandemic results (1H FY20), the cumulative increase in CF Products revenue has been less than 10%.

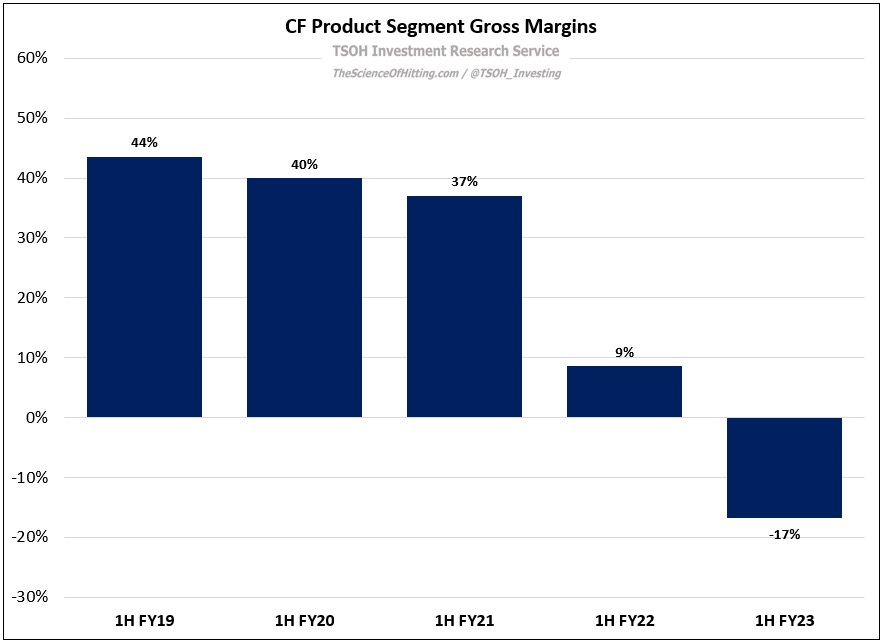

That’s an ugly situation for Peloton to navigate – and unfortunately, it gets much worse as we work down the P&L: despite the fact that the segment had a slightly larger revenue base in 1H FY23 versus 1H FY20, CF Products gross profit margins were negative 17% in the current period - nearly 6,000 basis points lower than the 40% gross margins reported in 1H FY20.

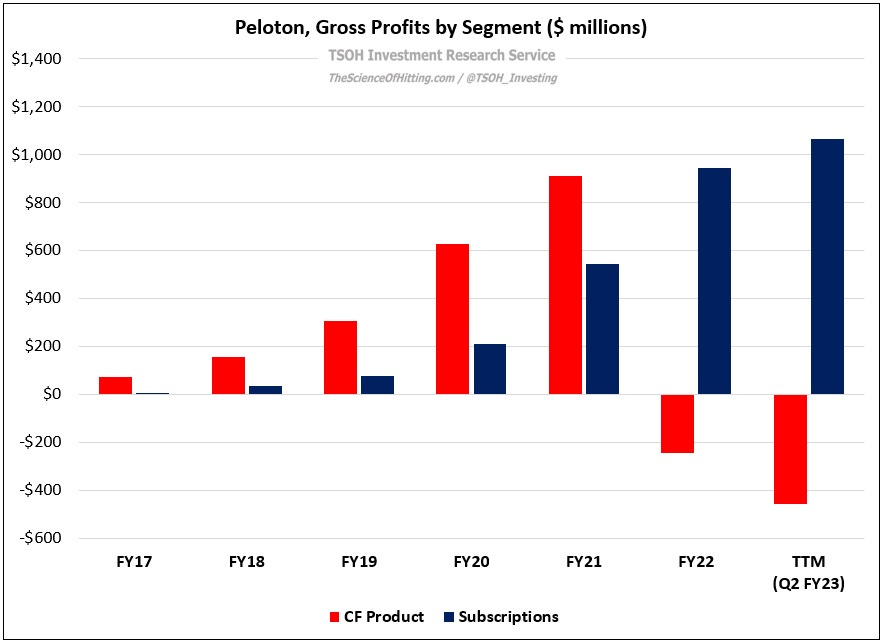

While the company has made significant business model changes under McCarthy’s leadership - more on that in a moment - their impact will take some time to materialize (and will be impacted by the normalized level of hardware sales). The result has been a ~$1.1 billion swing in run rate gross profits for the CF Products segment from FY20 to TTM 1H FY23.

That’s the bad news. The good news is that Peloton ended Q2 FY23 with more than three million Connected Fitness subscribers, an all-time high. In addition, revenues per average sub increased mid-single digits YoY, driven by the aforementioned price increases. The combination of these factors is having a significant impact on the business: based on the 1H FY23 results, the company is on pace for more than $1.6 billion of Subscription segment revenues this year – nearly 10x larger than four years ago (FY19).

In summary, Peloton experienced massive tailwinds during the pandemic, but they proved fleeting. They got caught offsides when demand fell off a cliff, with some of prior management’s decisions making today’s problems much worse than they would’ve been otherwise (“they always had this blind optimism”). McCarthy is working to rectify that situation, while simultaneously juggling a financial position that leaves them with limited room for error. At the same time, Peloton still has three million people who collectively pay ~$1.6 billion a year for access to the platform, with FY23 Subscription segment gross profits likely to exceed $1 billion - a five-fold increase from FY20.

This could be an attractive business – but there are two big assumptions embedded in that statement: (1) Peloton can cost effectively produce and sell its hardware to consumers at prices that are significantly lower than a few years ago (in mid-2020, the core Bike model cost $2,245; today, you can buy it with delivery and installation included for $1,445); and (2) Peloton can maintain, and ideally continue growing, its CF subscriber base. (“A significant portion of our content creation costs are fixed... We expect the fixed nature of those expenses to scale over time as we grow our CF Subscription base.”)

Let’s look at each of those assumptions in more detail.