Ollie's: Revisiting The Thesis

From the conclusion of “Good Stuff Cheap” (January 2022):

“Ollie’s has thrived in a closeout industry that has seen its fair share of failures, including an ill-fated attempt by Walmart in the 1990’s. In addition, its business has historically performed well in economic downturns – with flat comps in 2008 and +8% comps in 2009 - which can add some helpful diversification benefits to one’s investment portfolio during tough times (that’s not a reason to buy a stock in my book, but it’s a nice cherry on top).

And yet, despite that belief, something still gives me pause.

Maybe that’s a recognition of the near term headwinds: their core customer is dealing with a difficult economic environment (higher prices for gas and groceries will meaningfully impact their disposable income), and there are supply chain pressures as well. Personally, I wouldn’t be surprised if FY22 was a somewhat difficult year for Ollie’s, particularly in the first six months.

But I don’t think that alone is sufficient reason for a long-term investor to pass on the stock (if you agree that it’s reasonably priced). That said, maybe those short-term business headwinds will give Mr. Market a reason to push the stock price down to ~$40 per share, which could takes this from the grey area to a firm decision. On the other hand, maybe that’s just me being a touch too cute and / or trying to compensate for some other concerns (that ‘key man risk’ discussed earlier).”

In early December, Ollie’s reported its Q3 FY22 financial results. The company’s performance through the first nine months of the year, in combination with its Q4 guidance, shows that my prior concerns were warranted: 2022 has proven to be a difficult year for Ollie’s.

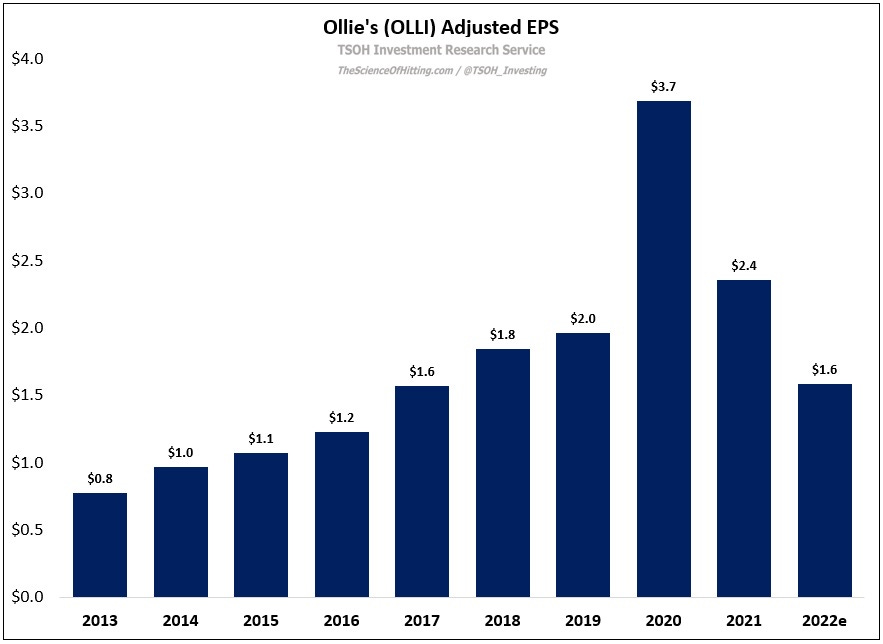

At the outset of the year (outlined on the Q4 FY21 call), management was guiding to a slight increase in same store sales, ~10% operating margins, and adjusted EPS of ~$2.2 per share (down <10% from 2021). Today, the company expects 2022 comps to decline by ~3.5%, with operating margins of ~7% and adjusted EPS of ~$1.6 per share (down >30% versus 2021).

As you can see in the below chart, the past few years have presented a difficult operating environment for Ollie’s. They greatly benefited at the outset of the pandemic (2020 comps +16%), only to see the vast majority of that lift fade away in 2021 and 2022 (two-year stacked comps -15%). EPS, which nearly doubled in 2020, has since been cut in half; on current guidance, 2022e EPS will be unchanged from the ~$1.6 per share earned in 2017.

The significant volatility in the business has been mirrored by the stock price. At the end of 2019, Ollie’s traded at ~$65 per share. During the height of the COVID concerns (March 2020) it fell below $40 per share, followed by a massive climb to all-time highs of ~$110 per share (August 2020) when it became apparent that the 2020 results would be stellar. On Wednesday, it closed at $46 per share, ~30% below where it traded at the end of 2019.

The long-term bull case for Ollie’s largely rests on its unit growth prospects: management believes there’s an opportunity for >1,000 stores throughout the United States over time, up from less than 500 units today. Historically, new boxes have generated attractive returns: as noted in the 2021 annual report, stores opened in 2016 - 2020 generated ~$4.7 million in average year one sales, with an average payback period of approximately two years (the initial cash investment to open a new store is ~$1 million, with EBIT per average unit at maturity of ~$500,000). It’s also worth remembering this comment from the S-1: “Since 1998, 100% of our stores have generated positive four-wall EBITDA on a trailing 12-month basis, and prior to that, we believe all stores were profitable in each year since opening our first store in 1982.”

The question, as I see it, is whether that bull case is still intact.