Microsoft: "Lead This New Era"

From “It’s Always About The People” (December 2023): “Over time, I’ve come around to a different conclusion. Put simply, I think the quality of the business tends to bend towards the quality of the management team. As a CEO’s tenure lengthens, the combination of their long-term strategic vision and capital allocation decisions has a growing influence on the quality of what remains… Through that lens, the starting assumption for a long-term investor should be that most businesses are likely to be greatly impacted by the decision-making of a CEO who remains at the helm for an extended period.”

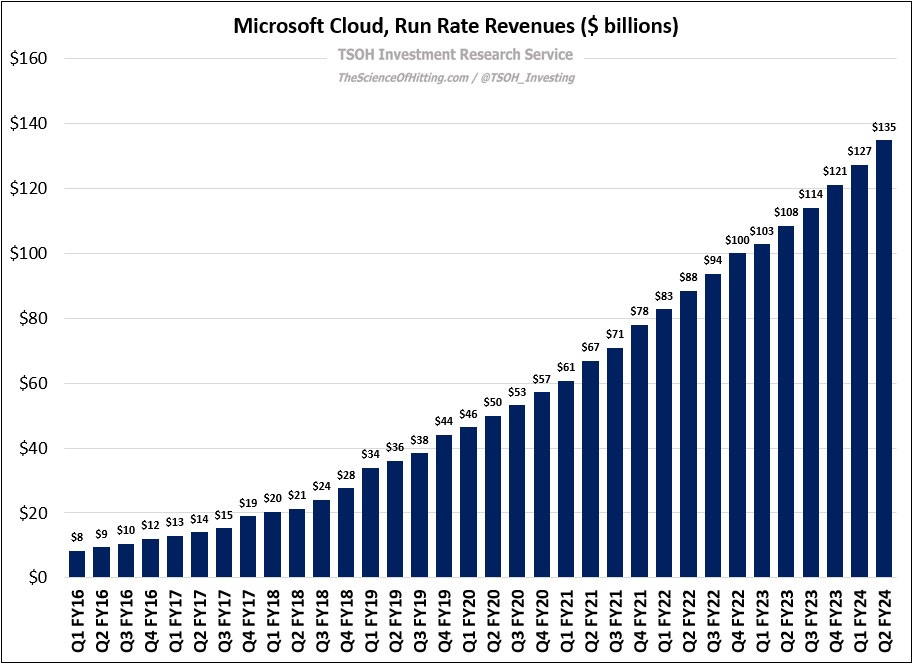

That post went into detail about the decisions made at Microsoft, primarily in the early 2010’s, that positioned the company to become a leader in the cloud computing business. As shown below, the payoff from successful execution against that strategic vision continues to take the business to astounding new heights: run rate revenues for Microsoft Cloud reached ~$135 billion in Q2 FY24 (+24% YoY), nearly 5x larger than at the end of FY18 (~$28 billion).

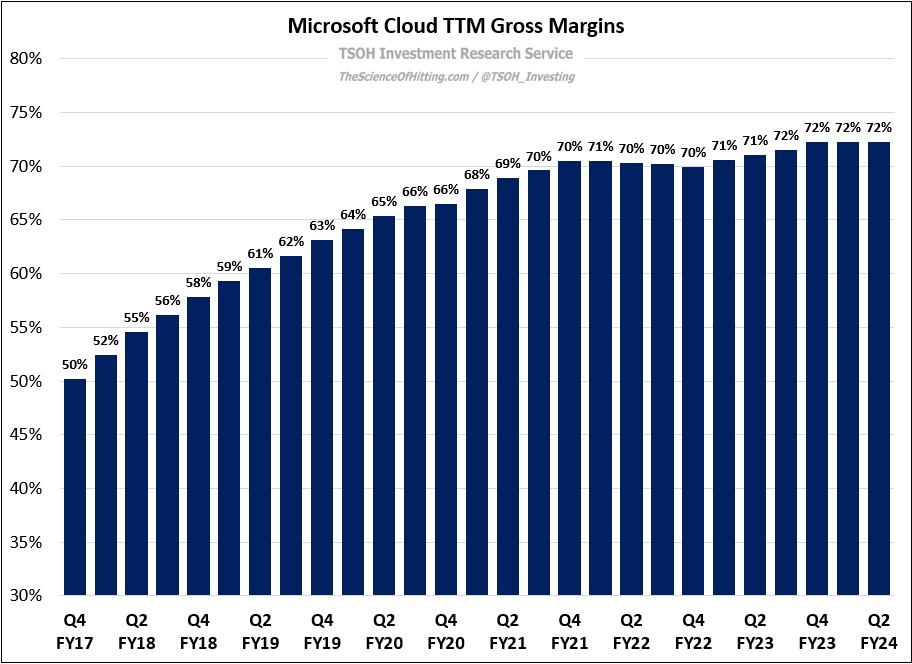

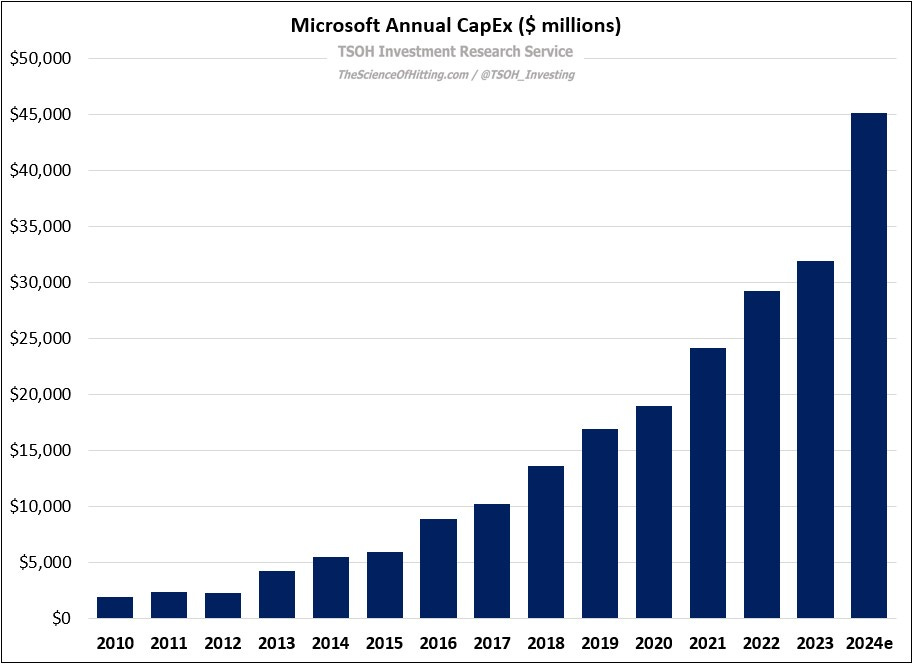

Investments to support this impressive long-term outcome led to years of material income statement pressure on the front end, with operating margins falling by nearly 1,000 basis points from FY11 to FY17; in addition, annual CapEx quadrupled to ~$10 billion over that period. (CEO Satya Nadella’s 2016 shareholder letter: “We’re building a sturdy foundation for an even brighter future.”) As the Cloud businesses scaled, the benefits began to outweigh the costs (upfront investments). As an example, Cloud TTM gross margins were 72% in Q2 FY24 - an improvement of >2,000 basis points since management began disclosing this KPI. As a result, run rate cloud gross profits were ~$97 billion in Q2 FY24 - a 6x increase since yearend FY18.

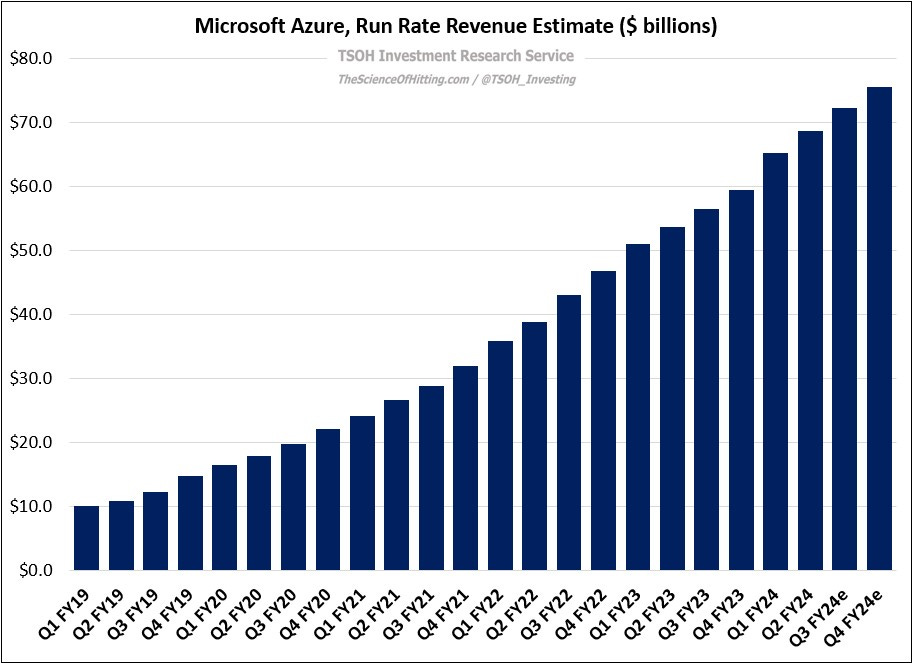

As we think about the next phase of Microsoft’s evolution – “applying AI at scale” – it’s critical to note that the cost of admission is climbing rapidly: FY24e CapEx will likely be around $45 billion, comparable to Microsoft’s cumulative CapEx spend over the 15-year period from FY02 to FY16.

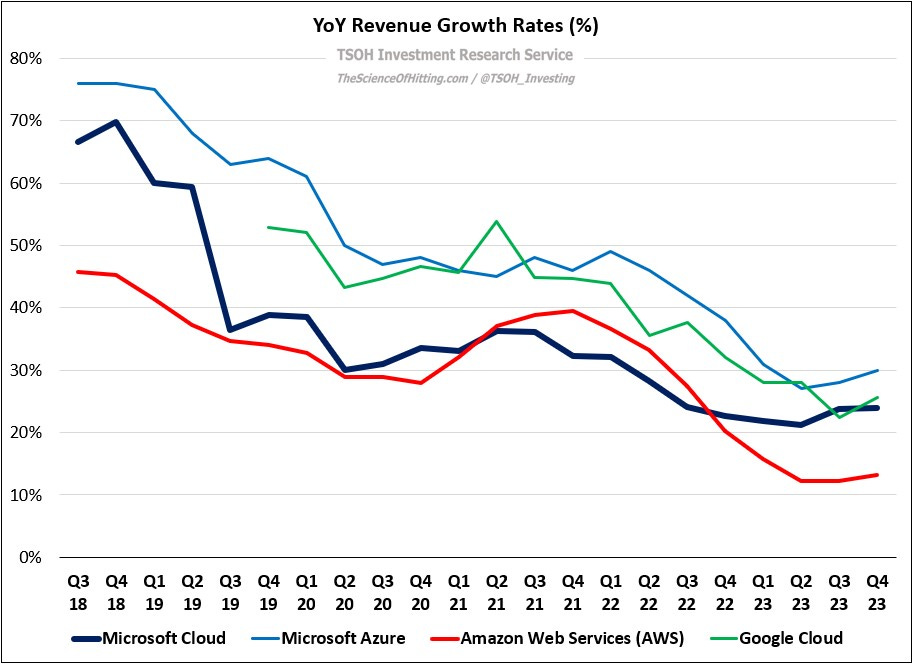

Naturally, Microsoft’s long-term value will be greatly impacted by the ROI achieved on these massive investments. My confidence on that question reflects a few key factors: long-term internal conviction / strategic vision with demonstrated success (scale and industry leading cloud growth rates), the necessary resources and support from shareholders to to aggressively pursue this next phase, and clear mechanisms for monetizing the tools and services created on the back end. (Azure AI services run rate revenues have increased from ~$500 million to ~$3 billion over the past six months.)

Said differently, Microsoft can invest astounding sums of money while being highly confident it will ultimately generate an attractive return. (CFO Amy Hood: “We feel really good about where we’ve been in terms of adding capacity… It’s going toward servers and new data center footprints to meet demand, and really changing [accelerating] demand as we look forward… You'll tend to see accelerating CapEx, to continue to be able to add capacity in the coming quarters, given what we see in the pipeline.”)

On the consolidated figures, the contribution from the Cloud businesses has led to an impressive string of results: with Q2 FY24 at +16%, Microsoft’s constant currency YoY revenues have now increased at a double-digit rate in 26 of the past 27 quarters (with the Cloud mix increasing from ~18% of total company revenues in Q4 FY17 to ~54% of company revenues in Q2 FY24).