Nike: The Middle Innings

From “I Hate Advertising” (July 2022):

“The China business had a very difficult FY22, with constant currency revenues down 13% (and -20% in Q4)… As we look to the long-term, I see clear parallels between Nike and Starbucks… Nike faces competition from domestic brands (ANTA’s revenues increased ~7x from 2013 to 2021)… These periodic brush-ups – or something worse - could have a real impact on Nike’s brand and business over time (‘A recent survey of Chinese consumers found that ~34% of respondents said the Xinjiang controversy made them ‘significantly less likely’ to buy foreign brands’). It’s a very difficult risk to handicap, and the type of concern that seems unlikely to ever go away.”

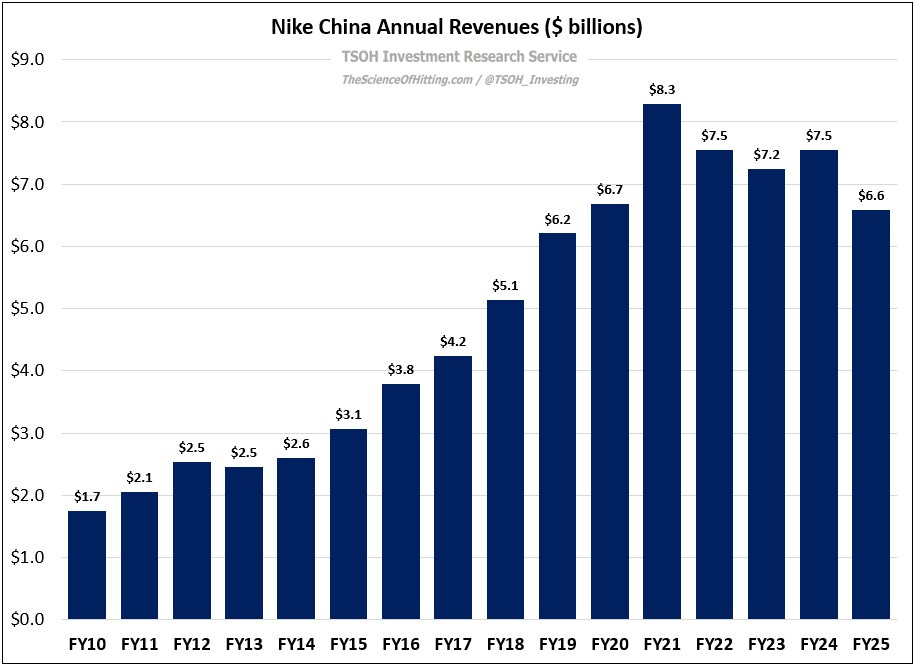

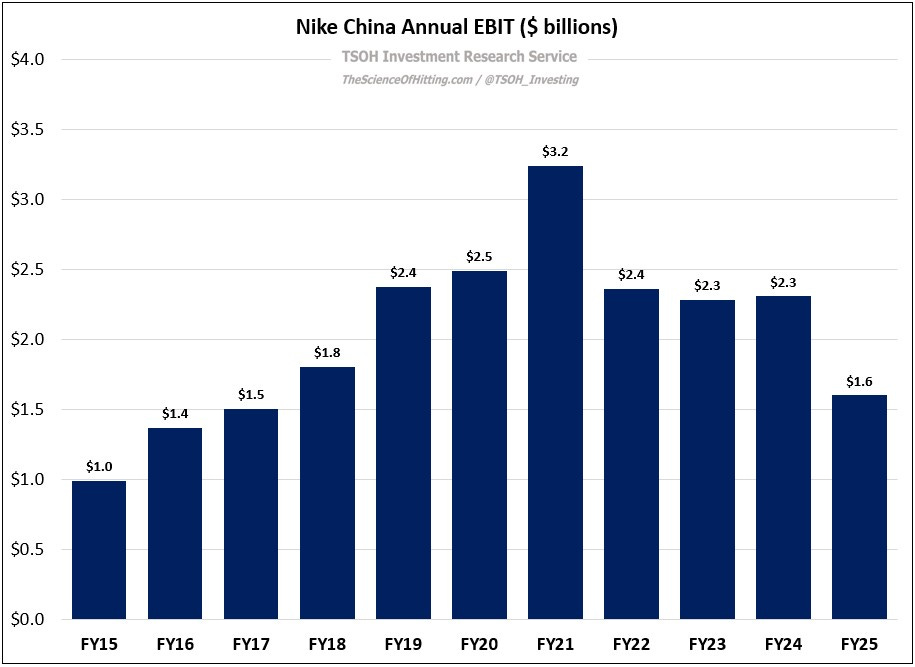

In subsequent updates, I provided additional data to frame Nike’s evolving competitive position in China relative to brands like ANTA and Li-Ning. These concerns are now front and center, with meaningful implications for the financials: as shown below, Nike China revenues were ~$6.6 billion in FY25, down ~21% from the FY21 highs; the impact to profitability has been even more significant, with operating income down ~50% over the same period.