Microsoft: A Heavy Lift

Note: Review all prior Microsoft research at the “MSFT” tab on the website

From “Microsoft: Transition Period” (November 2024):

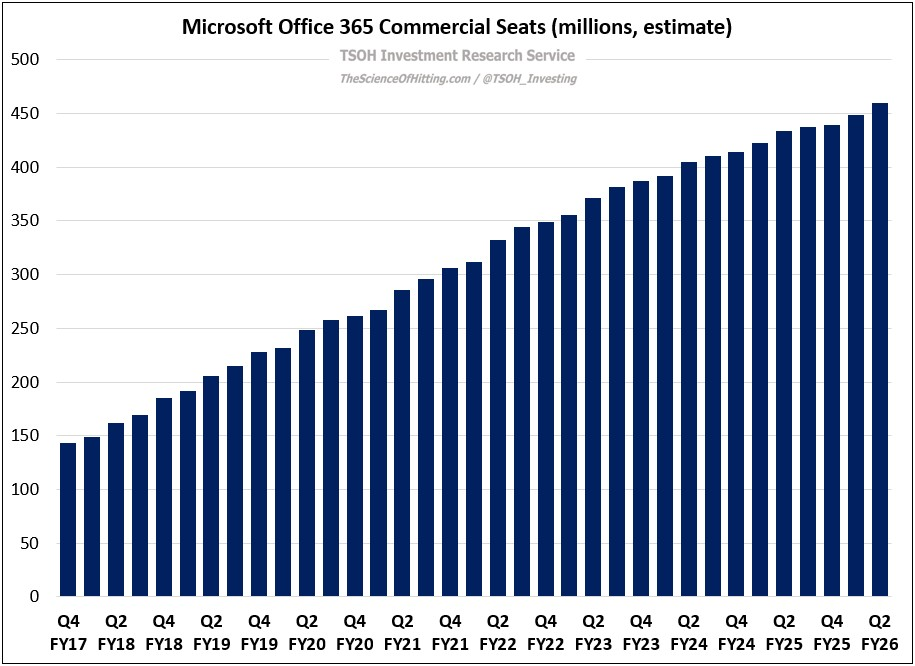

“When Nadella compared it to the PC revolution in the 1990’s, it helped to frame the size of the prize - but it also spoke to the heavy lift required for broader adoption: ‘Take a business process like forecasting - what was it like before e-mail and Excel, compared to post e-mail and with Excel? That’s the type of change you’ll see with Copilot.’ The metric to keep an eye on is M365 Commercial ARPU growth (gap between revenue growth and seats growth).”

Microsoft’s stock price declined by ~10% following the company’s Q2 FY26 results, and the shares have now declined by ~25% from the late 2025 highs.

In reviewing the recent results, I broadly agree with Mr. Market: this near-term downward pressure on the stock price is appropriate. (To provide some context for that statement, note that I’ve held MSFT as a top four portfolio position for the past 15 years.) A key reason why I believe so is seen below: