Ollie's: "Good Stuff Cheap"

On July 29th, 1982, Ollie’s Bargain Outlet opened the doors to its first store in Mechanicsburg, Pennsylvania (the company’s mascot, which bears a striking resemblance to Albert Einstein, is based on a caricature of co-founder Oliver “Ollie” Rosenburg). The inspiration for Ollie’s was Building #19, a chain of discount stores throughout Massachusetts, New Hampshire and Rhode Island (Building #19 went bankrupt 2013, with founder Jerry Ellis saying, “We woke up one day and the world outgrew us… our model was outdated”).

Ollie’s co-founders, pictured from left to right: Harry Coverman, Mort Bernstein, Mark Butler, and Oliver “Ollie” Rosenburg

Ollie’s is a closeout retailer that sells brand name products in no frills, “semi-lovely” stores (Class B and Class C shopping centers) at substantially discounted prices (“up to 70% below department and fancy stores and up to 20% - 50% below mass market retailers”). Ollie’s buyers “scour the world” for closeouts, overstocks, package changes, and irregulars – products that can be acquired at a fraction of the cost of comparable offerings (think Halloween candy in January or a bottle of Tide detergent with outdated packaging). In a nutshell, “we buy cheap and we sell cheap”.

This is a unique concept that doesn’t appeal to everyone – but for the target customer, Ollie’s offers huge savings across a wide selection of merchandise in a treasure hunt shopping experience (think, books, toys, housewares, and even wedding dresses – “There was a distributor in Florida that went out of business. They had a warehouse full of Demetrios wedding dresses - and we bought them all... we’re 80% - 90% off their pricing”).

In January 2003, the youngest of Ollie’s co-founders, Mark Butler, replaced Mort Bernstein as the company’s CEO (Bernstein had significant health issues and passed away in 2004; Coverman and Rosenburg died in 1993 and 1996, respectively). This transition required a change of ownership: in 2003, Dollar Tree and the PE firm SKM acquired 70% of Ollie’s in a deal that valued the 27-store chain at ~$65 million, with Butler retaining the other 30% (“they had already demonstrated that the concept resonated with consumers across multiple markets”). Nine years later, when SKM liquidated its investment, Ollie’s valuation had increased to more than $500 million.

Financials

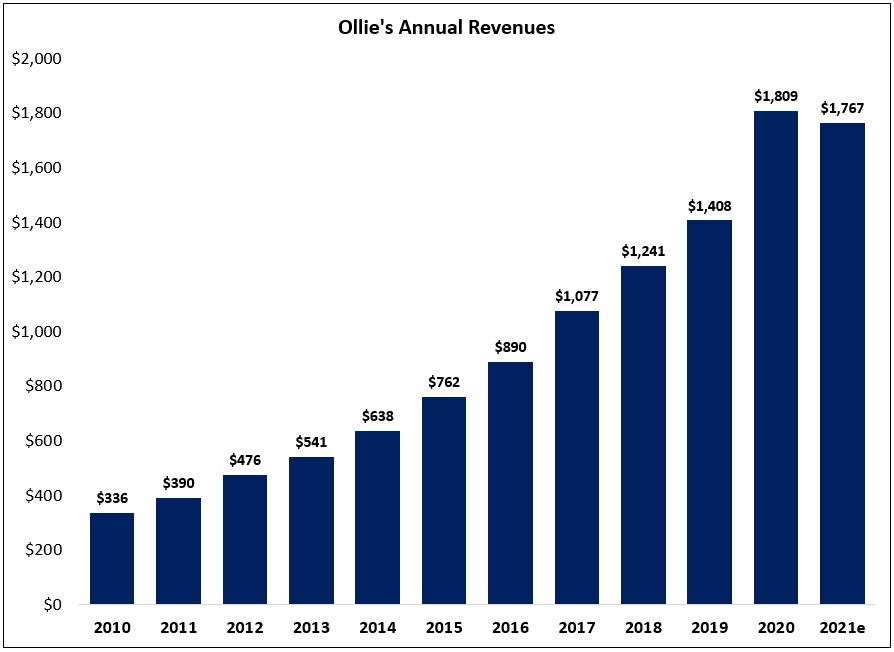

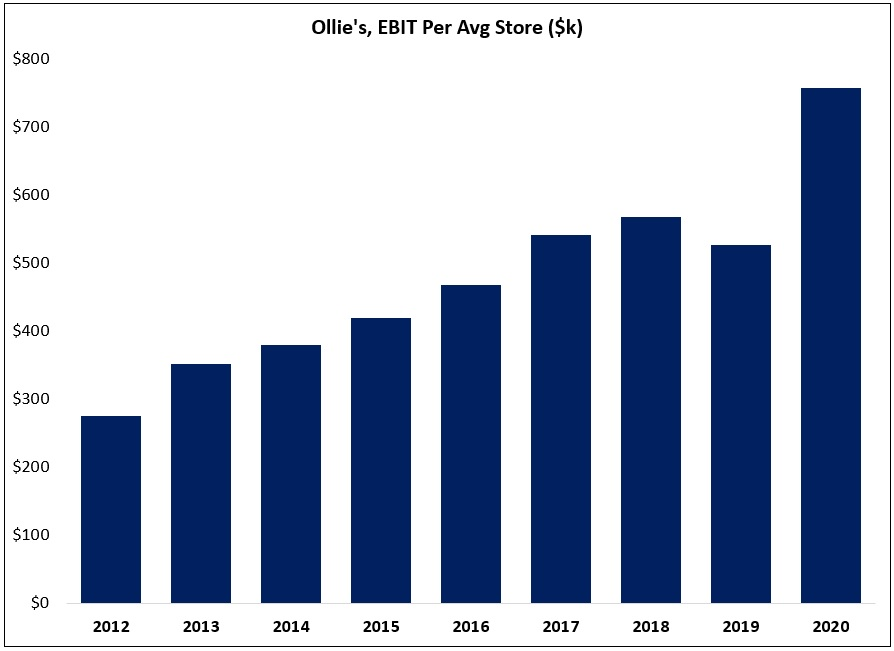

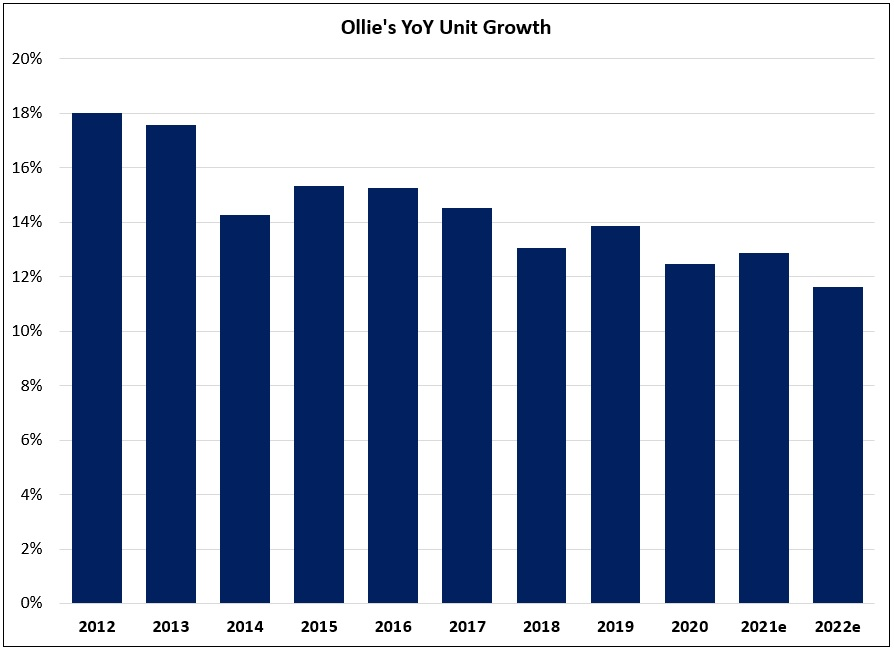

In May 2011, Ollie’s opened its 100th store. A decade later, the company has 426 locations scattered throughout the eastern half of the United States (trailing 10-year unit CAGR in the mid-teens). As noted in the S-1, the stores have consistently generated strong financial results: “Since 1998, 100% of our stores have generated positive four-wall EBITDA on a trailing 12-month basis, and prior to that, we believe all of our stores were profitable in each year since opening our first store in 1982.” (A new Ollie’s requires an initial cash investment of ~$1 million, with the average store generating more than $500,000 in operating income per year.)

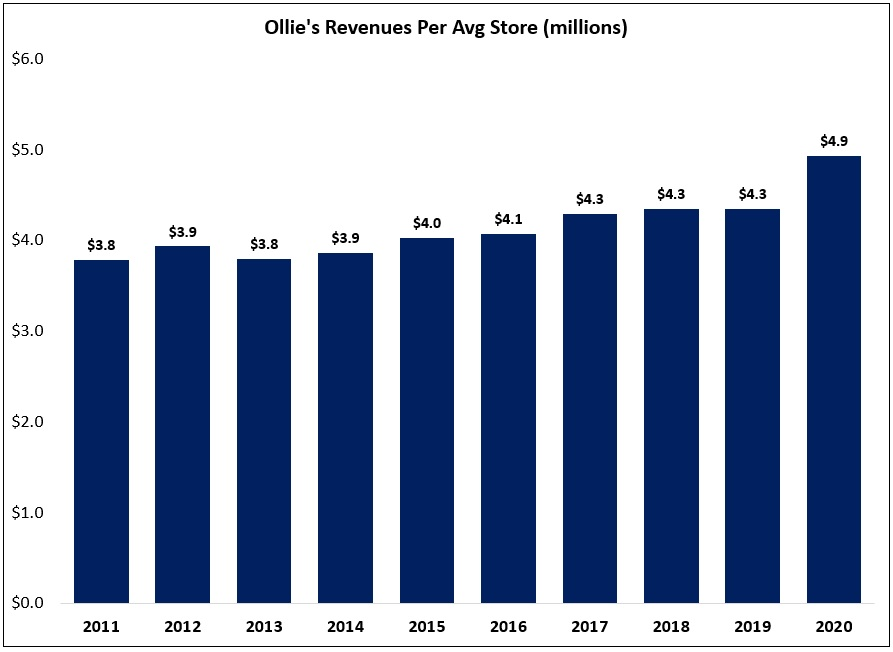

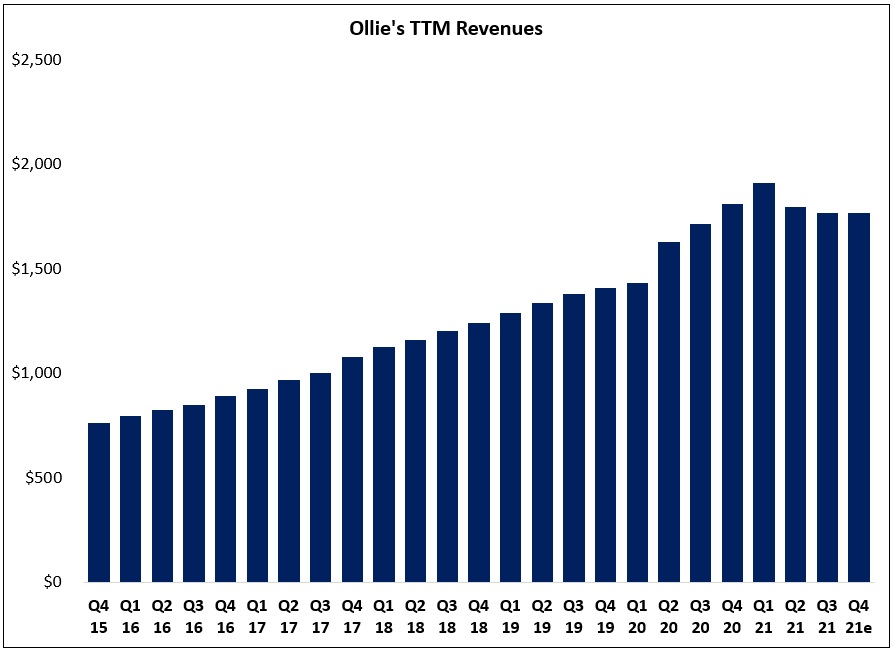

Over this period, sales per average store have steadily crept higher (+2% CAGR from 2011 to 2019, which excludes the significant pandemic-related tailwind throughout 2020; more on that in a moment). In summary, the +18% revenue CAGR reported over the past decade has largely been attributable to new unit growth (a period of unprecedented expansion for Ollie’s).

(Note that Ollie’s reported comps are somewhat unique among its retail peers because Ollie’s stores open very strongly: “New stores opened from 2015 to 2019 have generated an average of $4.6 million in net sales in their first 12 months of operations” [compares to ~$4.3 million in net sales per average across the chain in 2019]. Unlike many retailers, where a store provides a “waterfall” to comps as it seasons to full productivity over the course of a few years, Ollie’s reported comps do not benefit from this tailwind.)

Roughly 70% of Ollie’s sales in 2020 were attributable to the ~12.5 million members of Ollie’s Army, the company’s loyalty program (members spend 35% - 40% more per visit than non- members, with an average member spend of ~$125 in FY20; the member count is up >2x since 2015). Army members accounted for ~80% of Ollie’s sales in Q3 FY21, with the mix of revenues up meaningfully over the past 5+ years (the first disclosure was in FY14, with Army members accounting for ~55% of Ollie’s sales).

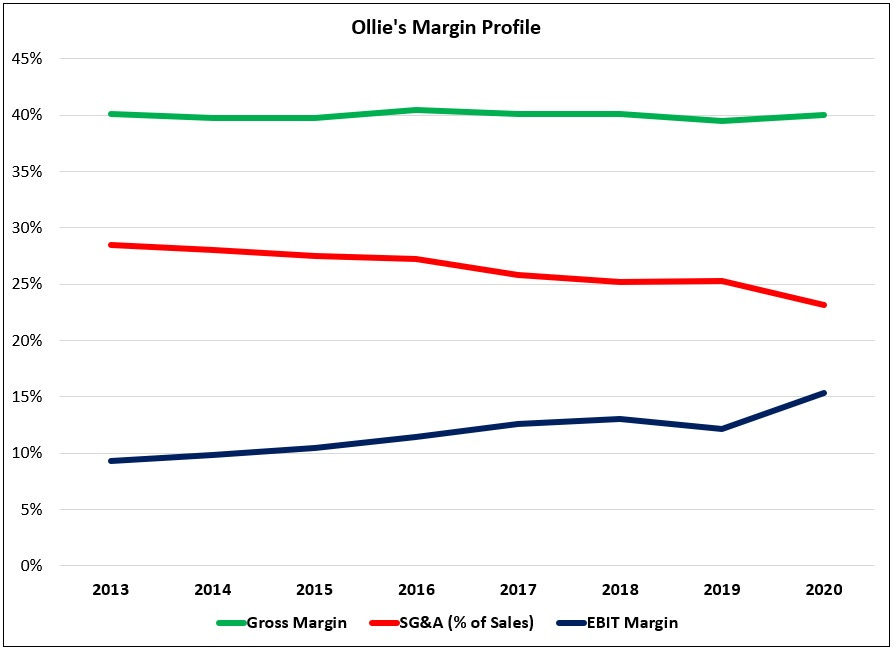

As shown below, Ollie’s has consistently generated gross margins of ~40% (Butler at ICR in January 2017: “A perfect world for us would be one of the marts is selling something for $0.99. We want to sell it for $0.50 and we want to pay a $0.25. Everything goes up and down from there. We have very, very, very stringent margin metrics that we try to hit each and every day.”)

From 2013 – 2019, due to a continued improvement in the cost structure (SG&A declined from 28% of sales to 25% of sales), Ollie’s operating margins expanded by ~300 basis points to ~12%. (They expanded even further in FY20, reaching ~15% EBIT margins, but those levels will prove short-lived).

In summary, the past decade took Ollie’s to new heights.

The business will generate ~$1.77 billion in revenues in 2021, compared to less than $400 million in 2011 (with the average store generating ~$530,000 in EBIT in 2019, up considerably from the early 2010’s). But there’s still room to run: based on management’s long-term targets, we could see another decade of ~10% annualized unit growth for the discount retailer (“we see a tremendous runway for growth, with the potential to expand our store base to over 1,050 locations nationwide”).

Key Man Risk

In December 2019, Ollie’s announced devastating news: Mark Butler, the company’s 64-year old CEO, had passed away (before he died, Butler was the largest shareholder, with ~16% of Ollie’s outstanding shares). Butler had been Ollie’s CEO for the past 16 years, a period when its store count increased ~15x (from 28 stores to 426 stores). He rang the register when Ollie’s completed its first sale back in Mechanicsburg in July 1982, and he rang the opening bell in New York City 33 years later when the company went public in July 2015. In summary, Butler was “key man risk” personified – and unfortunately, that risk materialized in December 2019. A week later, John Swygert, who had been Ollie’s CFO for 14 years before stepping into the COO role in January 2018, was named as Butler’s permanent replacement. Three months later, the stock was down ~30%. Clearly Mr. Market had serious concerns about the company’s business, particularly its ability to effective merchandise its stores (source new deals), without Butler.

Butler (left) and Swygert (right), Ollie’s 2015 IPO

While Butler has undoubtedly been the key contributor to Ollie’s success over the past two decades, there are reasons to believe the merchandising team can find its way forward. For one, Ollie’s has worked with its top 15 suppliers for an average of 16 years, with no single supplier accounting for more than 5% of its purchases. In addition to direct, long-term relationships with a diverse group of suppliers (like manufacturers, wholesalers, distributors, and retailers), the company has significant scale and buying power; as a result, Ollie’s is often the first buyer that a supplier will call when a deal becomes available. It’s also important to note that private label brands (i.e. non-closeout merchandise) accounts for ~30% of Ollie’s revenues. Finally, the remaining members of Ollie’s merchant team have significant experience; as noted on the Q3 FY19 call, the four senior buyers on the merchant team (excluding Butler) had been with Ollie’s, on average, for nearly two decades.

As shown below, many of the company’s top executives have worked at Ollie’s for 5+ years; on the other hand, the COO and SVP of Supply Chain are both new hires. All-in, this seems like a uniquely tough situation as it relates to “key man risk” (given Butler’s larger than life presence at Ollie’s for the past 20+ years, as well as the execution risk inherent to retail generally, and the closeout business specifically). If we can take comfort in anything, it’s Butler’s belief that he had built a strong team around him (at ICR in 2017: “We have a highly experienced and very disciplined merchant team. This is the secret sauce of the business… It's relationships. It's our buying team.”)

Business Concerns

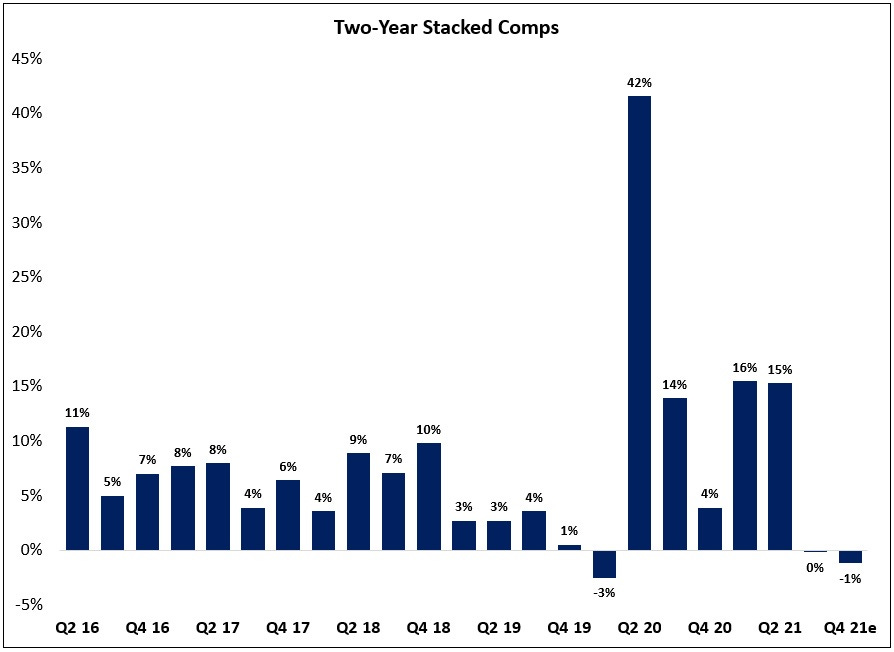

While management has consistently argued that this is a 1% - 2% comp story, they managed to outpace that result by a good margin in the first few years after their IPO. But as shown below, that changed for the first time in late 2019, when the company’s two-year stacked comps contracted to +1%.

But then the pandemic happened. Ollie’s was deemed an essential retailer, with the combination of great values, available inventory, and government stimulus leading to previously unimaginable results: in Q2 FY20, the company reported SSS growth of +43%, with traffic +18% and average basket +25%. As shown above, that tailwind would hold for the next year or so (mid-teens two-year stacked comps in three of the next four quarters).

But then it flipped again: two-year stacked comps were negative in Q3 FY21 (“a very challenging and difficult quarter”), with a comparable two-year guide for Q4 FY21. As a result, the comp store sales growth concerns that surfaced in late FY19 have reemerged; in my opinion, this is one of the primary reasons why the stock is down ~50% since mid-2020. (TTM revenues in Q4 FY21e will be ~10% lower than TTM revenues in Q1 FY21).

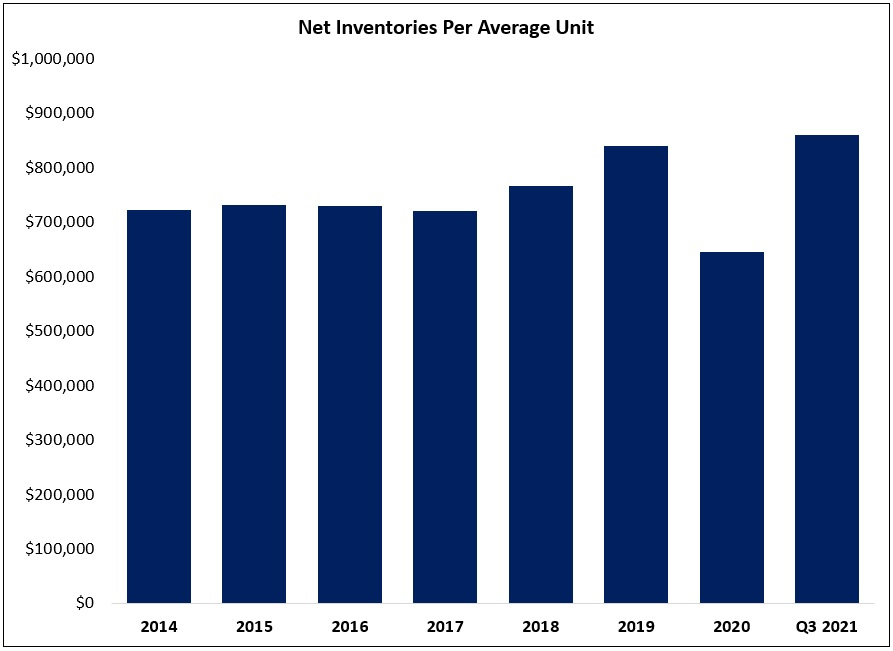

Ollie’s is also facing supply chain / inventory challenges.

Here’s what Swygert had to say on this topic at a conference in September 2021: “The supply chain has been challenging for 18 months in one way, shape, or form. Every retailer has had that same challenge since the slowdown / shutdown in the economy plus the stimulus that started in Q1 2020… Recently, the cost of moving import freight is just the nail in the coffin; it's been very difficult to not only get containers moved, but also the cost of the containers has put a lot of stress on retail…”

When the company reported quarterly results two months later (in December 2021), the impact of those supply chain issues became apparent - and some of Swygert’s comments from September didn’t hold up well (for example, “we've worked very, very, very hard to get ourselves in a good position for the holiday season… I think we're well positioned.”); from the Q3 FY21 call:

“Sales and operating performance was primarily impacted by greater-than-expected supply chain-related headwinds… these headwinds included shipping delays of imported seasonal product into our supply chain network, which in turn created backlogs in our distribution centers, causing delays in shipping the right product to the stores in a timely fashion. We also believe that the sudden rise inflation had an outsized impact on a portion of our customers who mostly live on a fixed income… we were unable to overcome these headwinds.”

Finally, in August 2021, Ollie’s parted ways with its supply chain leader (“the leadership qualities that we needed to take it to the next level were something we didn't have”). On December 14th, Mario Sampson, who has previously held operational roles at Macy’s, Amazon and Target, was named Ollie’s new senior VP of supply chain, effective immediately.

In summary, Ollie’s has not been immune to the supply chain pressures felt throughout the retail industry (as Swygert noted in September, “we're seeing cost pressures everywhere”). When those external headwinds coincide with significant changes in the C-suite (COO and SVP of Supply Chain), that’s cause for concern; if those challenges persists throughout the holiday season (Q4 FY21) and into FY22, management will likely find that it has lost some trust in the investment community, with the stock responding accordingly.

Capital Returns

For many years, the playbook at Ollie’s was singularly focused on new units; but we’ve reached a point where the growth algorithm requires evolution. Based on management’s guidance, the company is likely to end FY22 with just under 500 stores. If the pace of new unit growth is capped at 50-55 stores per year, as management has suggested, that implies the YoY unit growth rate will likely slip into the single digits in the next few years – a meaningful deceleration from the ~15% YoY growth of a few years ago.

Part of the answer came to light in March 2019, when the Board approved a $100 million share repurchase authorization (the company has subsequently authorized additional increases to the repurchase program). While the company only repurchased ~$40 million of stock in 2019 and 2020 (cumulatively), it has since become a more important avenue for capital allocation at Ollie’s: through the first nine months of FY21, they repurchased $200 million of stock ($165 million in Q3 alone), with the diluted share count declining ~3% year-over-year in Q3. Expect this continue in the years ahead (the company’s balance sheet is clean, with ~$230 million in net cash).

Valuation

My biggest long-term question about Ollie’s relates to its ability to effectively merchandise its stores as they reach their long-term goal of 1,000+ units. To be fair, as Butler noted a few years ago, this isn’t a new concern: “That’s the question I’ve been asked for 34 years, and it will never go away, nor should it… That’s the jugular vein to our business: can we get deals?”

The answer to date: so far, so good. This is a big industry (J.P. Morgan analyst estimate for the closeout market is ~$65 billion a year, compared to Ollie’s 2021e sales of ~$1.77 billion), and management has consistently told investors they turn down eight out of every ten deals they’re offered. That said, I do wonder if companies (OLLI suppliers) like P&G, Kellogg’s, and Hershey’s will improve their operational efficiency over time (more closely match supply and demand); said differently, if the vision of “digitization” becomes a reality, even if it only resulted in a relatively small improvement on the margin, it would impact Ollie’s business. Effectively, this is another layer of execution risk beyond the key man risk that I discussed earlier.

If we assume 50 – 55 net new units per year, Ollie’s will reach 1,050 locations in 11 – 12 years. From a starting base of ~$4.3 million per box per year, and assuming ~1% comps over this period, that implies ~1,050 locations with ~$4.8 million in sales per store, or ~$5 billion in total revenues. Assuming low-double digit EBIT margins (trailing five-year average of ~13%), the business would generate $625 million in EBIT, or 5x – 6x today’s ~$3.2 billion market cap (at ~$50 per share). If we demand 12% - 15% annualized over this period (and potentially a few hundred basis points higher after accounting for repurchases), that puts the terminal market cap within a range of $11 billion - $15 billion, or 18x – 24x our $625 million EBIT estimate.

Conclusion

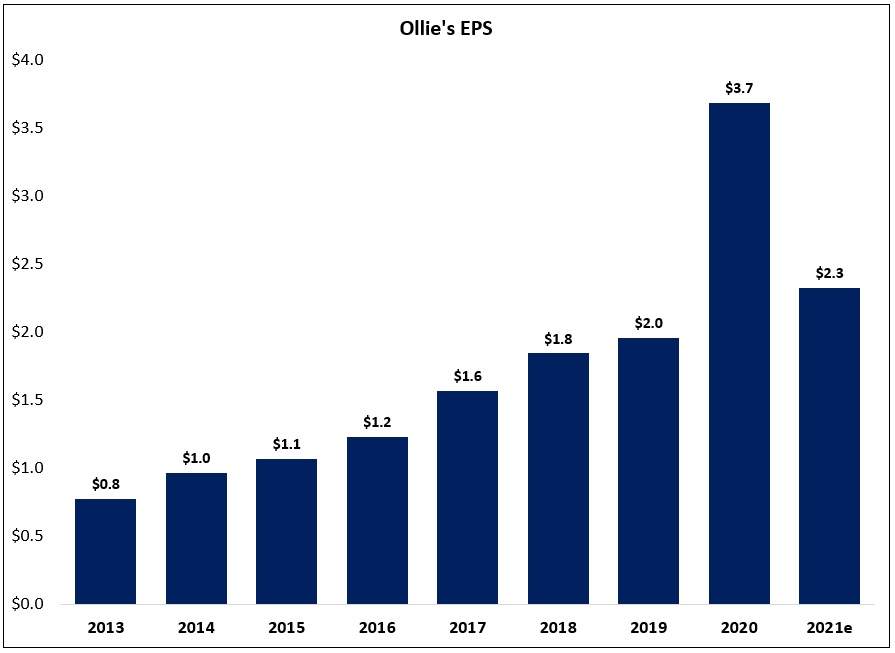

If you have confidence in the long-term unit growth targets, this is a good business trading at a reasonable valuation; if the next 600 stores have economics anywhere close to the first 430 stores, there’s meaningful value creation ahead. Today, at a low-20’s 2021e P/E (with EPS up ~2x from 2016 – 2021e), I think OLLI is attractively valued relative to its long-term prospects.

Ollie’s has thrived in a closeout industry that has seen its fair share of failures, including an ill-fated attempt by Walmart in the 1990’s. In addition, its business has historically performed well in economic downturns - see flat comps in 2008 followed by +8% comps in 2009 - which can add some helpful diversification benefits to one’s investment portfolio during tough times (that’s not a reason to buy a stock in my book, but it’s a nice cherry on top).

And yet, despite that belief, something still gives me pause.

Maybe that’s a recognition of the near term headwinds: their core customer is dealing with a difficult economic environment (higher prices for gas and groceries will meaningfully impact their disposable income), and there are supply chain pressures as well. Personally, I wouldn’t be surprised if FY22 was a somewhat difficult year for Ollie’s, particularly in the first six months.

But I don’t think that alone is sufficient reason for a long-term investor to pass on the stock (if you agree that it’s reasonably priced). That said, maybe those short-term business headwinds will give Mr. Market a reason to push the stock price down to ~$40 per share, which could takes this from the grey area to a firm decision. On the other hand, maybe that’s just me being a touch too cute and / or trying to compensate for some other concerns (that “key man risk” discussed earlier).

I think this one requires a bit more time and reflection.

For now, I have no plans to purchase shares of Ollie’s.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.