"I Don't Care How Much We're Losing"

In “WarnerMedia + Discovery”, which was published a few days after the deal was announced in May 2021, I concluded the write-up with the following:

“The combined company has real risks from its sizable debt load and significant exposure to the U.S. pay-TV bundle. In addition, there’s an open question in terms of its ability to transition to a global DTC business over time (particularly if the pace of pay-TV sub declines accelerates)… It’s not clear to me that the combined company is set to become a major competitor to the established streamers… Time will tell if Zaslav has the answers.”

Since that was published, a lot has happened at WBD specifically and in the media industry generally. For WBD, the most notable development has been management’s recent strategy shift, particularly as it relates to the company’s global DTC business (compared to what they were saying 15 months ago).

Today’s post will examine that shift, along with some additional thoughts on what it likely means for the company’s go forward strategy. (For more background information on this topic, please revisit “It’s All About Scale”.)

“I Don’t Really Care What The Number Is”

At the press event where the rationale for the WBD deal was laid out for investors (05/17/2021), Warner Bros. Discovery CEO David Zaslav said the following when asked about the company’s long-term strategic focus:

“I think the key to this business is the extraordinary IP… That will be the core of what we think is going to be 200 million, 300 million, and eventually 400 million subscribers around the world. The appeal of what we have is so broad that there's no reason why this can't be the broadest, most successful DTC platform in the world… That was the vision John [Stankey] and I had.… I couldn't be more excited about the opportunity this presents. It's all about 200, 300, 400 [million subs]. It's about a global platform that reaches people on every device.”

By contrast, here’s what Zaslav said when he was asked about the company’s long-term DTC subscriber targets on WBD’s Q2 FY22 call (08/04/2022): “I don't really care what the number is. We're not in the business of trying to pick up every subscriber… We're going to grow subs significantly, but we want to drive profitability and free cash flow.”

Instead of the 200, 300, or 400 million subs once envisioned, management has set a new target: 130 million global subs by 2025 (that implies about 40% cumulative growth from the 92.1 million subs at the end of Q2). If we assume the company meets that objective, in addition to a 25% lift for global ARPU’s by 2025 (more on this in a moment), that would leave WBD with an annual DTC revenue base of ~$15 billion. (Note that WBD management was expecting >$15 billion in FY23 DTC revenues back in May 2021.)

Clearly, Zaslav has set his sights on a new goal in the DTC business (near term profits and FCF). And as I’ve discussed previously, most notably as it relates to Disney, I think there’s some logic in the idea of not chasing subscriber growth at all costs; the real long-term objective is to maximize DTC revenues, which is a question of volumes / subs and pricing / ARPU’s.

The question I have is what this more limited view of a global DTC video platform will look like in practice, both internationally and domestically. Consider what John Malone said a few years ago about scale (and HBO):

“This game has migrated from a domestic game to a global game… It’s all about scale. [Reed] saw early on that if he could drive a business on the top of the internet, he had a global business… If he gets global scale, he’s the only guy that’s able to write the check to create content at the level and at the quality that people are going to get used to… He’s got a big lead, and I don’t believe anybody will catch him… So, unless whoever owns HBO is willing to say, ‘I don’t care about free cash flow, I’m going to spend it all on content’ – which they have to do to catch Reed on budget – he’s just going to keep getting bigger than they are.”

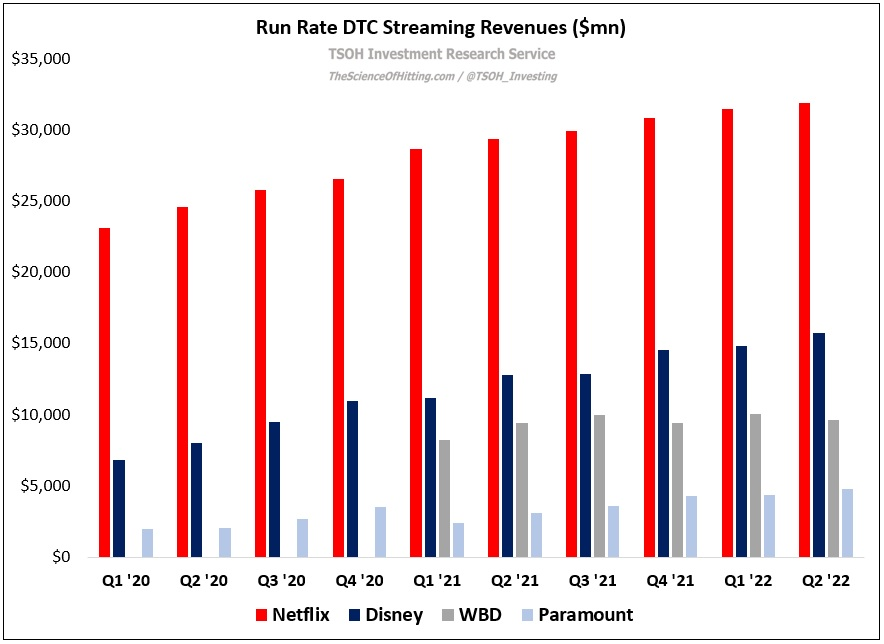

In terms of global scale (on a revenue basis), we can see that there’s a meaningful divergence between the results of some key competitors; as shown below, Netflix ended Q2 FY22 with run rate revenues of $31.9 billion – more than 3x higher than the run rate DTC revenues WBD is currently generating ($9.6 billion). Even if WBD achieves its 2025 targets (~$15 billion), Netflix today would still be ~2x larger. (And as a reminder, WBD has rolled a large base of wholesale revenues – from the days when HBO was primary sold alongside linear TV through MVPD’s like Comcast – into DTC.)

Importantly, this statement doesn’t just apply on a global basis; if we break the world into two regions (UCAN and International), we can see that WBD’s subscale position still remains. This is most notable outside UCAN (in international markets), where HBO is impacted by its licensing-first approach (and where Discovery, despite its breadth in linear, has been unable to build a significant DTC business). Internationally (ex-UCAN), Netflix generated run rate revenues of $17.6 billion in Q2 FY22 – roughly 10x higher than WBD’s run rate International DTC revenues in the same period. (Regional figures for WBD are guesstimates based on quarter end paid subs and ARPU’s.)

Even in UCAN, where WBD can lean on the decades long head start for HBO, Netflix has a built a much larger DTC business than its competitor: at the end of Q2, Netflix’s run rate UCAN revenues were $14.0 billion, roughly 75% higher than WBD (~$7.9 billion run rate). That difference is reflective of a larger sub base (Netflix at ~73 million and WBD at ~54 million), as well higher ARPU’s (Netflix at $16.0 per month and WBD at $10.5 per month).

From day one of this deal, I’ve argued that WBD would struggle to exhibit the ability and / or the willingness to accept the near term financial pain that would be required to go after global scale in the DTC business; while they started from a strong base in UCAN, it appeared that the path to International success would prove far too onerous (AT&T’s decision to saddle NewCo with significant financial leverage met their primary concern – improving the wireless operator’s balance sheet - but the potential cost / risk associated with that decision is now being clearly reflected in WBD’s stock price).

With the Q2 call, WBD management effectively admitted global scale isn’t a realistic goal (at least as it relates to the next 3 - 4 years, but I suspect the state of the industry at that time will effectively make this closer to a permanent decision). The question I’d like to address in the remainder of this article is the following: if WBD is no longer pursuing global scale in DTC, what impact will that have on their strategy and business model?