Meta: "A Meaningful Cultural Shift"

From “Moving The Goal Posts” (November 2022):

“If FOA [the Family Of Apps segment] is capable of double digit annualized revenue growth over the next few years - which, again, assumes that the significant incremental CapEx investments will deliver a reasonable ROI through a combination of improved ad targeting / measurement and better recommendations / higher user engagement (and which would widen Meta’s moat) - that would make the expense growth currently anticipated much more manageable… On that point, there’s significant room to operate this business (FOA) much more efficiently; that may not have been the highest priority for Meta management two or three years ago, but the realities of the business have since changed – and that demands a response.”

I don’t typically reuse quotes (this was also the introduction to the February 2023 update), but in this case I’ve made an exception. I did so because the combination of the two factors discussed above – reaccelerated revenue growth, along with an intense focus on operating efficiency – has led to a very significant change in the trajectory of Meta’s (FOA’s) financial results.

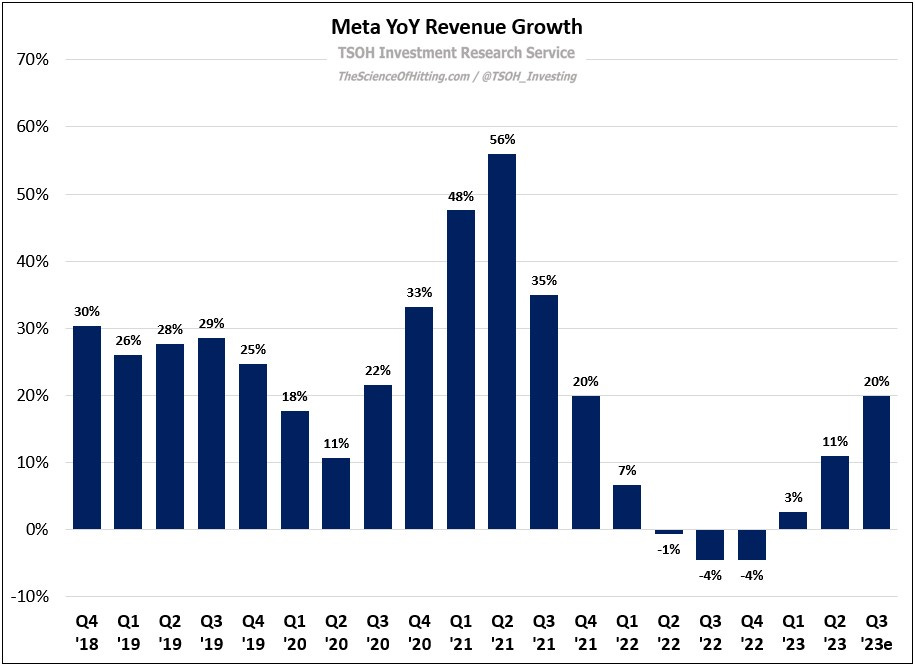

On the first point, a reacceleration of revenue growth, this graph says it all.

Following a (very) unenjoyable period throughout the back half of 2022, when revenues declined by 4% YoY in Q3 2022 and in Q4 2022, Meta returned to revenue growth in Q1 2023 (+3%) and double-digit growth in Q2 2023 (+11%, with Q2 FOA ad revenues +13% YoY in constant currencies). As you can see, that accelerated revenue growth is expected to continue, with management guiding to +20% YoY for Q3 2023 (midpoint). This is somewhat attributable to external tailwinds (which we can summarize as “lapping favorable comps”), but it also reflects the payoff from difficult decisions and large investments that the company made in earlier periods. As an example, this comment from CEO Mark Zuckerberg stood out to me: “Last year, I think we were getting quite a bit of critique for the volume of AI CapEx that we were doing… at this point, it's more well understood that that this was a good investment; it is driving results in the near term and it is enabling us to build some new experiences that we think are pretty fundamental [to FOA]… Investments over the years in AI, including the billions spent on AI infrastructure, are clearly paying off across our ranking and recommendation systems and improving engagement and monetization.”

One example of those new(er) experiences is Reels; engagement across Facebook and Instagram now exceeds 200 billion Reels plays per day, with run rate revenues crossing $10 billion this quarter (up >3x from a year ago).

This is incremental to total usage, with the growing engagement having a material impact on FOA advertising volumes: ad impressions grew 34% YoY in Q2, which is a great sign for the health of the apps (so is ~7% DAU growth, with the number of daily users across the family reaching 3.07 billion in the quarter). As I wrote in May, the problem of effectively monetizing new ad formats is something management has navigated previously. Beyond the inherent pressures associated with the video format - people scroll more slowly through Reels - I remain confident management will continue closing the monetization gap (“if you watch a video for ten seconds, you previously would’ve scrolled through four posts and probably would have seen an ad… it tends to be good for time spent, but it’s bad for revenue, comments, etc.”).

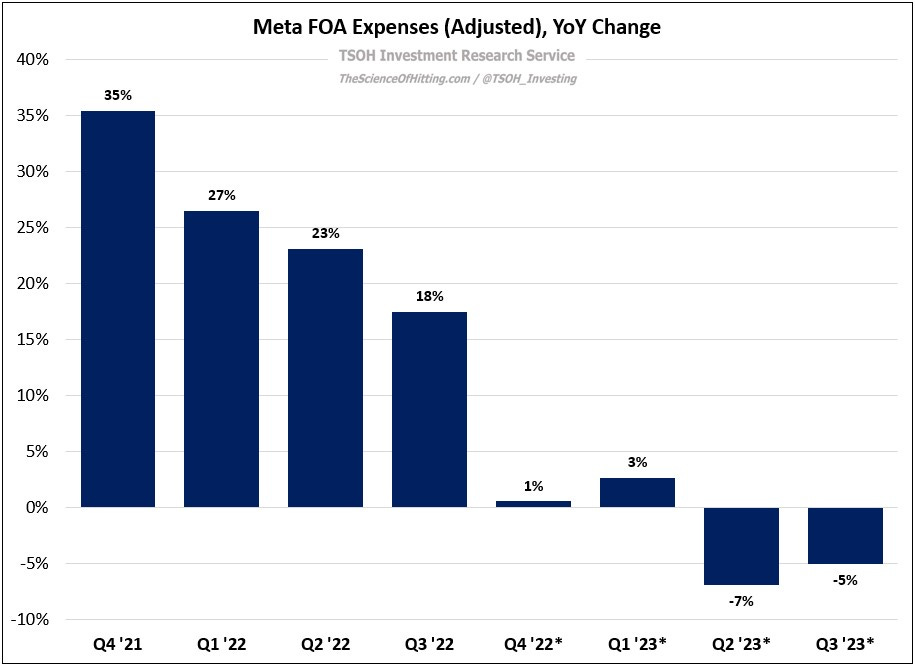

The other major consideration within FOA is operating efficiency. Simply put, the pace of change (improvement) here over the past nine months has been astounding. When Meta reported its Q3 FY22 results in October 2022, the company guided to FY23 total expenses of $96.5 billion – implying another year of double digit expense growth at a time when FOA revenues were declining YoY. The market response was unsurprising, with the stock price falling by more than 20% the day after earnings. As noted in the quote at the introduction of this post, my view at that time was that the realities of the business had changed, which demanded a response from management.

On November 9th, two weeks after the company reported its Q3 FY22 results, Zuckerberg sent a memo to Meta employees. In it, he took personal responsibility for the company’s earlier decision-making, along with their planned corrective action: the company decided that it needed to let go of ~11,000 employees (~13% of the base). In the memo, he also explained that the company would see “a meaningful cultural shift in how we operate”.

With the benefit of hindsight, this was a pivotal moment for Meta (FOA). Fast forward to Q2 FY23; management now expects total (adjusted) costs for 2023 will be ~$84 billion – roughly $12 billion lower than what they guided to in late 2022 (and on that point, if the Q3 FY22 guidance didn’t assume a meaningful ramp in revenue growth, this outcome is even more impressive than it appears at first glance). As shown below, the company is likely to end Q3 FY23 with roughly 67,000 employees, down ~25% from Q3 FY22.

The significance of these changes is most apparent when looking at FOA profitability. At the nadir (Q3 FY22), segment operating income had fallen to $9.3 billion, or -30% YoY; for the entirety of 2022, FOA would go on to report $46.4 billion of operating income (down ~19% from 2021). By comparison, my math has the segment at TTM adjusted operating income in Q3 FY23 of $58.1 billion, with EBIT margins for the quarter climbing by ~1,400 basis points YoY (TTM operating margins of 47%, up ~600 basis points YoY).

Long story short, I think that management deserves immense credit for successfully navigating the significant challenges that arose at FOA over the past few years (ATT, TikTok, etc.); they made difficult decisions and large investments (CapEx) that have repositioned the business for profitable growth. As it relates to the stock price moves over the course of the past year, I think the idea that “price drives narrative” is an incomplete read on what happened here (when I hear people say that, it honestly makes me wonder how closely they’ve been following the actual results). The trajectory of the business has meaningfully changed – and thankfully, Meta is now on the other side of the painful and challenging environment it faced late last year.

Threads