"Our Industry Does Not Respect Tradition"

An update on Microsoft

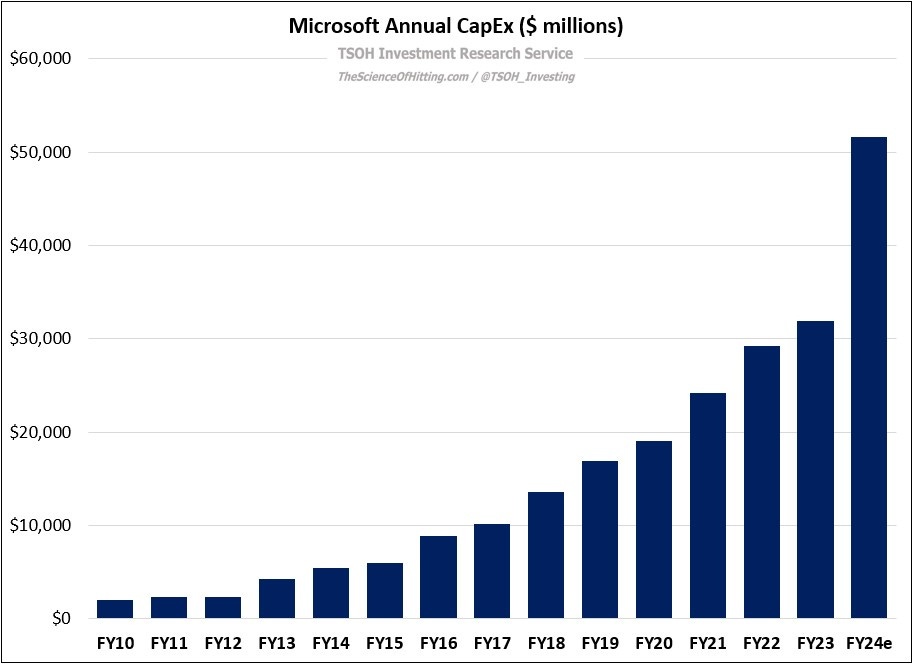

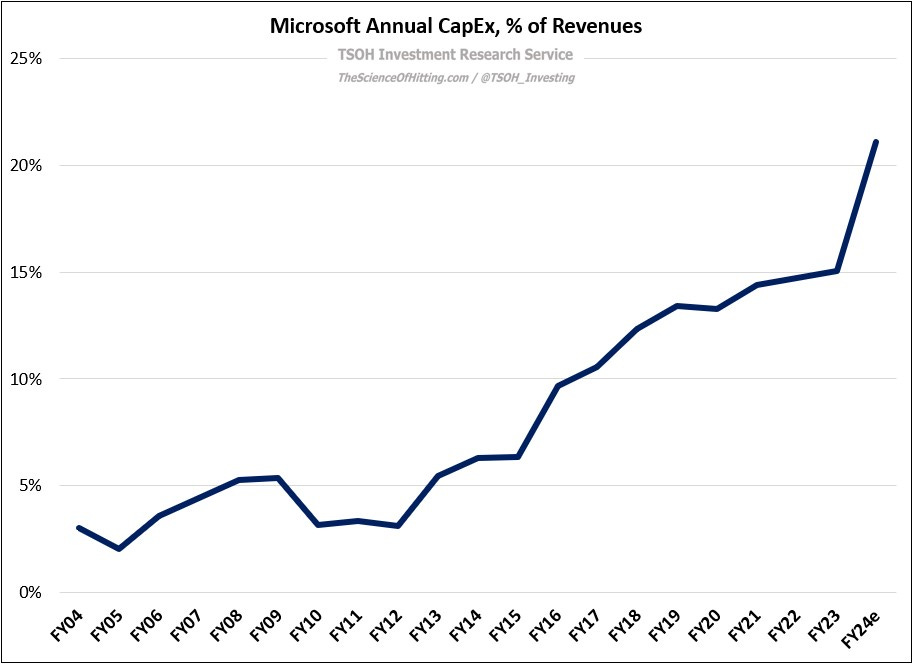

As discussed in Monday’s update, Mr. Market reacted to Meta’s rising AI investments / capital expenditures (CapEx) with some uneasiness. Microsoft is working through similar developments, with FY24e CapEx likely to exceed $50 billion – nearly 3x higher than its FY19 spend. But the market responded more optimistically to the Microsoft news, with the stock climbing a few points following the Q3 FY24 results. In my view, that reaction reflected a clearer understanding from investors on the opportunities that Microsoft is pursuing, along with their strong starting hand (seeing the path to an attractive ROI).

With that said, this period isn’t without risk for Microsoft. As CEO Satya Nadella noted in a recent keynote, they are going all-in on AI: “We’ve taken this platform shift and etched it into every layer of our tech stack… People ask, ‘What’s the AI product?’ The answer is everything; the infrastructure, the data layer, the tools, everything.” We are in the early innings of this platform shift, with the winners and the losers to be determined in due time. For now, as you can see in the graphs below, shareholders are being asked to accept significant investment risk. When we look back in five or ten years, Microsoft’s results will have been greatly impacted by the output from this CapEx ramp. (On this topic, here’s what Amazon CFO Brian Olsavsky had to say about their rising CapEx: “We've done this [at AWS] for 18 years. We invest capital and resources upfront. We create capacity very carefully for our customers. And then we see revenue, operating income, and free cash flow benefits for years to come after that, with strong returns on invested capital.”)

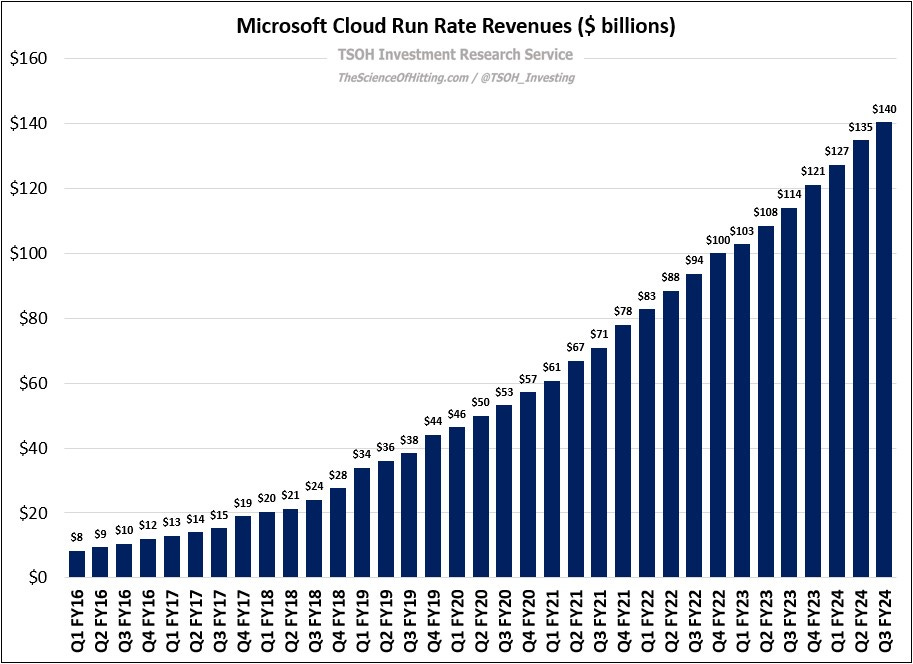

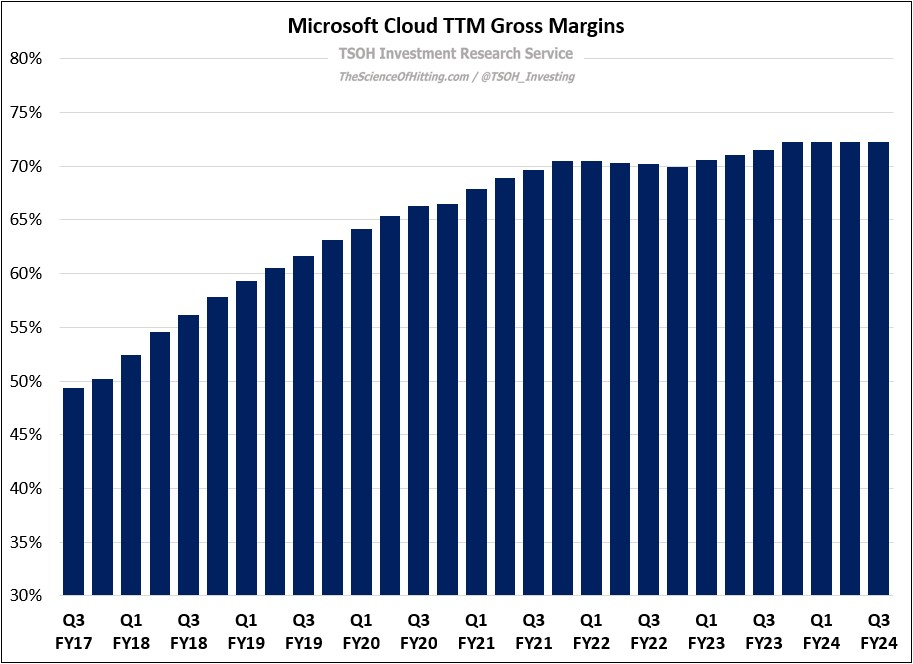

In the face of this investment cycle, my optimism on Microsoft is informed by what I’ve witnessed from the company since my initial investment in 2011, and particularly since Nadella became CEO in 2014. That is most evident at Microsoft Cloud, which has continued its run of stellar results into Q3 FY24: revenues increased 23% YoY in the quarter, with run rate revenues crossing $140 billion. In addition to strong revenue growth, Cloud has sustained 70%+ gross margins, with run rate gross profits of >$100 billion for the first time (gross profits increased by ~33% annualized over the past five years).

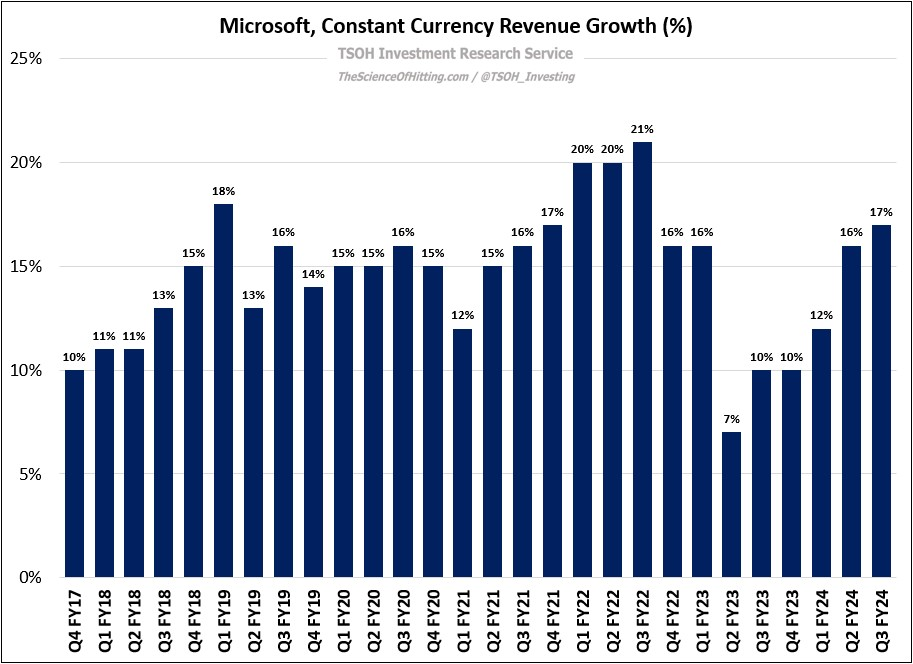

Cloud was the primary driver of mid-teens YoY revenue growth in Q3 (also helped by four points of contribution from Activision), bringing the tally for double digit constant currency revenue growth to 27 of the past 28 quarters. Despite starting from a massive base - FY24e revenues at ~$245 billion - that is expected to continue: as CFO Amy Hood noted on the call, management sees another year of double digit revenue growth and EBIT growth in FY25.