"Our Intent Is To Grow"

An update on Comcast and Charter

From “Walking The Peacock Plank” (February 2023): “I think Charter’s more focused strategy may be showing up in the financial results, particularly as it relates to their impressive wireless line net adds in Q4 FY22 (which speaks to the long-term opportunity with Spectrum One). This gets to the heart of the matter: as these companies looks to navigate a changing competitive environment, one that I still believe they can thrive in but which demands a clear strategic vision and an ability to execute, Charter is 100% focused on their position in the connectivity industry; Comcast isn’t.”

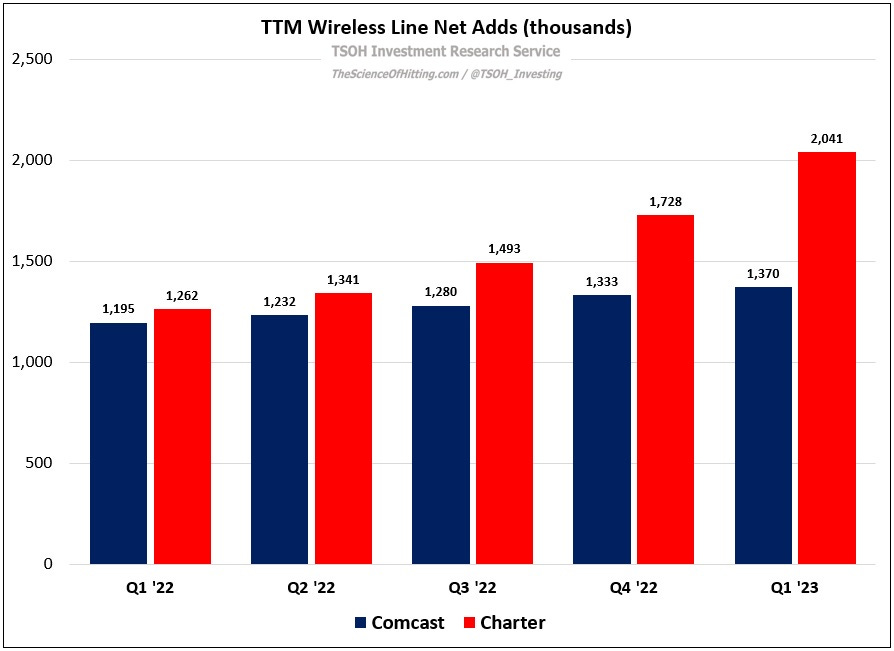

As of Q1 FY23, Comcast and Charter remain within spitting distance of each other in wireless, with each company at roughly six million lines and roughly 10% penetration of their broadband base (Charter is slightly higher than Comcast on both metrics). That said, the following chart - an updated version of what I shared in February - shows that the difference in the pace of wireless line net adds between Charter and Comcast widened in the first quarter (TTM wireless line net adds at Charter were 2.04 million, roughly 50% larger than Comcast); it’s only another 90 days of financial results, but this data speaks to the conclusion reached in “Walking The Peacock Plank”.

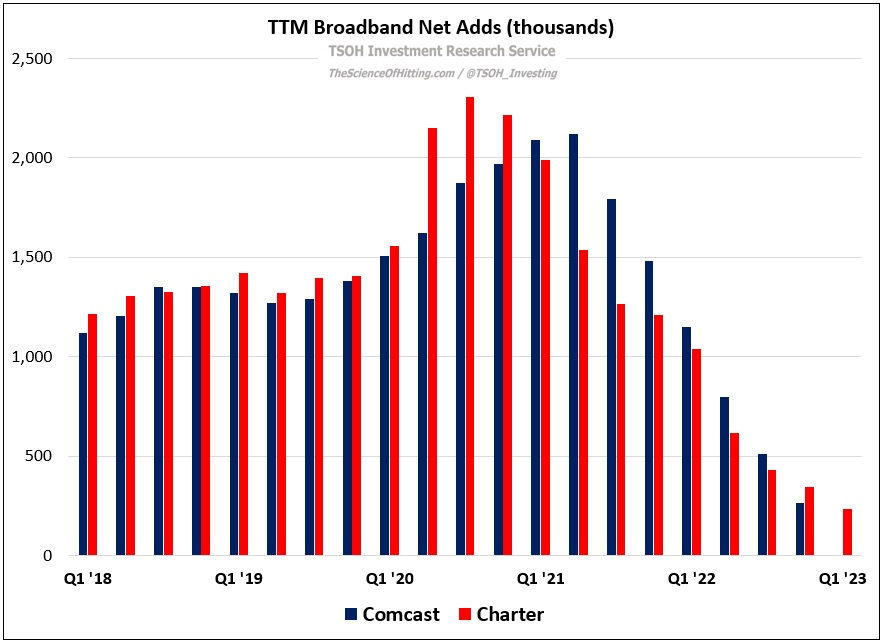

Directionally, albeit on relatively small differences, we’re seeing a similar trend in broadband: over the past year, Comcast added just 4,000 net customers (+0.0% YoY), compared to 235,000 net adds at Charter (+0.8% YoY). As it relates to volumes and pricing, both reported ~5% YoY revenue growth in domestic broadband in Q1 (outsized ARPU growth at Comcast).

This comment, from Comcast President Mike Cavanagh, stood out to me:

“While we had some success towards the end of the first quarter with a couple of offers targeting the lower end of the market, the broadband environment remains highly competitive… Our view remains that 2023 will be a challenging period to add subs. Our outlook for growth and our strategy has been consistent: we will compete aggressively, but in a financially disciplined way. While we expect to return to growth in broadband subscribers over time, during this interim period, as well as over the longer term, we will focus on protecting and growing broadband ARPU.”

Contrast that with the following comment from Charter CEO Chris Winfrey:

“Ultimately, we're focused on everything a customer would want us to do - investing in the network to offer even faster speeds, providing seamless connectivity products not available elsewhere, then bringing that same seamless connectivity to markets that have never had broadband before, and delivering better customer service… while helping save customers significant money… Our intent is to grow, to continue down the path we're on…”

I think there’s a subtle, but noteworthy, difference in their approaches.