Meta: Turning Tides?

From “Meta: When It All Matters” (May 2023): “It seems likely that we’re heading into a sweet spot for the FOA [Family Of Apps] segment financials (accelerating revenue growth on tight expense controls), which aligns with my long held views about the profitability and sustainability of the core business.”

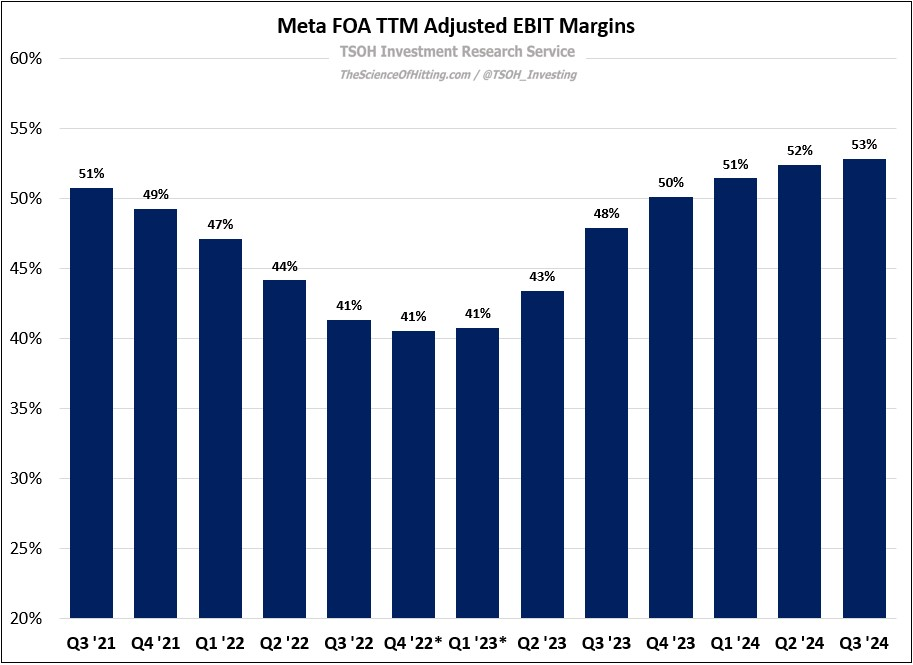

That, in my view, has been the critical thing that investors needed to grasp over the past 12-18 months. At that time (Q1 FY23), FOA had TTM revenues of ~$115.5 billion, with TTM EBIT margins of 41%, down ~1,000 basis points from the prior year period. Compare that to Q3 FY24, when TTM segment revenues were ~$153.7 billion, with record high TTM FOA segment EBIT margins of 53%, up ~1,200 basis points from Q1 FY23. As a result, TTM segment EBIT in Q3 FY24 was ~$81.2 billion, up >70% from 18 months earlier. (As a reminder, Meta’s enterprise value was ~$200 billion at the bottom tick in late 2022.) While undoubtedly difficult to quantify with anything close to precision, a thoughtful analyst could have seen by early 2023 how the pieces could come together to produce something like the current results.