Microsoft: "The UI For AI"

From “Microsoft: CapEx Conundrum” (August 2024): “Embedded in that valuation framework are two critical assumptions: the long-term ROI from this CapEx spend and whether management can / will meaningfully adjust if faced with adverse outcomes. From where we stand, it’s tough to answer those questions with a ton of confidence; the list of competitors in this space is daunting, including some who have clearly stated that they plan to invest aggressively despite a period that may appear bubble-like in the near term. This situation is a good example of why it is often difficult to parse between growth CapEx and maintenance CapEx, i.e., what is elective versus table stakes to remain competitive (‘the downside of being behind: you will be out of position for the most important technology of the next 10-15 years’).”

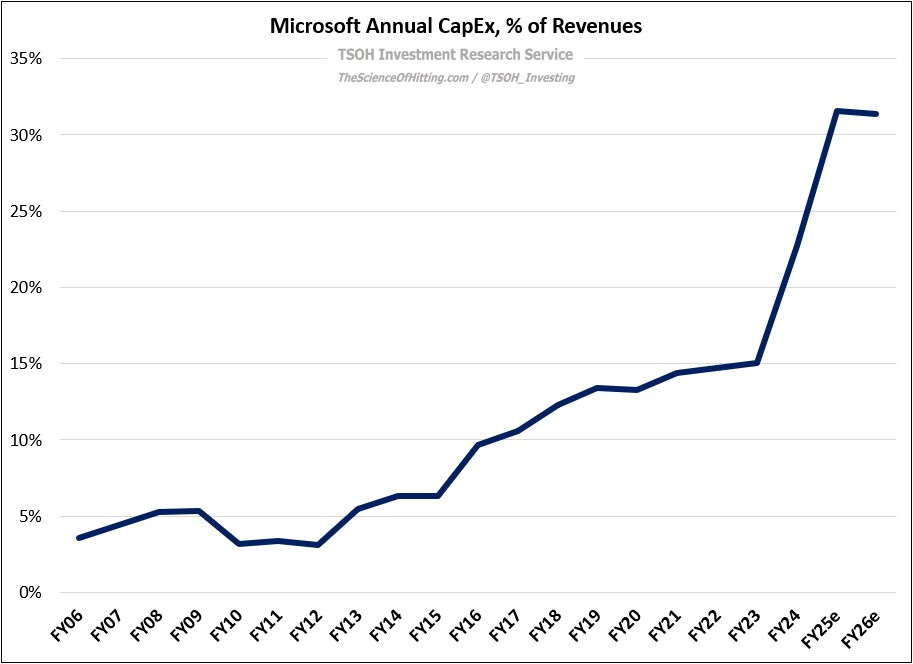

With another six months behind us, I think we’re still receiving some (early) mixed signals as we try to develop incremental confidence on those answers. First, on the key input, CapEx spend, the numbers keep galloping forward; as you can see below, despite double digit revenue growth in FY25e and FY26e, I expect CapEx spend at >30% of revenues for (at least) the next two years – roughly three times higher than CapEx intensity at Microsoft from FY14 to FY23. (As discussed in “CapEx Conundrum”, there are important nuances to consider as we look underneath the headline figures; from the Q2 FY25 call: “more than half of our cloud and AI-related spend was on long-lived assets”.)

As we review the output from that spend, I’m focused on a few key buckets.