Nike: "A Balanced Approach"

From “Nike: A Transition Year” (June 2024): “Management has consistently been caught offsides on short-term and long-term projections… Investors have no reason to believe management has their arms around the forward trajectory for this business… Beyond a reasonable price, the other thing I need to see is real change from the C-suite, and specifically Donahoe.”

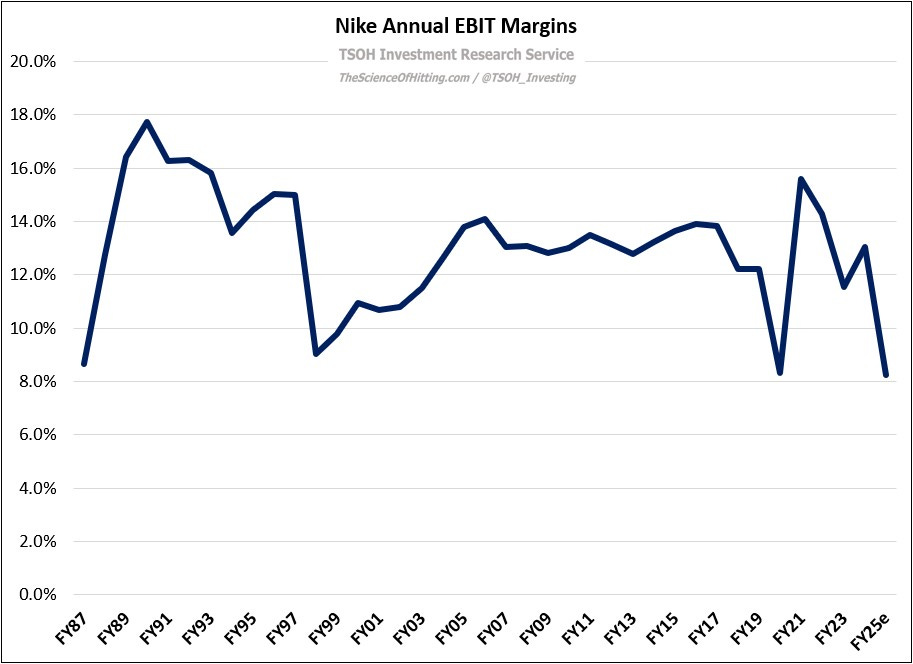

In terms of the financials, Nike’s recent results are quite discouraging: for FY25e, we’re likely to see revenues decline double digits (%), to ~$46 billion, along with ~500 basis points of EBIT margin compression. As a result, FY25e EPS will be nearly cut in half, back to a level first eclipsed a decade ago.

From my perspective, today’s pain is reflective of addressing prior mistakes; it’s a worthwhile and necessary cost to position the company for a brighter future. Here’s another way to say that: since becoming CEO in October, the actions taken in the early days of Elliott Hill’s tenure are indicative of a company with a renewed sense of purpose and focus. Change takes time, but there are signals that suggest Nike is headed back in the right direction.