Netflix: "Content, Variety, Quality"

From “Netflix: In The Right ZIP Code” (July 2022):

“Mr. Market is clearly concerned by this recent course of events; despite a nice pop for the stock in response to the Q2 results, NFLX is still down ~70% from its November 2021 highs. The question that matters most to me is what these recent results indicate about the long-term health of the business: is Netflix wilting in the face of heightened competition, or does it have some combination of factors that will enable the company to navigate through this current malaise while continuing to hold onto the leadership position that it has established in the global streaming / VOD business?”

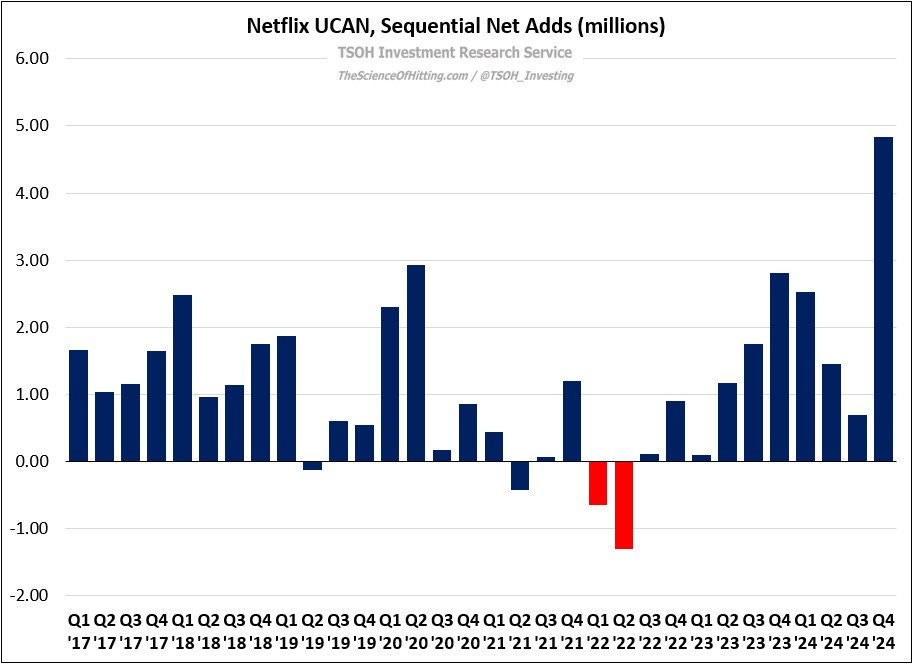

When “In The Right ZIP Code” was published, Netflix had just posted a quarterly (sequential) net loss of nearly one million subscribers, led by weakness in UCAN. The business ultimately reported mid-single digit FY22 revenue growth, but with margin compression driving a double digit decline in operating income. People often say price drives narrative, a statement I can appreciate in terms of the magnitude of price moves – but what it glosses over is that the narrative at a point in time, as was the case with Netflix in 2022, is rarely far removed from reality. Delineating between what is temporary and solvable, from what portends meaningful change, is critical.

In the case of Netflix, one important factor to consider was the impact the company’s near term struggles would ultimately have on the actions of its competitors; as I wrote at the time, those responses would significantly impact long-term developments within the global streaming business:

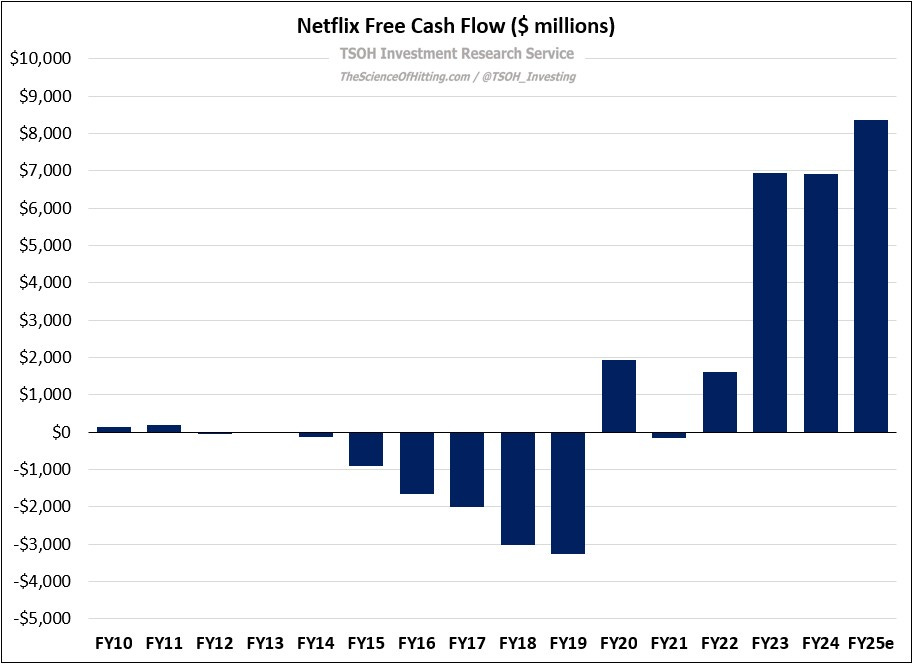

“For years, Netflix was painted as a company solely chasing subscriber growth, without any line of sight to building a sustainable business and while burning billions of dollars in FCF. Today, I’d argue this reality has flipped; Netflix has established global revenue scale (~$32 billion run rate), with a path to significant FCF generation in the years ahead. Now, it is companies like Paramount, NBCUniversal, and Warner Bros. Discovery that need to demonstrate a path to a viable DTC business. Mr. Market is clearly skeptical they will do so - and it’s unclear if their shareholder truly want them to try… For many emerging competitors in the DTC business, the demands of their investors and their current financial position will likely dictate a more balanced approach between subscriber growth and net pricing. Naturally, that reality – when combined with a more conservative posture on content investments – presents its own risks. Simply put, the bar continues to rise; time will tell if the laggards are up for the task at hand.”

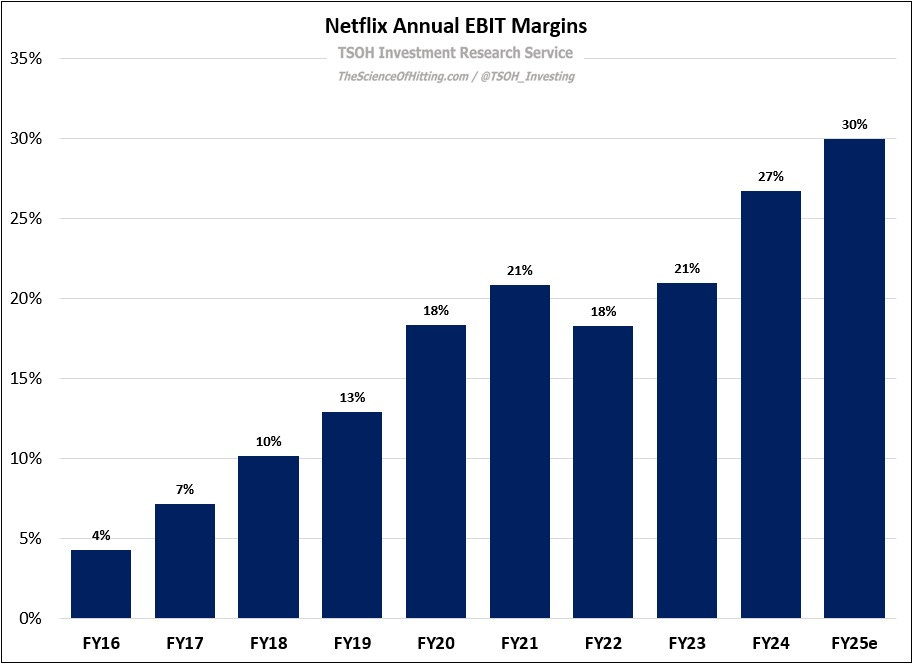

In due time, the struggles of 2022 have proven to be a blessing in disguise for Netflix: the business has since raced to new heights, with FY25e revenues and operating income increasing ~13% p.a. and ~33% p.a., respectively, over the past three years (EBIT margins up from ~18% to ~30%). The company has also furthered important long-term strategic changes, both in terms of password sharing / effective monetization and its breadth of content.

In a few years, we went from “streaming is a terrible business” to “Netflix has won the streaming wars”; the company’s stock price and valuation reflect that view… which is where value investors like myself tend to get uncomfortable.

As you know, I first started to trim the position in March 2024 at ~$600 per share (at that time, it was ~16% of the portfolio). The share price has roughly doubled subsequently, to ~$1,209 per share, with the company’s enterprise value climbing to ~$530 billion; relative to FY25e operating income of ~$13.5 billion, the stock trades at ~39x FY25e EV/EBIT. For the remainder of today’s post, I would like to focus on that valuation: what lies ahead for Netflix, and how does that compare to the expectations being expressed by Mr. Market?

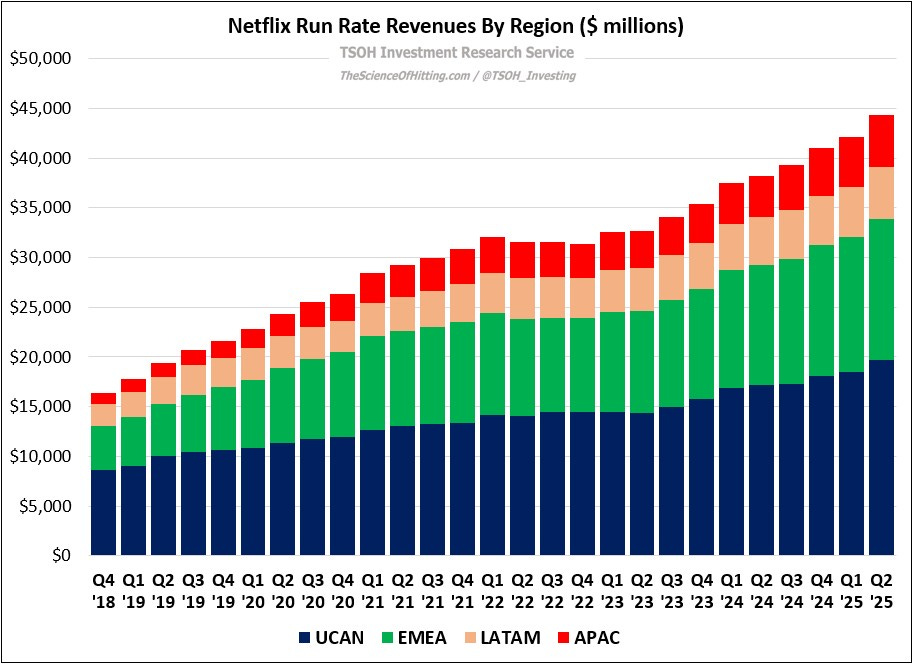

First, let’s level set some key figures: Netflix has surpassed 300 million global paid subscribers, who generate an average revenue per user, or ARPU, of about $145 per year. Collectively, this has resulted in a business with ~$45 billion in run rate revenues (a trailing five-year revenue CAGR of +13% p.a.).

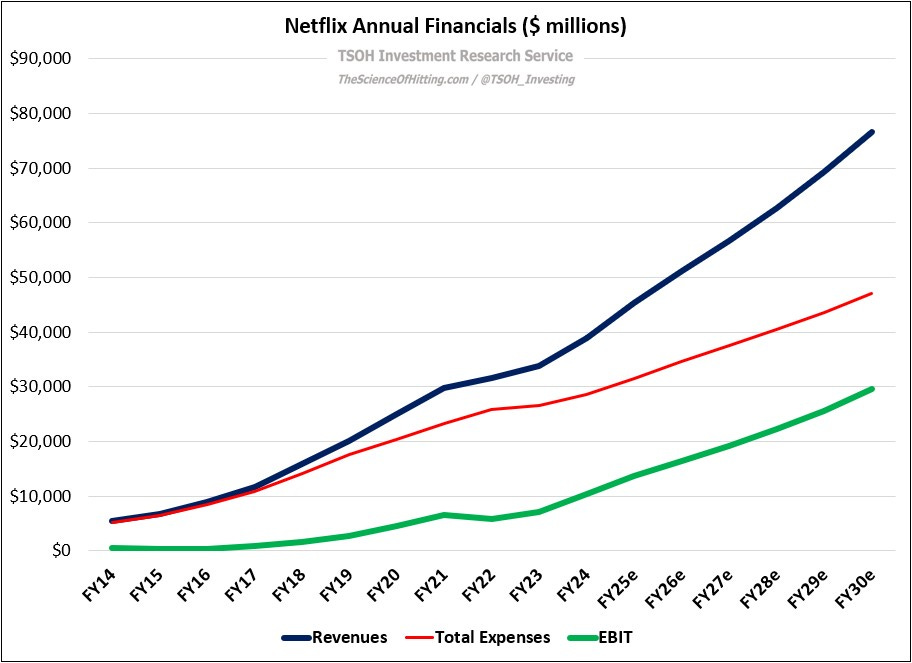

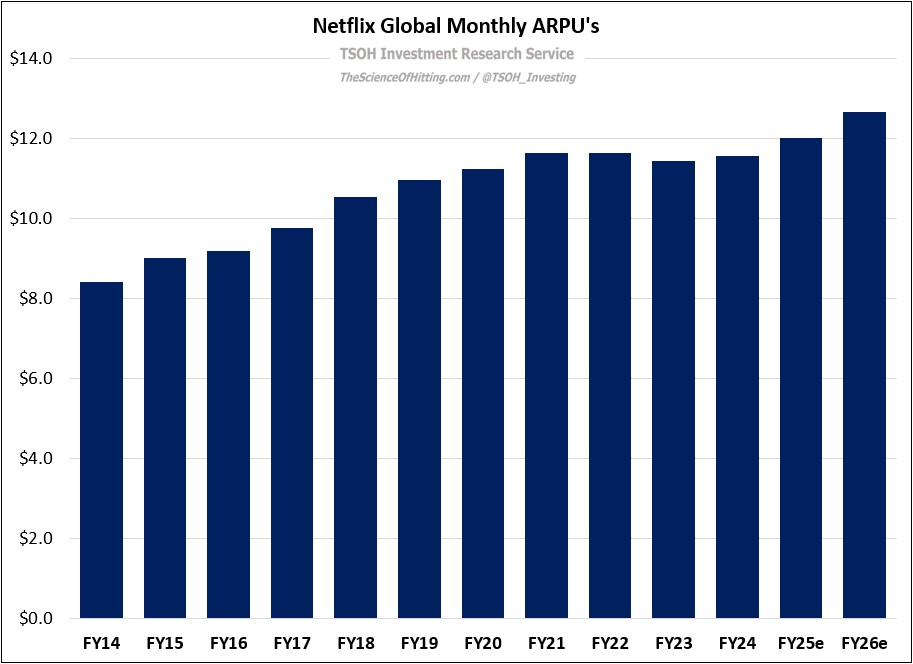

While there was significant volatility in the interim, the first part of that equation, paid subscribers, increased by ~12% annualized for FY19 – FY24. The second part of the equation, global ARPU, was only up ~1% annualized from FY19 – FY24, with significant ARPU growth in certain geographies – most notably UCAN – offset by mix shift headwinds (outsized sub growth in lower ARPU geographies). As we look out over the next five years, I’m comfortable assuming that management can pull these levers to drive low double-digit annualized revenue growth (at ~11% p.a., ~$77 billion in FY30).

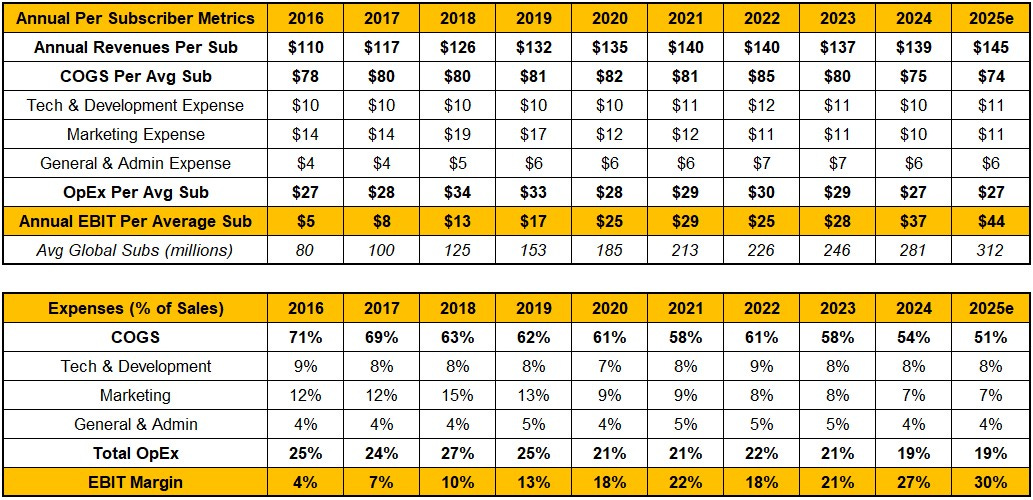

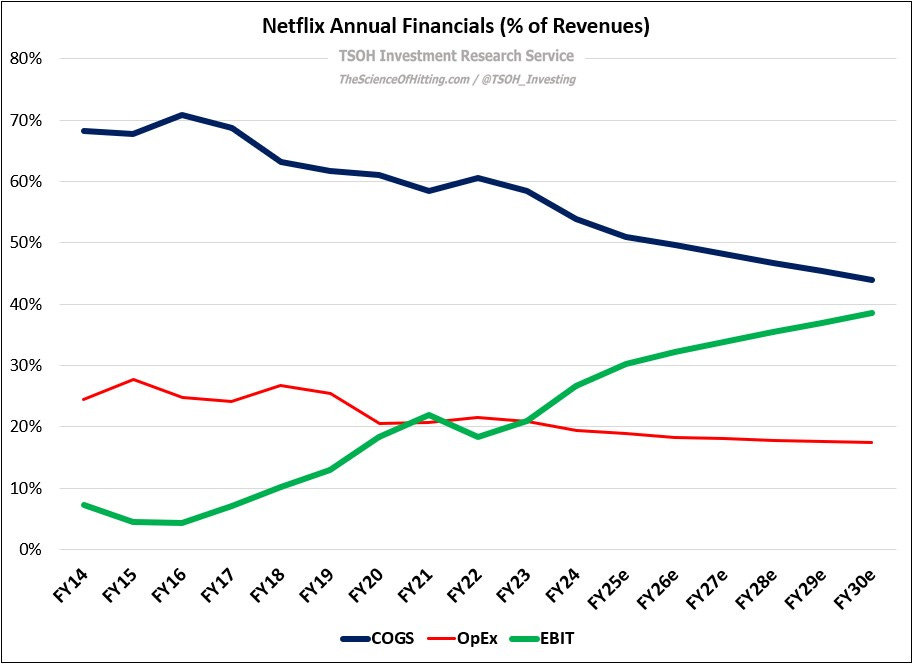

As I first discussed in “The Greatest Opportunity In Entertainment” (January 2022), it’s important to appreciate how Netflix’s various expense buckets, measured in dollars and as a percentage of sales, have changed on a per subscriber basis. As you can see below, the main driver of Netflix’s financial success has not been spending less per sub on COGS or OpEx (on a dollar basis): annual per sub total expenses in FY25e will only be ~$4 less than in FY18. The real driver has been ARPU, with the annual per sub tally rising ~$35, from ~$110 in FY16 to ~$145 in FY25e.

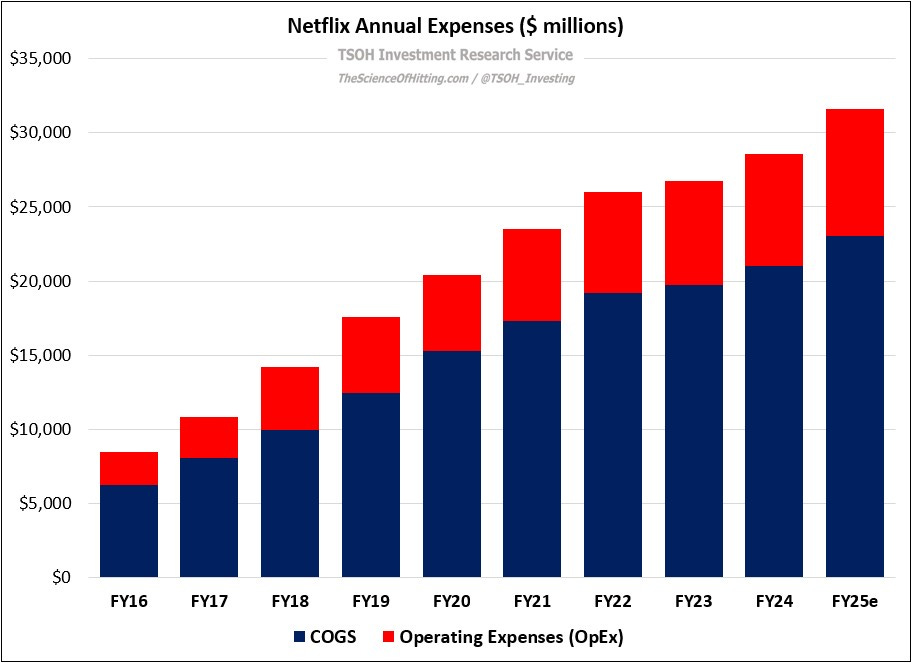

When we zoom in on operating expenses, we can see that they’ve increased significantly over time – from $2.2 billion in FY16 to $8.5 billion in FY25e – while still driving ~600 basis points of OpEx leverage. As we think about the current standing of Netflix’s peers, consider that this ~$8.5 billion is about 70% higher than Peacock’s TTM revenues – and that’s before allocating a single dollar to content spend. While this isn’t true across the board, certain expenses – for example, think of technology spending related to content recommendation engines and effectively dealing with password sharing - are more fixed in nature. These are some of the non-content considerations that help to explain why Netflix’s leadership position is so daunting; it’s a reality that has effectively led many to bow out of the fight in global DTC, while still enabling Netflix to build a business that has seen ~2,000 basis points of cumulative operating (EBIT) margin expansion over the past seven years.

This is even more meaningful on content spend (using COGS as a proxy): while total COGS will be at ~$23 billion in FY25e, which is more than $10 billion above FY19 levels, it will be ~1,100 basis points lower when measured as a percentage of revenues (from ~62% in FY19 to ~51% in FY25e).

To summarize, Netflix continues to invest aggressively in its global content strategy, which has led to unparalleled breadth across their slate (the primary focal point of management’s Q2 FY25 letter); in addition, they’ve invested billions to build a platform that is best-in-class on ease of use, reliability, and an effective recommendation engine, while also navigating other strategic considerations like password sharing. At the same time, EBIT margins have expanded ~1,200 basis points over the past three years, with EBIT up ~140% over the same period.

To argue this will slow or stop in the years ahead, you need to believe these variables will meaningfully change; I don’t see it, which is why I believe that the business will move up towards 40% EBIT margins by FY30. (This assumes that total expenses increase ~50% for FY25 – FY30, inclusive of COGS climbing from ~$23 billion in FY25 to ~$33 billion in FY30.)

A final consideration is capital allocation. The good news, as you can see below, is that Netflix is now generating a significant level of free cash flow, with FY25e at ~$8.3 billion. The glass half empty take is that the company doesn’t seem to have the ability or willingness to use these funds to further their position, which leaves repurchases as the default – a decision that may or may not be an intelligent use of capital depending upon the attractiveness of the equity. Directionally, we can at least state with confidence that this is a less attractive use of the company’s excess cash than it was a few years ago.

For what it’s worth, management’s commentary on this topic over the years leaves me with the impression that future repurchases are not dependent upon an assessment of the attractiveness of the equity; it will be a pressure release valve used when excess cash is left on the balance sheet. Honestly, I don’t feel too much discontent about this state of affairs. It isn’t ideal, but I accept it as a reality of where management’s focus and expertise lies. That said, it’s clearly still a relevant long-term factor: the reflectivity of this default action, to repurchase billions of dollars’ worth of shares each year without any real consideration for the attractiveness of doing so, has an impact on my expectation for forward returns, particularly if the stock moves to new highs.

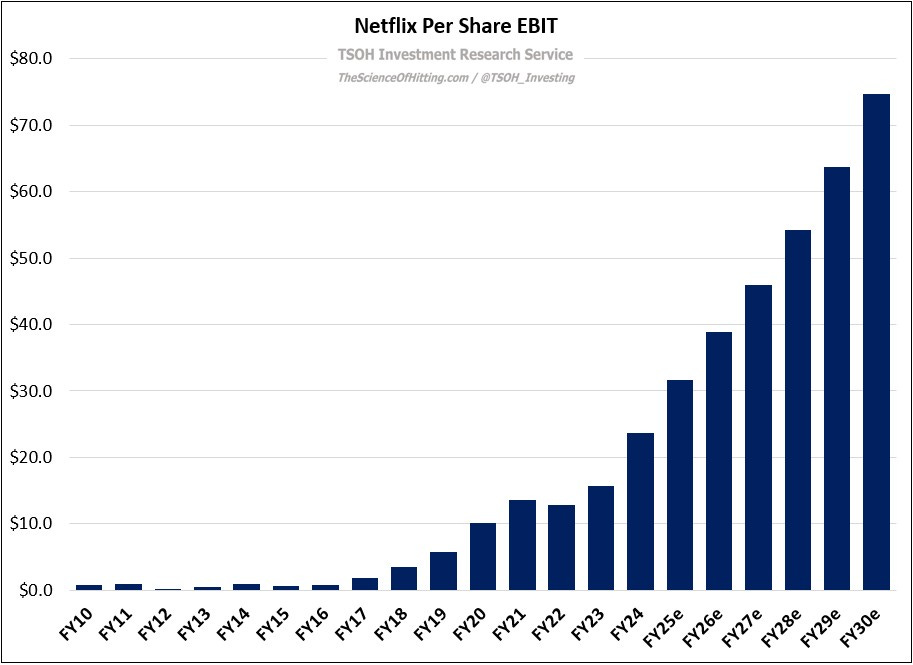

Below, I assume the stock continues to trade around 40x EV/EBIT, with ~100% of Netflix’s FCF allocated to repurchases. As you can see, the net result of the above financial assumptions – roughly 11% annualized revenue growth, another ~1,000 basis points of EBIT margin expansion from FY25, and a roughly 10% reduction in the share count - is FY30e EBIT of ~$75 per share. At ~$1,209 per share, that puts NFLX at ~16x FY30e EV/EBIT. (See “Valuation and Long-Term Investing” for additional context on how I think about that output in portfolio construction.)

If I had to make the argument on the most likely scenario where these financial estimates prove far too conservative, I suspect it would be due to one or more of the following developments: (1) a much more aggressive push into live rights; (2) a strategic shift on capital allocation / M&A, with a notable example being the pursuit of marquee entertainment programming franchises / IP; or (3) the gaming / interactivity investments gaining significant traction. All three of these would impact the financial lever that I think is most likely to surprise to the upside: ARPU, with an acceleration from recent trends attributable to more aggressive pricing actions and advertising (AVOD). That outcome is one where the UCAN playbook would prove replicable around the world for Netflix.

As we think about that, I thought the following comment from co-CEO Greg Peters about the TF1 deal was the most notable part of the call: “You would think we have enough to satisfy every person on the planet - but we consistently hear from members that they want more. They want more variety and more breadth of content. The fundamental purpose of this partnership is about that goal: expanding our entertainment offering. How do we enhance the value we deliver to members? We want to provide more content, more variety, and more quality… It's about highly relevant local content in a country with strong demand for that local content. This is an accelerated way to satisfy that need… Why was this the right time? We have invested in a bunch of enabling capabilities that are either required or will be highly leveraged by this deal: live, ads, and the new UI, among other things.”

Conclusion

One could argue that my decision to trim another ~200 basis points off the Netflix position last week, which follows multiple trims throughout 2024, is a telling signal. At the same time, the position accounted for ~8% of my portfolio heading into the Q2 results, a weighting that clearly still suggests optimism around Netflix’s future. The middle ground between those two actions strikes me as the appropriate place to be for now. I am not going to take further action on NFLX at this time, but you will be the first to know, as always, if that changes.

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.